Should You Buy GeoPark Limited (NYSE:GPRK) For Its Upcoming Dividend?

Should You Buy GeoPark Limited (NYSE:GPRK) For Its Upcoming Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that GeoPark Limited (NYSE:GPRK) is about to go ex-dividend in just 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase GeoPark's shares before the 21st of November in order to receive the dividend, which the company will pay on the 6th of December.

一些投资者依赖于分红来增加财富,如果你是其中一位分红猎手,你可能会对知道geopark有限公司(纽交所:GPRK)将在4天后进行除息感兴趣。除息日期是公司录得日的前一个营业日,也就是公司确定哪些股东有资格获得分红的日子。除息日期很重要,因为任何股票交易在录得日之前必须已经结算,才有资格获得分红。因此,你可以在11月21日之前购买geopark的股票以便领取分红,该公司将在12月6日支付。

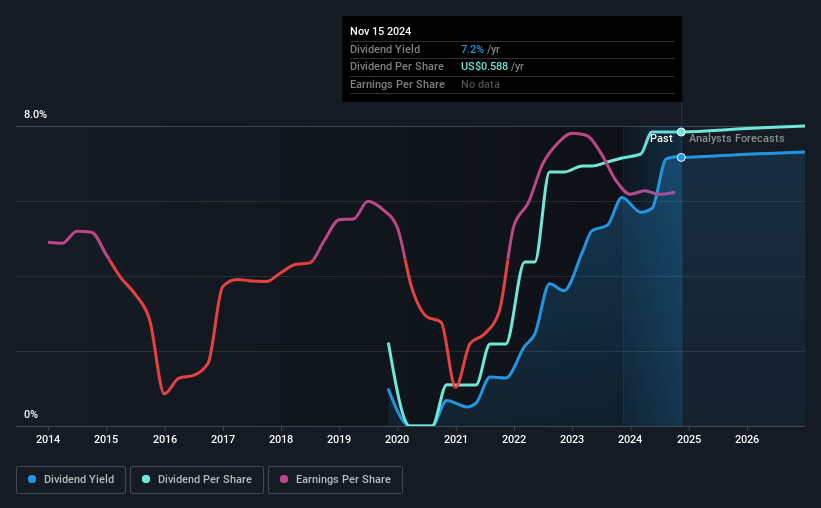

The company's upcoming dividend is US$0.147 a share, following on from the last 12 months, when the company distributed a total of US$0.59 per share to shareholders. Looking at the last 12 months of distributions, GeoPark has a trailing yield of approximately 7.2% on its current stock price of US$8.21. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

公司即将发放的分红为每股美元0.147,延续了过去12个月,公司向股东总共派发了每股美元0.59。观察最近12个月的分红,geopark当前的股价为美元8.21,其追踪收益率约为7.2%。分红对于长期持有者的投资回报是一个重要贡献因素,但前提是分红持续支付。这就是为什么我们应该始终检查分红支付是否可持续,以及公司是否在成长。

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. GeoPark paid out a comfortable 29% of its profit last year. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Luckily it paid out just 18% of its free cash flow last year.

通常,分红是由公司利润支付的。如果一家公司支付的分红超过其盈利,那么这种分红就可能不可持续。geopark去年支付了其利润的舒适29%。然而,现金流通常比利润更重要,用于评估分红的可持续性,因此我们应该始终检查公司是否有足够的现金来支付分红。幸运地是,它去年只支付了自由现金流的18%。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

看到股息既有盈利也有现金流的覆盖是令人鼓舞的。这通常表明股息是可持续的,只要收益没有急剧下降。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

点击此处查看公司的支付比率以及未来分红的分析师预期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. For this reason, we're glad to see GeoPark's earnings per share have risen 12% per annum over the last five years. Earnings per share are growing rapidly and the company is keeping more than half of its earnings within the business; an attractive combination which could suggest the company is focused on reinvesting to grow earnings further. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

公司每股收益稳步增长通常是最佳的分红股,因为它们通常更容易增加每股分红。投资者喜爱分红,所以如果收益下滑且分红减少,预计股票会同时遭受重挫。因此,我们很高兴看到geopark过去五年每股收益每年增长12%。每股收益增长迅速,公司将超过一半的收益留在业务内;这种吸引人的组合可能表明公司致力于再投资以进一步增加收益。大力再投资的快速增长业务从分红角度看很吸引人,特别是因为它们往往可以随后提高派息比率。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. GeoPark has delivered 29% dividend growth per year on average over the past five years. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

大多数投资者评估公司分红前景的主要方式是检查历史的分红增长率。geopark过去五年平均每年提供29%的分红增长。看到每股收益在过去几年快速增长,而每股分红也在同步增长,这让人很高兴。

The Bottom Line

最终结论

From a dividend perspective, should investors buy or avoid GeoPark? GeoPark has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past five years, but the conservative payout ratio makes the current dividend look sustainable. Overall we think this is an attractive combination and worthy of further research.

从分红角度看,投资者应该买入geopark还是避开?geopark在同时增加每股收益的同时重新投资于业务。不幸的是,在过去五年中至少削减过一次分红,但保守的派息比率使当前的分红看起来是可持续的。总体而言,我们认为这是一个有吸引力的组合,值得进一步研究。

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 2 warning signs for GeoPark and you should be aware of these before buying any shares.

因此,在深入研究股票时,最重要的部分之一是了解股票目前面临的任何风险。我们的分析显示geopark存在2个警告信号,您在购买任何股票之前都应该注意这些。

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

一个常见的投资错误是购买你看到的第一个有趣的股票。在这里,您可以找到高股息股票的完整列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.