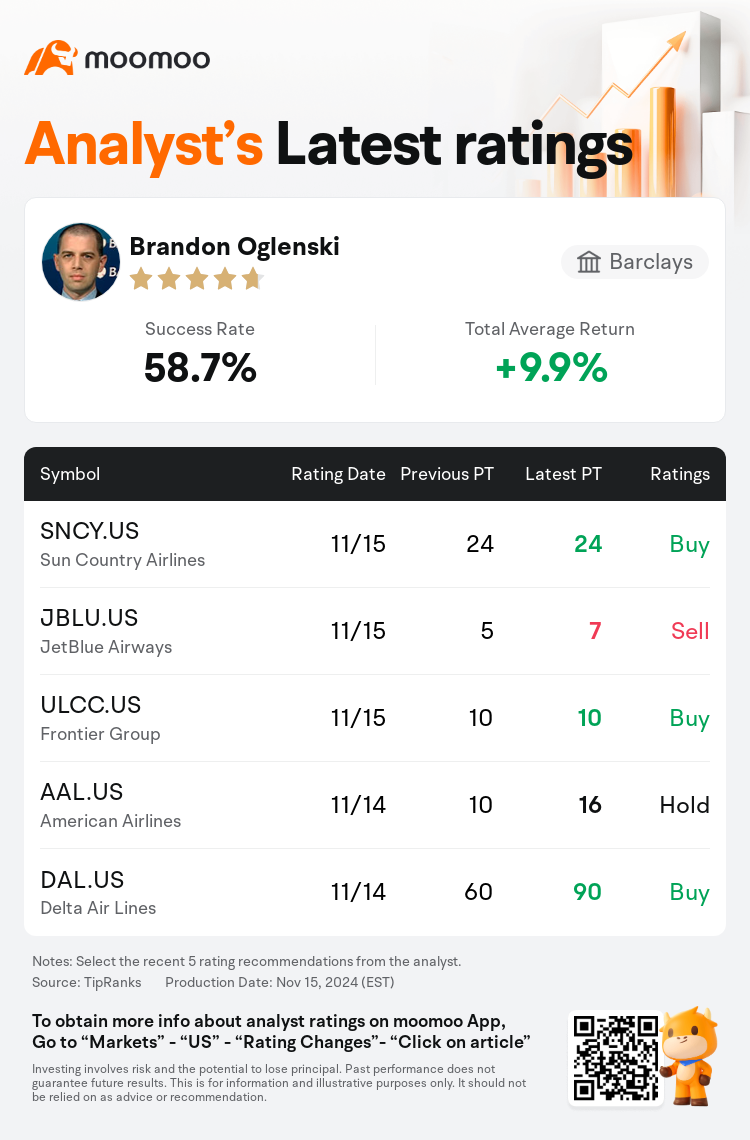

Barclays analyst Brandon Oglenski maintains $Sun Country Airlines (SNCY.US)$ with a buy rating, and maintains the target price at $24.

According to TipRanks data, the analyst has a success rate of 58.7% and a total average return of 9.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Sun Country Airlines (SNCY.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Sun Country Airlines (SNCY.US)$'s main analysts recently are as follows:

Anticipation for sustained margin growth into 2025 is prevalent, with improved pilot staffing predicted to enable increased peak capacity during the first quarter of 2025 for the passenger business.

The firm anticipates that airline industry fundamentals will see a marked improvement by 2025, which is expected to enhance market sentiment and potentially lead to notable increases in share value, especially for leading companies in the sector. This combined enhancement of industry fundamentals and investor outlook may contribute to a robust surge in airline stocks as the next year approaches. It is suggested that companies that are currently performing well are likely to continue their success. As airline capacity growth becomes more controlled in 2025, with a reorganization of low-cost carrier competition, and stronger competitive advantages for the leading players, there is significant upside potential seen for the industry.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

