With EPS Growth And More, LeMaitre Vascular (NASDAQ:LMAT) Makes An Interesting Case

With EPS Growth And More, LeMaitre Vascular (NASDAQ:LMAT) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

投资者通常以发现 “下一件大事” 的想法为指导,即使这意味着在没有任何收入的情况下购买 “故事股票”,更不用说获利了。不幸的是,这些高风险投资通常几乎不可能获得回报,许多投资者为吸取教训付出了代价。亏损的公司尚未用利润证明自己,最终外部资本的流入可能会枯竭。

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in LeMaitre Vascular (NASDAQ:LMAT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

如果这种公司不是你的风格,你喜欢那些创造收入甚至赚取利润的公司,那么你很可能会对LeMaitre Vascular(纳斯达克股票代码:LMAT)感兴趣。尽管利润不是投资时应考虑的唯一指标,但值得表彰能够持续生产利润的企业。

LeMaitre Vascular's Earnings Per Share Are Growing

LeMaitre Vascular的每股收益正在增长

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years LeMaitre Vascular grew its EPS by 11% per year. That's a pretty good rate, if the company can sustain it.

通常,每股收益(EPS)增长的公司的股价应该会出现类似的趋势。因此,经验丰富的投资者在进行投资研究时密切关注公司的每股收益是有道理的。我们可以看到,在过去的三年中,LeMaitre Vascular的每股收益每年增长11%。如果公司能维持下去,这是一个相当不错的利率。

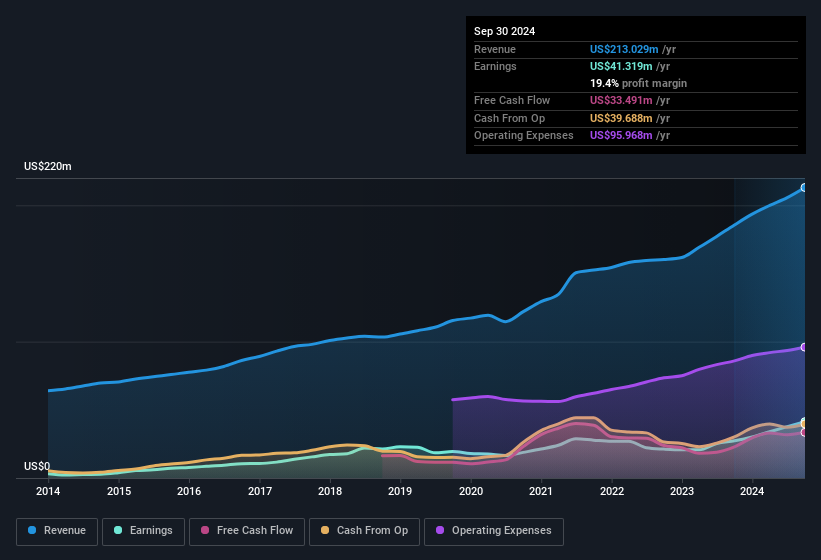

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. LeMaitre Vascular shareholders can take confidence from the fact that EBIT margins are up from 18% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.

查看利息和税前收益(EBIT)利润率以及收入增长通常会很有帮助,这样可以重新了解公司的增长质量。LeMaitre Vascular的股东可以从息税前利润率从18%上升到23%,收入也在增长这一事实中获得信心。这两个指标都是衡量潜在增长的好指标。

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

您可以在下表中查看该公司的收入和收益增长趋势。要查看实际数字,请单击图表。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for LeMaitre Vascular?

虽然我们生活在当下,但毫无疑问,未来在投资决策过程中最重要。那么,为什么不查看这张描绘LeMaitre Vascular未来每股收益估计值的交互式图表呢?

Are LeMaitre Vascular Insiders Aligned With All Shareholders?

LeMaitre 血管内部人士是否与所有股东保持一致?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that LeMaitre Vascular insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth US$200m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

如果内部人士也拥有股份,这应该会给投资者一种拥有公司股份的安全感,从而使他们的利益紧密一致。因此,很高兴看到LeMaitre Vascular内部人士将大量资本投资于该股。值得注意的是,他们拥有该公司令人羡慕的股份,价值2亿美元。投资者会感谢管理层拥有如此数量的风险股份,因为这表明了他们对公司未来的承诺。

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between US$1.0b and US$3.2b, like LeMaitre Vascular, the median CEO pay is around US$5.4m.

很高兴看到内部人士投资于公司,但是薪酬水平是否合理?我们对首席执行官薪酬的快速分析似乎表明确实如此。对于市值在10亿美元至32亿美元之间的公司,例如LeMaitre Vascular,首席执行官的薪酬中位数约为540万美元。

The LeMaitre Vascular CEO received total compensation of just US$2.2m in the year to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

在截至2023年12月的一年中,勒迈特血管首席执行官的总薪酬仅为220万美元。这看起来像是微不足道的工资待遇,可能暗示着对股东利益的某种尊重。尽管首席执行官的薪酬水平不应成为公司看法的最大因素,但适度的薪酬是积极的,因为这表明董事会将股东利益放在心上。从更广泛的意义上讲,它也可以是诚信文化的标志。

Is LeMaitre Vascular Worth Keeping An Eye On?

LeMaitre 血管值得关注吗?

One important encouraging feature of LeMaitre Vascular is that it is growing profits. Earnings growth might be the main attraction for LeMaitre Vascular, but the fun does not stop there. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. If you think LeMaitre Vascular might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

LeMaitre Vascular的一个重要令人鼓舞的特点是利润不断增长。收益增长可能是LeMaitre Vascular的主要吸引力,但乐趣并不止于此。由于公司内部人士非常赞同公司的成功和适度的首席执行官薪酬,因此没有理由认为这是一只值得研究的股票。如果你认为LeMaitre Vascular可能适合你作为投资者的风格,你可以直接查看其年度报告,也可以先查看我们对该公司的折扣现金流(DCF)估值。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

买入收益不增长且没有内部人士购买股票的股票总是有可能表现良好。但是,对于那些考虑这些重要指标的人,我们鼓励您查看具有这些功能的公司。您可以访问量身定制的公司名单,这些公司在大量内部持股的支持下实现了增长。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易是指相关司法管辖区内应报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗?直接联系我们。或者,发送电子邮件给编辑组(网址为)simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. LeMaitre Vascular shareholders can take confidence from the fact that EBIT margins are up from 18% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. LeMaitre Vascular shareholders can take confidence from the fact that EBIT margins are up from 18% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.