Nvidia's Q3 earnings preview: Making profits with option strategies

Nvidia's Q3 earnings preview: Making profits with option strategies

$NVIDIA (NVDA.US)$ is set to announce its Q3 2024 earnings on November 20 after market close. Investors will look at the company’s full-year forecast alongside positive sentiments surrounding the next-generation Blackwell chips.

$英伟达 (NVDA.US)$ 预计将在11月20日市场收盘后发布2024年第三季度财报。投资者将关注公司全年预测以及对下一代Blackwell芯片的积极情绪。

What guidance does the options market provide?

期权市场提供了什么指导?

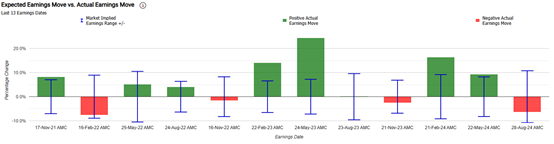

The options market overestimated Nvidia stocks earnings move 62% of the time in the last 13 quarters. The predicted move after earnings announcement was ±8.0% on average vs an average of the actual earnings moves of 8.0% (in absolute terms).

在过去的13个季度中,期权市场对英伟达股票的盈利变动高估了62%。盈利公告后的预测变动平均为±8.0%,而实际盈利变动的平均值也是8.0%(绝对值)。

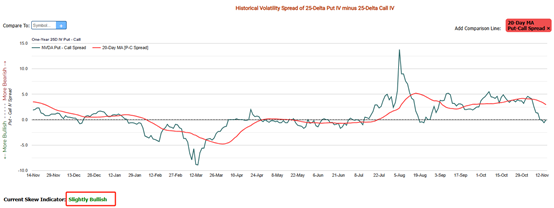

From the perspective of implied volatility skew, market sentiment is slightly bullish on Nvidia.Over the last 12 quarters earnings day, there has been a 67% probability of achieving positive returns, with the maximum gain reaching 24.4%.

从隐含波动率的角度来看,市场情绪对英伟达略显看好。在过去的12个季度的盈利日中,有67%的概率实现正收益,最高收益达24.4%。

Option strategies

期权策略

Investors can utilize various strategies to navigate the potential volatility surrounding Nvidia's earnings report. Here are some potential option strategies for investors to consider:

投资者可以利用各种策略来应对围绕英伟达财报的潜在波动。以下是一些投资者可以考虑的潜在期权策略:

Long calls or long puts

开多看涨期权或开空看跌期权

Investors who are optimistic about Nvidia's performance post-earnings might opt to purchase call options at a specific strike price. This gives them the right to buy shares at that price if they rise above it by the expiration date. Conversely, for those with a negative outlook, buying put options can be advantageous, as these allow them to profit from a potential decline in the stock price.

对于对英伟达财报表现持乐观态度的投资者,他们可能会选择在特定行权价购买看涨期权。这赋予他们在到期日之前以该价格购买股票的权利,如果股价上涨超过该行权价。相反,对于持负面展望的投资者,购买看跌期权可能更具优势,因为这使他们可以从股价可能下跌中获利。

This strategy offers the possibility of substantial gains if Nvidia's stock soars, with the potential for high leverage and limited downside risk. However, if the stock doesn't surpass the break-even point by the expiration date, the initial investment in the option premium is at risk.

这一策略提供了在英伟达股票飙升时实现可观收益的可能性,并具有高杠杆和有限的下行风险。然而,如果股票在到期日前未能超过盈亏平衡点,则期权溢价的初始投资将面临风险。

2. Selling Covered calls

2. 卖出备兑看涨期权

For shareholders who own Nvidia stock and anticipate a stable or moderately rising market, selling covered calls can be a way to generate additional income. By selling call options with a higher strike price, they can earn a premium, which acts as a buffer against minor stock price declines and can enhance returns in a flat or slightly bullish market.

