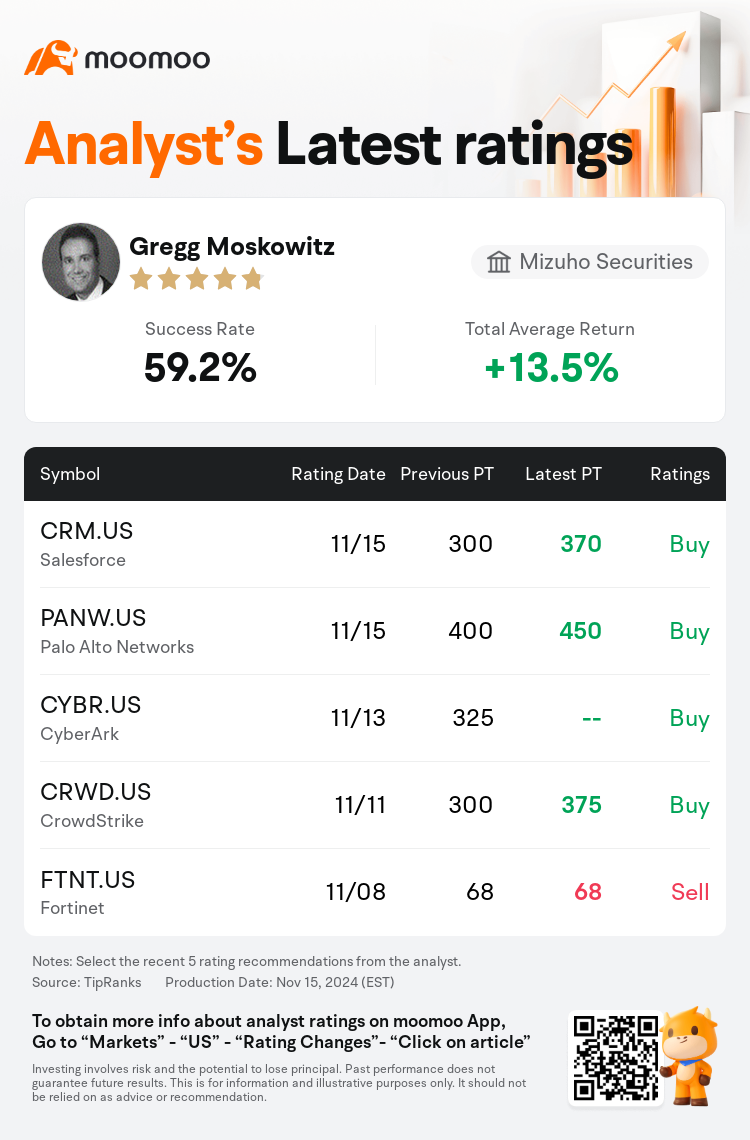

Mizuho Securities analyst Gregg Moskowitz maintains $Salesforce (CRM.US)$ with a buy rating, and adjusts the target price from $300 to $370.

According to TipRanks data, the analyst has a success rate of 59.2% and a total average return of 13.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

The recent surge in software stocks presents a complex scenario for this quarter's earnings, with indications that the sector has seen some improvements. However, there is skepticism regarding whether this will suffice to propel stock values further following their recent uptick.

Insights from discussions with partners indicate that deal activity in the third quarter is consistent with expectations, with prospects for a stronger fourth quarter pipeline. It is suggested that there is increasing clarity for an uptick in top-line growth in the coming year, which is factored into the forward-looking valuation.

Initial channel feedback on Salesforce's Agentforce has been notably positive, surpassing reactions to previous new solutions. It is suggested that Agentforce may contribute to a modest increase in revenue and growth in the latter part of FY26. In anticipation of the upcoming earnings report, it is expected that Salesforce may achieve a slight increase to its constant-currency CRPO growth projections.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

瑞穗证券分析师Gregg Moskowitz维持$赛富时 (CRM.US)$买入评级,并将目标价从300美元上调至370美元。

根据TipRanks数据显示,该分析师近一年总胜率为59.2%,总平均回报率为13.5%。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

软件股票最近的激增对本季度的收益形势提出了复杂的情景,迹象表明该板块已经出现了一些改善。然而,对于这是否足以推动股票价值在最近的上涨之后进一步增长存在怀疑。

与合作伙伴讨论的见解表明,第三季度的交易活动与预期一致,前景看好,预计第四季度的业务将更为强劲。有人认为,即将到来的一年内,营业收入有望出现提升,并已纳入前瞻性评估中。

赛富时的Agentforce的初步渠道反馈明显积极,超过了以往新解决方案的反应。据建议,Agentforce可能有助于营业收入适度增加,并在FY26年后期实现增长。在即将到来的财报公布前,预计赛富时可能会将其恒定货币CRPO增长预测略微上调。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of