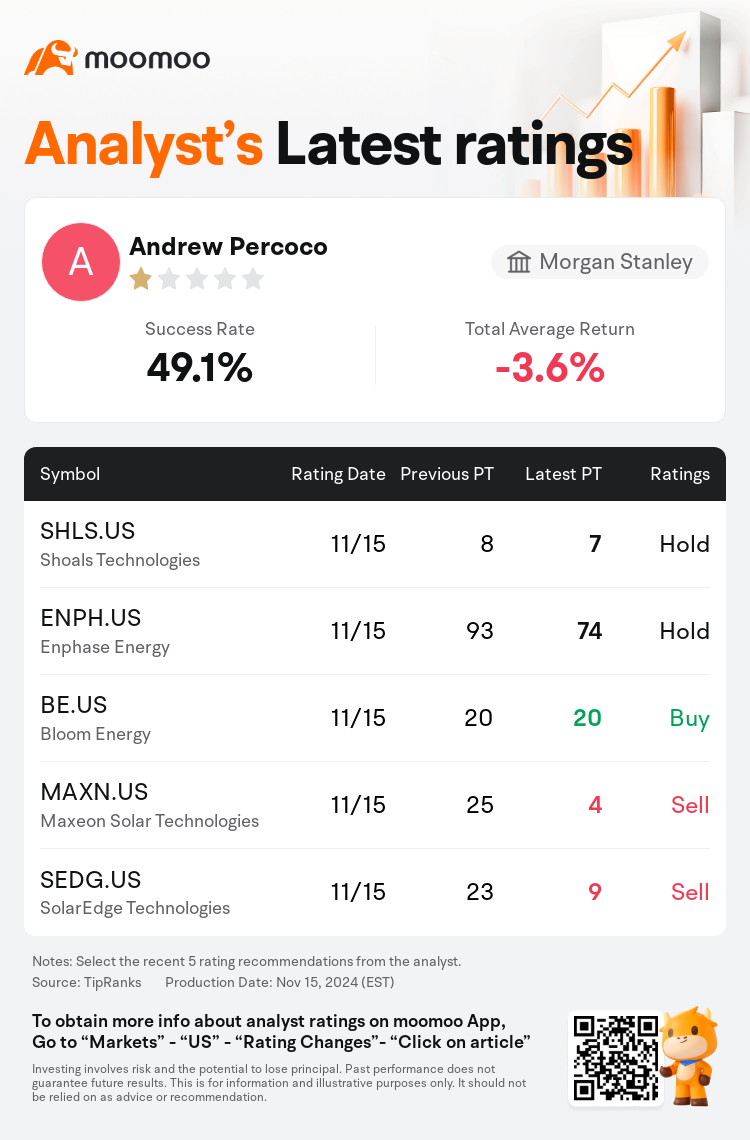

Morgan Stanley analyst Andrew Percoco maintains $Shoals Technologies (SHLS.US)$ with a hold rating, and adjusts the target price from $8 to $7.

According to TipRanks data, the analyst has a success rate of 49.1% and a total average return of -3.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Shoals Technologies (SHLS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Shoals Technologies (SHLS.US)$'s main analysts recently are as follows:

The assessment of the clean technology sector has been moderated to reflect a neutral stance, with an emphasis on the increased uncertainty surrounding the renewable policy landscape due to the recent change in administration. In this environment, the recommendation is to focus on companies that exhibit robust and dependable growth and margins, possess a well-defined trajectory for growth catalysts, or have a solid financial foundation to navigate potential short-term fluctuations in growth and profitability.

Shoals Technologies appears to be on track to reach the higher end of its revenue range for 2024, accompanied by promising qualitative data points from its earnings report. However, concerns arise from modest bookings and the latest update on backlog, which may present near-term challenges looking towards fiscal 2025.

