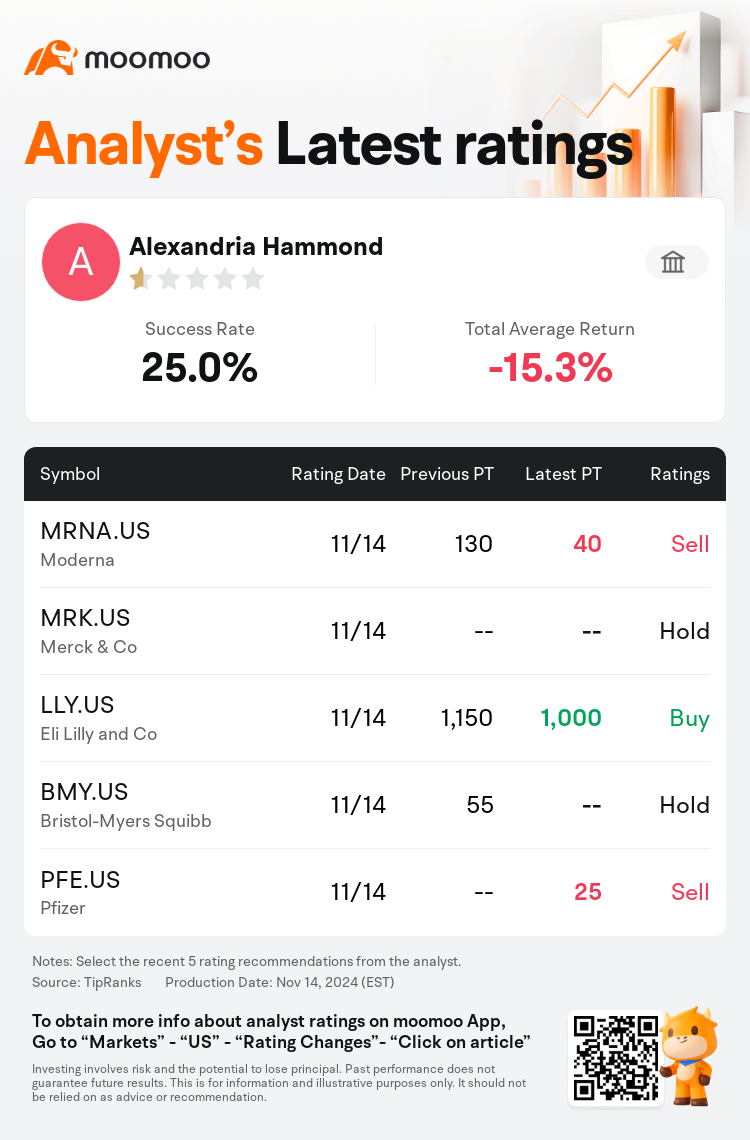

Wolfe Research analyst Alexandria Hammond maintains $Bristol-Myers Squibb (BMY.US)$ with a hold rating.

According to TipRanks data, the analyst has a success rate of 25.0% and a total average return of -15.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Bristol-Myers Squibb (BMY.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Bristol-Myers Squibb (BMY.US)$'s main analysts recently are as follows:

The unexpected update regarding the Phase 2 results of emraclidine by a competitor has led to a reassessment of the market, with projections for Bristol Myers' Cobenfy being increased. Consequently, the anticipated total revenue for the year 2033 has been adjusted upwards by 7%. This revision, however, does not alter the forecasted revenue or earnings per share growth trajectory for the involved companies.

The pivotal Phase 2 data for a competitor's emraclidine failed to show a statistically significant change from baseline in the primary scale used to measure symptoms in schizophrenia studies. This medication was anticipated to be a significant revenue generator and a strong competitor against a drug produced by Bristol Myers. The analyst suggests that this development should improve the outlook for Bristol Myers's drug, although concerns about exclusivity losses in the near term persist.

