Samsonite International S.A. Just Missed Earnings - But Analysts Have Updated Their Models

Samsonite International S.A. Just Missed Earnings - But Analysts Have Updated Their Models

It's shaping up to be a tough period for Samsonite International S.A. (HKG:1910), which a week ago released some disappointing third-quarter results that could have a notable impact on how the market views the stock. Samsonite International missed earnings this time around, with US$878m revenue coming in 4.6% below what the analysts had modelled. Statutory earnings per share (EPS) of US$0.045 also fell short of expectations by 19%. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

新秀丽国际S.A.(HKG:1910)正在经历一个艰难的时期。一周前,该公司发布了一些令人失望的第三季度业绩,这可能会对市场对该股票的看法产生显著影响。 新秀丽国际这次的营业收入为87800万美元,低于分析师的预期4.6%。法定每股收益(EPS)为0.045美元,亦低于预期19%。 对投资者来说,业绩发布是一个重要时刻,因为他们可以追踪公司的表现,关注分析师对明年的预测,以及查看市场情绪是否发生变化。因此,我们收集了最新的财报后预测,以了解预计明年会发生什么。

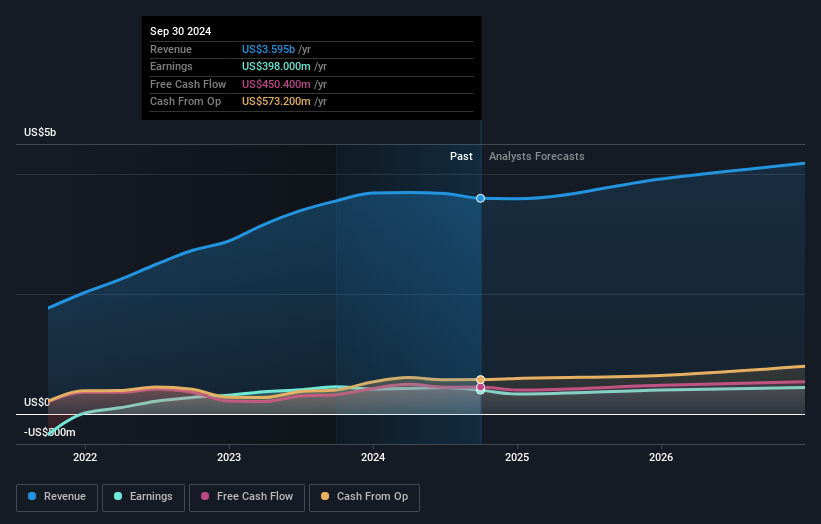

Taking into account the latest results, the current consensus from Samsonite International's 17 analysts is for revenues of US$3.92b in 2025. This would reflect a notable 9.0% increase on its revenue over the past 12 months. Statutory per-share earnings are expected to be US$0.28, roughly flat on the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of US$3.95b and earnings per share (EPS) of US$0.29 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a minor downgrade to their earnings per share forecasts.

考虑到最新的结果,目前来自新秀丽国际17位分析师的共识是2025年营业收入为39.2亿美元。这将反映出在过去12个月中营业收入显著增长9.0%。法定每股收益预计为0.28美元,与过去12个月大致持平。在此次报告之前,分析师预计2025年的营业收入为39.5亿美元,预计每股收益(EPS)为0.29美元。因此,近期业绩公布后整体情绪略微降低——尽管营业收入的预估没有重大变化,但分析师对每股收益的预测进行了小幅下调。

It might be a surprise to learn that the consensus price target was broadly unchanged at HK$26.91, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Samsonite International analyst has a price target of HK$37.08 per share, while the most pessimistic values it at HK$19.40. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

了解到共识价格目标基本不变为26.91港元,分析师们显然暗示收益预测的下降预计不会对估值产生太大影响。不过,观察价格目标的另一种方式是查看分析师提出的价格目标区间,因为广泛的估计范围可能表明对业务可能结果的多样化看法。最乐观的新秀丽国际分析师的价格目标为每股37.08港元,而最悲观的估值为19.40港元。因此,在这种情况下,我们不应过于相信分析师的价格目标,因为显然对这项业务能产生何种业绩有一些明显的不同看法。考虑到这一点,我们不应过于依赖共识价格目标,因为它只是一个平均值,分析师们对这家公司的看法显然存在较大分歧。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Samsonite International'shistorical trends, as the 7.1% annualised revenue growth to the end of 2025 is roughly in line with the 7.5% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 9.6% per year. So although Samsonite International is expected to maintain its revenue growth rate, it's forecast to grow slower than the wider industry.

现在从更大的角度来看,我们理解这些预测的一种方式是查看它们与过去的表现和行业增长预期的比较。我们可以从最新的估计中推断出,预测预计新秀丽国际的历史趋势将持续,因为到2025年底的年化营业收入增长7.1%大致符合过去五年的7.5%的年增长率。相反,我们的数据表明,在类似行业中(有分析师覆盖)的其他公司预计其收入将以每年9.6%的速度增长。因此,尽管预计新秀丽国际将保持其营业收入增长率,但其增长速度预计将低于更广泛的行业。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Samsonite International. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

最大的担忧是分析师降低了他们的每股收益估计,暗示新秀丽国际可能面临业务阻力。好消息是,营业收入估计没有重大变化;尽管预测表明它们的表现将低于更广泛的行业。共识价格目标没有实际变化,这表明随着最新估计,业务的内在价值没有经历任何重大变化。

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Samsonite International going out to 2026, and you can see them free on our platform here..

沿着这一思路,我们认为业务的长期前景远比明年的收益更为相关。在Simply Wall St,我们有新秀丽国际到2026年的一系列完整分析师估计,您可以在我们的平台上免费查看。

Even so, be aware that Samsonite International is showing 2 warning signs in our investment analysis , you should know about...

尽管如此,请注意,新秀丽国际在我们的投资分析中显示出2个警告信号,您应了解...

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Samsonite International'shistorical

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Samsonite International'shistorical