Shoals Technologies exhibited robust top-line revenue performance for the third quarter of 2024, although gross margins faced pressures from labor costs, non-repeating expenses, and volume discounts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

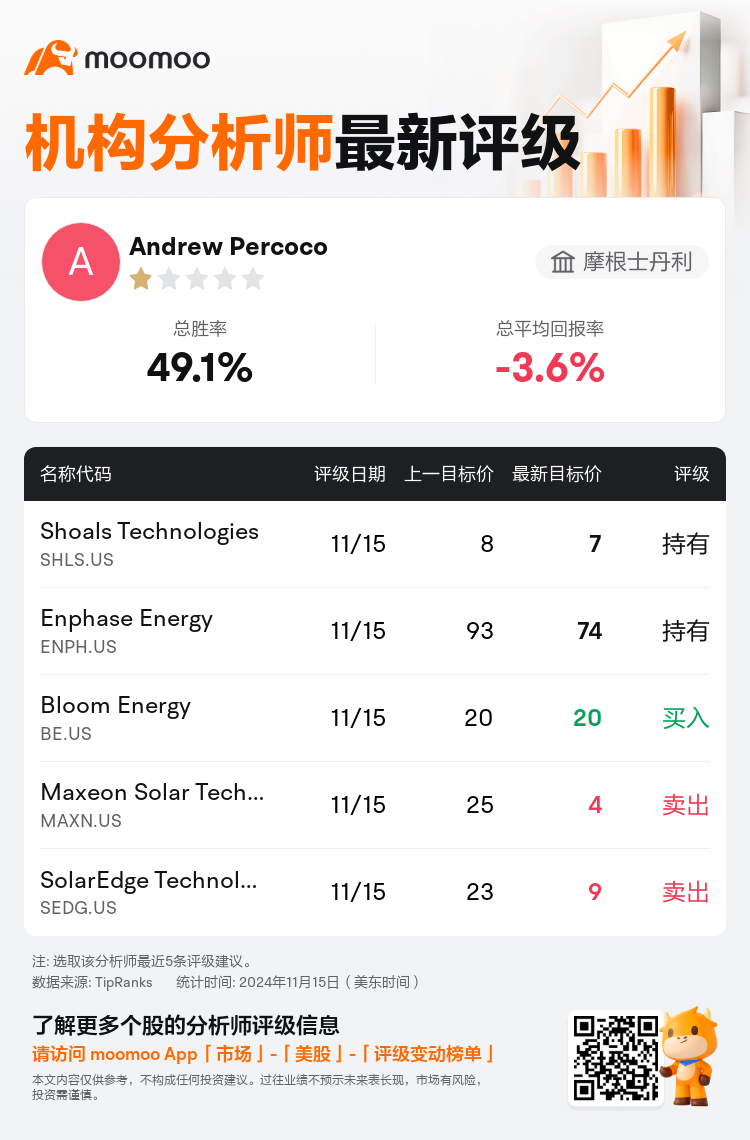

摩根士丹利分析师Andrew Percoco维持$Shoals Technologies (SHLS.US)$持有评级,并将目标价从8美元下调至7美元。

根据TipRanks数据显示,该分析师近一年总胜率为49.1%,总平均回报率为-3.6%。

此外,综合报道,$Shoals Technologies (SHLS.US)$近期主要分析师观点如下:

此外,综合报道,$Shoals Technologies (SHLS.US)$近期主要分析师观点如下:

对清洁科技板块的评估已经调整为中立立场,强调政策不确定性增加,主要是由于最近政府管理层的变动导致可再生能源政策格局的不确定性增加。在这种环境下,建议重点关注那些表现出稳健和可靠增长及利润率的公司,具有明确的增长催化剂轨迹,或者具有坚实的财务基础以应对潜在的短期增长和盈利能力波动。

Shoals Technologies似乎正朝着2024年营业收入区间的高端发展,其盈利报告中的有望定性数据点也令人振奋。然而,对2025财年可能带来近期挑战的担忧主要来自订单的温和增长和关于积压订单的最新更新。

Shoals Technologies在2024年第三季度表现出强劲的营业收入业绩,尽管毛利润面临来自劳动力成本、非重复性支出和成交量折扣的压力。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Shoals Technologies (SHLS.US)$近期主要分析师观点如下:

此外,综合报道,$Shoals Technologies (SHLS.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of