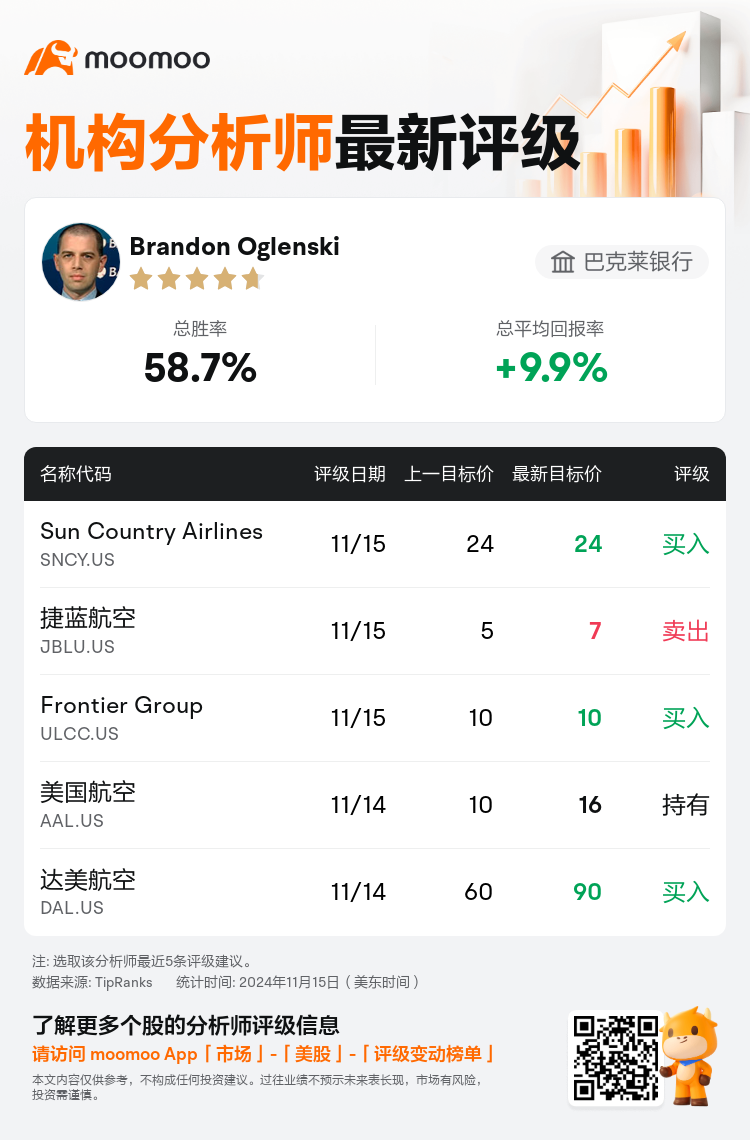

巴克莱银行分析师Brandon Oglenski维持$Sun Country Airlines (SNCY.US)$买入评级,维持目标价24美元。

根据TipRanks数据显示,该分析师近一年总胜率为58.7%,总平均回报率为9.9%。

此外,综合报道,$Sun Country Airlines (SNCY.US)$近期主要分析师观点如下:

此外,综合报道,$Sun Country Airlines (SNCY.US)$近期主要分析师观点如下:

对持续的利润增长到2025年的期待普遍存在,预计改善的飞行员 staffing 将能在2025年第一季度提高乘客业务的峰值能力。

该公司预计到2025年,航空行业的基本面将显著改善,这预计将提升市场情绪,并可能导致板块内领先公司的股票价值显著增加。这种行业基本面与投资者前景的结合提升,可能为航空股票在明年到来时带来强劲的增长。据建议,当前表现良好的公司可能会继续其成功。随着2025年航空运力增长变得更加控制,低成本航空竞争的重组,以及领先企业的竞争优势增强,该行业被视为具有显著的上行潜力。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Sun Country Airlines (SNCY.US)$近期主要分析师观点如下:

此外,综合报道,$Sun Country Airlines (SNCY.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of