Nvidia Reveals 3.6% Stake In Applied Digital, Stock Soars

Nvidia Reveals 3.6% Stake In Applied Digital, Stock Soars

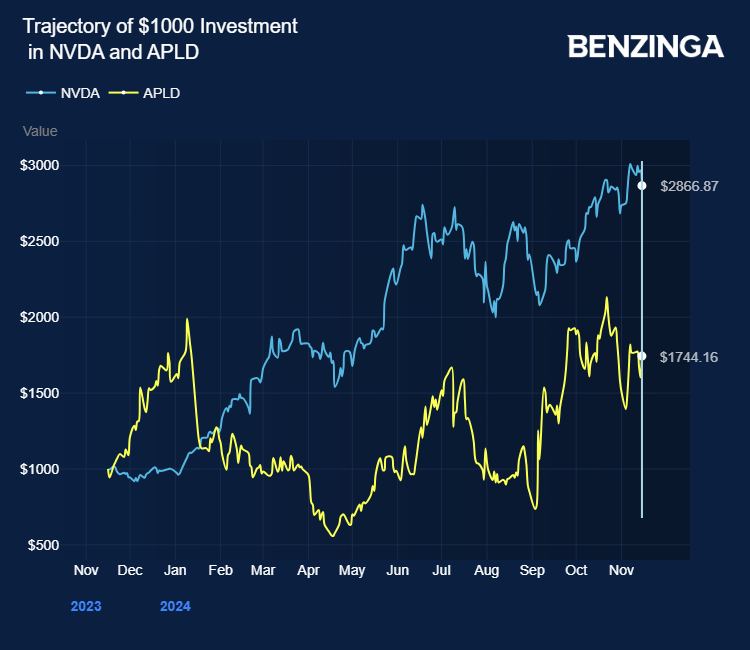

Applied Digital Corp (NASDAQ:APLD) stock is trading higher Friday as Nvidia Corp (NASDAQ:NVDA) gained exposure to the stock.

应用数字公司(纳斯达克股票代码:APLD)股价周五走高,原因是英伟达公司(纳斯达克股票代码:NVDA)增加了该股的敞口。

Nvidia's 13F fling shows it purchased 7.72 million Applied Digital shares worth $63.66 million as of September 30, 2024, which translates into close to a 3.6% stake in Applied Digital, which had 215.36 million outstanding shares as of October 8, 2024,

英伟达的13F报告显示,截至2024年9月30日,它购买了价值6,366万股应用数字的772万股股票,这意味着应用数字持有近3.6%的股份,截至2024年10月8日,应用数字拥有21536万股已发行股份,

Applied Digital, a U.S. company, delivers cutting-edge digital infrastructure tailored for high-performance computing and AI applications.

美国公司Applied Digital提供为高性能计算和人工智能应用量身定制的尖端数字基础设施。

Also Read: Salesforce Loses AI Chief Amid Major Push for Autonomous Agents

另请阅读:在大力推动自主代理的推动下,Salesforce失去了人工智能负责人

Applied Digital reported a first-quarter EPS loss of 15 cents, outperforming the analyst loss estimate of 29 cents. Revenue for the quarter reached $60.7 million, surpassing the expected $54.85 million.

应用数字公布的第一季度每股亏损15美分,超过了分析师预期的29美分亏损。该季度的收入达到6,070万美元,超过了预期的5,485万美元。

The company attributed the revenue boost to recognizing income from its Cloud Services segment following the launch of the service at the end of the prior fiscal year.

该公司将收入增长归因于在上一财年末推出云服务后确认了该服务部门的收入。

Applied Digital had secured $160 million in September through a private placement involving institutional and accredited investors, including Nvidia.

应用数字在9月份通过私募融资获得了1.6亿美元的融资,其中包括Nvidia在内的机构和合格投资者。

Applied Digital planned to allocate the proceeds toward expanding its data centers and developing AI cloud infrastructure, strengthening its position in the AI and high-performance computing (HPC) markets.