The recent failure of a competing drug to demonstrate a significant benefit at its primary endpoint in Phase 2 studies may benefit Bristol's Cobenfy, positioning it favorably in the market. This development potentially sets back competitors and places the focus on Bristol to successfully execute the introduction of Cobenfy.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

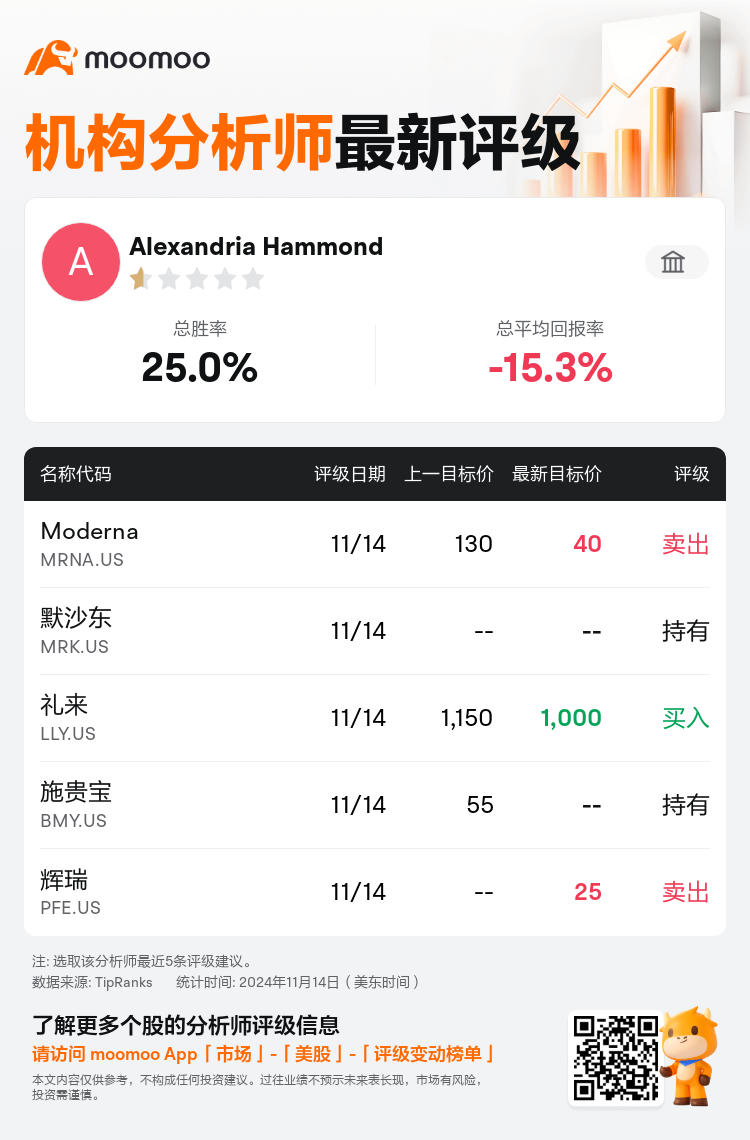

沃尔夫研究分析师Alexandria Hammond维持$施贵宝 (BMY.US)$持有评级。

根据TipRanks数据显示,该分析师近一年总胜率为25.0%,总平均回报率为-15.3%。

此外,综合报道,$施贵宝 (BMY.US)$近期主要分析师观点如下:

此外,综合报道,$施贵宝 (BMY.US)$近期主要分析师观点如下:

一家竞争对手关于emraclidine第2阶段结果意外更新导致市场重新评估,预计2023年布里斯托尔迈尔斯的Cobenfy的总营业收入增加。因此,预计2033年的总营业收入上调了7%。然而,这一调整并不改变涉及公司的预期营收或每股收益增长轨迹。

竞争对手的emraclidine的关键第2阶段数据未能显示在用于测量精神分裂症症状的主要评分基线上有统计学的显著变化。这种药物预计将成为一项重要的收入发生器,并且是布里斯托尔迈尔斯制造的一种药品的强大竞争对手。分析师建议,这一发展应当改善对布里斯托尔迈尔斯药物的前景,尽管对近期的排他性损失仍存有担忧。

竞争对手一种正在进行的药物未能证明在第2阶段研究中的主要终点上具有显著益处,这可能对布里斯托尔的Cobenfy有利,使其在市场上更具竞争优势。这一进展可能会使竞争对手受挫,并将焦点放在布里斯托尔成功推出Cobenfy上。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$施贵宝 (BMY.US)$近期主要分析师观点如下:

此外,综合报道,$施贵宝 (BMY.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of