Here's Why China Reinsurance (Group) (HKG:1508) Has Caught The Eye Of Investors

Here's Why China Reinsurance (Group) (HKG:1508) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

对于许多投资者来说,尤其是那些没有经验的投资者,即使这些公司亏损,也会购买这些公司的股票,这是很常见的。但是,正如彼得·林奇在 One Up On Wall Street 中所说的那样,“远射几乎永远不会得到回报。”亏损的公司尚未通过利润证明自己,最终外部资本的流入可能会枯竭。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Reinsurance (Group) (HKG:1508). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

如果这种公司不是你的风格,你喜欢创收甚至赚取利润的公司,那么你很可能会对中国再保险(集团)(HKG: 1508)感兴趣。尽管这并不一定说明其估值是否被低估,但该业务的盈利能力足以保证一定的升值——尤其是在其增长的情况下。

China Reinsurance (Group)'s Earnings Per Share Are Growing

中国再保险(集团)的每股收益正在增长

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years China Reinsurance (Group) grew its EPS by 8.9% per year. That growth rate is fairly good, assuming the company can keep it up.

市场在短期内是投票机,但从长远来看是一台权衡器,因此您预计股价最终将跟随每股收益(EPS)的结果。因此,有很多投资者喜欢购买每股收益不断增长的公司的股票。我们可以看到,在过去三年中,中国再保险(集团)的每股收益每年增长8.9%。假设公司能够保持增长,这个增长率相当不错。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of China Reinsurance (Group) shareholders is that EBIT margins have grown from 1.7% to 12% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

仔细检查公司增长的一种方法是查看其收入以及利息和税前收益(EBIT)利润率如何变化。令中国再保险(集团)股东耳闻的是,在过去的12个月中,息税前利润率从1.7%增长到12%,收入也呈上升趋势。这两个指标都是衡量潜在增长的好指标。

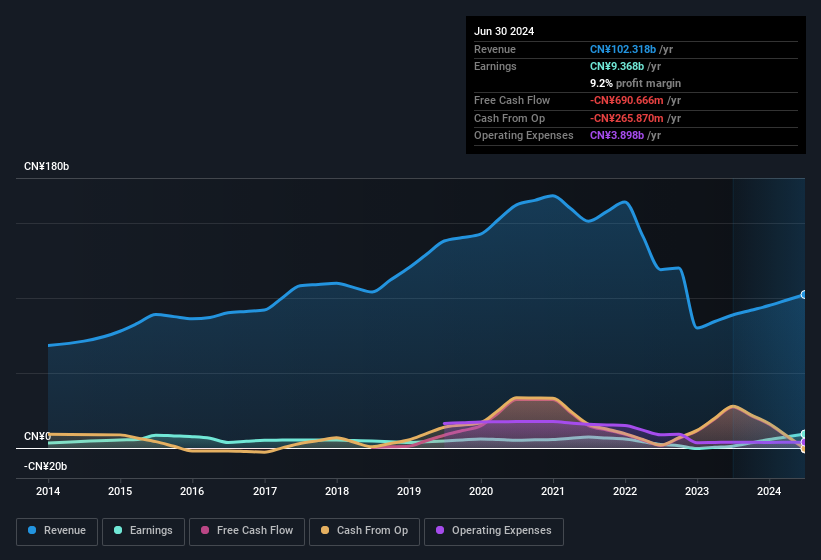

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

下图显示了该公司的收入和收入随着时间的推移是如何发展的。点击图表查看确切的数字。

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for China Reinsurance (Group)'s future EPS 100% free.

作为投资者,诀窍是寻找未来表现良好的公司,而不仅仅是过去。虽然不存在水晶球,但您可以100%免费查看我们对中国再保险(集团)未来每股收益的共识预测的可视化。

Are China Reinsurance (Group) Insiders Aligned With All Shareholders?

中国再保险(集团)内部人士是否与所有股东保持一致?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to China Reinsurance (Group), with market caps between CN¥29b and CN¥87b, is around CN¥5.1m.

检查公司的薪酬政策是一种好习惯,以确保首席执行官和管理团队不会将自己的利益置于薪酬待遇过高的股东的利益之上。规模与中国再保险(集团)相似的公司的首席执行官的总薪酬中位数约为510万元人民币,市值在290元人民币至870元人民币之间。

China Reinsurance (Group)'s CEO took home a total compensation package of CN¥937k in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

中国再保险(集团)首席执行官在2023年12月之前的一年中获得了93.7万元人民币的总薪酬待遇。第一印象似乎表明薪酬政策有利于股东。首席执行官薪酬并不是公司最需要考虑的方面,但如果合理,这可以增强领导层关注股东利益的信心。从更广泛的意义上讲,它也可以是诚信文化的标志。

Does China Reinsurance (Group) Deserve A Spot On Your Watchlist?

中国再保险(集团)值得在您的关注清单上占有一席之地吗?

As previously touched on, China Reinsurance (Group) is a growing business, which is encouraging. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So based on its merits, the stock deserves further research, if not an addition to your watchlist. We should say that we've discovered 3 warning signs for China Reinsurance (Group) (2 make us uncomfortable!) that you should be aware of before investing here.

如前所述,中国再保险(集团)是一项成长中的业务,这令人鼓舞。不仅如此,首席执行官的薪水也相当合理,这应该会促使投资者对董事会更加信任。因此,根据其优点,该股票值得进一步研究,甚至可以添加到您的关注清单中。我们应该说,我们已经发现了中国再保险(集团)的3个警告信号(2个让我们感到不舒服!)在这里投资之前,您应该注意这一点。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by significant insider holdings.

买入收益不增长且没有内部人士购买股票的股票总是有可能表现良好。但是,对于那些考虑这些重要指标的人,我们鼓励您查看具有这些功能的公司。您可以访问量身定制的香港公司名单,这些公司在大量内部持股的支持下实现了增长。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易是指相关司法管辖区内应报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗?直接联系我们。或者,发送电子邮件给编辑组(网址为)simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of China Reinsurance (Group) shareholders is that EBIT margins have grown from 1.7% to 12% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of China Reinsurance (Group) shareholders is that EBIT margins have grown from 1.7% to 12% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.