应用数字计划将所得款项用于扩大其数据中心和开发人工智能云基础设施,巩固其在人工智能和高性能计算(HPC)市场的地位。

The company is advancing a large-scale data center project in North Dakota while scaling up its cloud-computing operations.

该公司正在北达科他州推进一个大型数据中心项目,同时扩大其云计算业务。

Also, on November 4, Applied Digital completed raising $450 million via an upsized private convertible notes offering to fund share repurchases of the company's common stock.

此外,应用数字于11月4日通过发行规模扩大的私人可转换票据完成了4.5亿美元的融资,为公司普通股的股票回购提供资金。

The filing shows Nvidia retained its stake in Arm Holdings Plc (NASDAQ:ARM), Nano-X Imaging Ltd (NASDAQ:NNOX), Recursion Pharmaceuticals, Inc (NASDAQ:RXRX), Serve Robotics Inc (NASDAQ:SERV) and SoundHound AI, Inc (NASDAQ:SOUN).

文件显示,英伟达保留了其在Arm Holdings Plc(纳斯达克股票代码:ARM)、Nano-X Imaging Ltd(纳斯达克股票代码:NNOX)、Recursion Pharmicals, Inc(纳斯达克股票代码:RXRX)、Serve Robotics Inc(纳斯达克股票代码:SERV)和SoundHound AI, Inc(纳斯达克股票代码:SOUN)的股份。

As of September 30, 2024, the U.S. chip designer held 1.96 million Arm shares worth $280.41 million, 0.06 million shares of Nano-X Imaging worth $0.36 million, 7.71 million Recursion Pharmaceuticals shares worth $50.78 million, 3.73 million Serve Robotics shares worth $29.63 million, and 1.73 million SoundHound AI shares worth $8.07 million.

截至2024年9月30日,这位美国芯片设计师持有价值2.8041亿美元的196万股Arm股票,价值36万美元的Nano-X Imaging股票,价值5,078万股递归制药公司的股票,价值2963万美元的373万股Serve Robotics股票,价值807万美元的173万股SoundHound AI股票。

Oppenheimer's Rick Schafer reaffirmed his Outperform rating for Nvidia, raising the price target from $150 to $175.

奥本海默的里克·谢弗重申了他对英伟达跑赢大盘的评级,将目标股价从150美元上调至175美元。

He maintains a bullish long-term outlook, emphasizing Nvidia's leadership in AI hardware, robust margins, and strong data center ecosystem as key growth drivers.

他保持乐观的长期前景,强调英伟达在人工智能硬件领域的领导地位、强劲的利润率和强大的数据中心生态系统是关键的增长动力。

Schafer expects Nvidia's third-quarter results and January guidance to surpass estimates due to strong demand for AI products from cloud providers and enterprise clients.

谢弗预计,由于云提供商和企业客户对人工智能产品的强劲需求,英伟达的第三季度业绩和1月份的预期将超过预期。

He revised his projections upward, driven by high traction for Hopper AI accelerators and the initial ramp-up of Nvidia's Blackwell chips in the fourth quarter.

在Hopper AI加速器的高牵引力以及Nvidia的Blackwell芯片在第四季度首次上涨的推动下,他向上调整了预测。

Schafer forecasts Blackwell to generate several billion dollars in revenue in the January quarter despite supply constraints from CoWoS-L capacity.

舍弗预测,尽管Cowos-L的产能限制了供应,但布莱克韦尔将在1月份的季度创造数十亿美元的收入。

Price Actions: At last check on Friday, APLD stock was up 7.73% at $7.39. NVDA stock is down 3.24%.

价格走势:在周五的最后一次检查中,APLD股价上涨7.73%,至7.39美元。NVDA的股票下跌了3.24%。

Also Read:

另请阅读:

- Exxon Mobil To Cut 400 Texas Jobs In Stages Through 2026

- 埃克森美孚将在2026年之前分阶段裁员400个德克萨斯州工作岗位