Ningbo Ronbay New Energy Technology Co.,Ltd.'s (SHSE:688005) Shares Leap 50% Yet They're Still Not Telling The Full Story

Ningbo Ronbay New Energy Technology Co.,Ltd.'s (SHSE:688005) Shares Leap 50% Yet They're Still Not Telling The Full Story

Despite an already strong run, Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005) shares have been powering on, with a gain of 50% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.7% in the last twelve months.

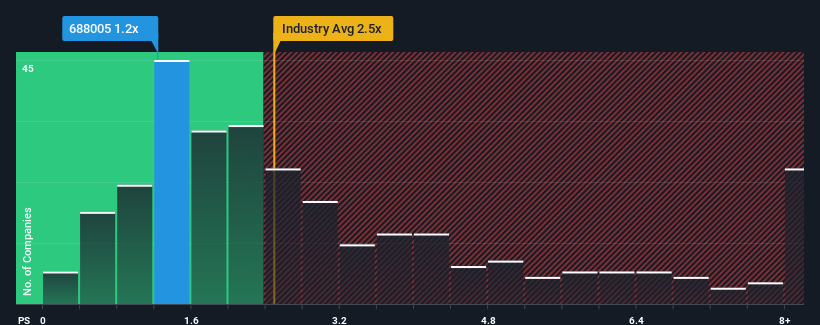

In spite of the firm bounce in price, Ningbo Ronbay New Energy TechnologyLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.5x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Ningbo Ronbay New Energy TechnologyLtd's P/S Mean For Shareholders?

Ningbo Ronbay New Energy TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Ronbay New Energy TechnologyLtd.Do Revenue Forecasts Match The Low P/S Ratio?

Ningbo Ronbay New Energy TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Ningbo Ronbay New Energy TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 48%. Still, the latest three year period has seen an excellent 100% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 26% over the next year. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Ningbo Ronbay New Energy TechnologyLtd's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Ningbo Ronbay New Energy TechnologyLtd's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Ningbo Ronbay New Energy TechnologyLtd remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Ningbo Ronbay New Energy TechnologyLtd is showing 4 warning signs in our investment analysis, and 1 of those is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.