对于持有英伟达股票并预期市场稳定或适度上涨的股东来说,出售有保障的看涨期权是一种产生额外收入的方式。通过出售更高行使价的看涨期权,他们可以获得一个溢价,这可以作为对小幅股价下跌的缓冲,并能在平稳或略微看好的市场中提升收益。

This approach has its benefits, such as providing a cushion against small stock price drops and increasing returns in a stagnant or mildly positive market. However, it caps the potential upside if Nvidia's stock rallies significantly, as profits are limited to the strike price of the sold call options. Additionally, if Nvidia's stock falls sharply, the strategy exposes the investor to potential losses on the stock position.

这种方法有其好处,例如为小幅股价下跌提供缓冲,并在停滞或温和积极的市场中增加收益。然而,如果英伟达的股票大幅反弹,则潜在的上涨空间受到限制,因为利润仅限于已出售的看涨期权的行使价。此外,如果英伟达的股票急剧下跌,该策略可能会让投资者面临股票头寸的潜在损失。

3. Cash-secured puts

3. 有保障的看跌期权

Investors who are interested in acquiring Nvidia shares at a lower price can implement a cash-secured put strategy. By selling put options and keeping cash on hand equivalent to the strike price, they are prepared to purchase shares if the option is exercised.

希望以较低价格购买英伟达股票的投资者可以实施有保障的看跌期权策略。通过出售看跌期权并保持现金准备金与行使价等额,他们可以在期权被行使时准备好购买股票。

This strategy allows investors to earn premium income while being ready to buy shares at a discounted price if the stock falls below the strike price. If successful, the premium income adds to the overall yield, and shares can be acquired at an effective discount. However, there are risks involved, such as the obligation to buy shares at the strike price even if the stock declines significantly, leading to potential paper losses, and the upside is limited to the premium received.

这种策略使投资者能够赚取溢价收入,同时准备在股票价格低于行使价时以折扣价格购买股票。如果成功,溢价收入将增加整体收益,并且可以有效地以折扣价获得股票。然而,也存在风险,例如,即使股票大幅下跌,仍有义务以行使价购买股票,从而导致潜在的账面损失,并且上行空间仅限于获得的溢价。

4. Protective puts

4. 保护性看跌期权

Investors who already own Nvidia shares and are long-term bullish but wish to mitigate downside risk in case of disappointing earnings can use protective puts. By purchasing put options on their existing shares, they create a safety net against sharp declines.

已经拥有英伟达股票并对其长期看好的投资者,但希望在收益不佳时降低下行风险,可以使用保护性看跌期权。通过为其现有股票购买看跌期权,他们建立了防范大幅下跌的安全网。

This strategy is suitable for those who want to maintain their long-term bullish stance while protecting against short-term volatility. It caps losses at the put option's strike price and provides peace of mind during potentially volatile earnings periods. However, the cost of the put option premium reduces overall returns if Nvidia doesn't decline as anticipated.

这种策略适合希望保持长期看好立场,同时保护自己免受短期波动影响的投资者。它将损失限制在看跌期权的行使价,并在潜在的波动收益期提供安心。然而,如果英伟达的股票未如预期下跌,看跌期权的溢价成本将降低整体收益。

5. Collars

5. 保护策略

For investors who own Nvidia shares and want to protect against potential downside while capping their upside, a collar strategy can be employed. This involves holding the shares, selling a call option, and buying a put option.

对于持有英伟达股票并希望保护潜在下行风险的投资者,可以采用保护策略。这包括持有股票,卖出看涨期权,并购买看跌期权。

This strategy is often favored by conservative investors who wish to maintain their equity exposure without taking on excessive risk. It has a low-cost structure since the premium from selling the call can offset the cost of the put, providing protection against significant losses while allowing for modest gains. However, it also limits the potential upside if Nvidia's stock price increases substantially.

这一策略通常受到保守投资者的青睐,他们希望在不承担过多风险的情况下保持股票投资。由于卖出看涨期权所获得的溢价可以抵消看跌期权的成本,因此该策略的成本结构较低,能够在提供显著损失保护的同时,实现适度的收益。然而,如果英伟达的股价大幅上涨,该策略也会限制潜在的收益。

Consensus Estimates

共识估计

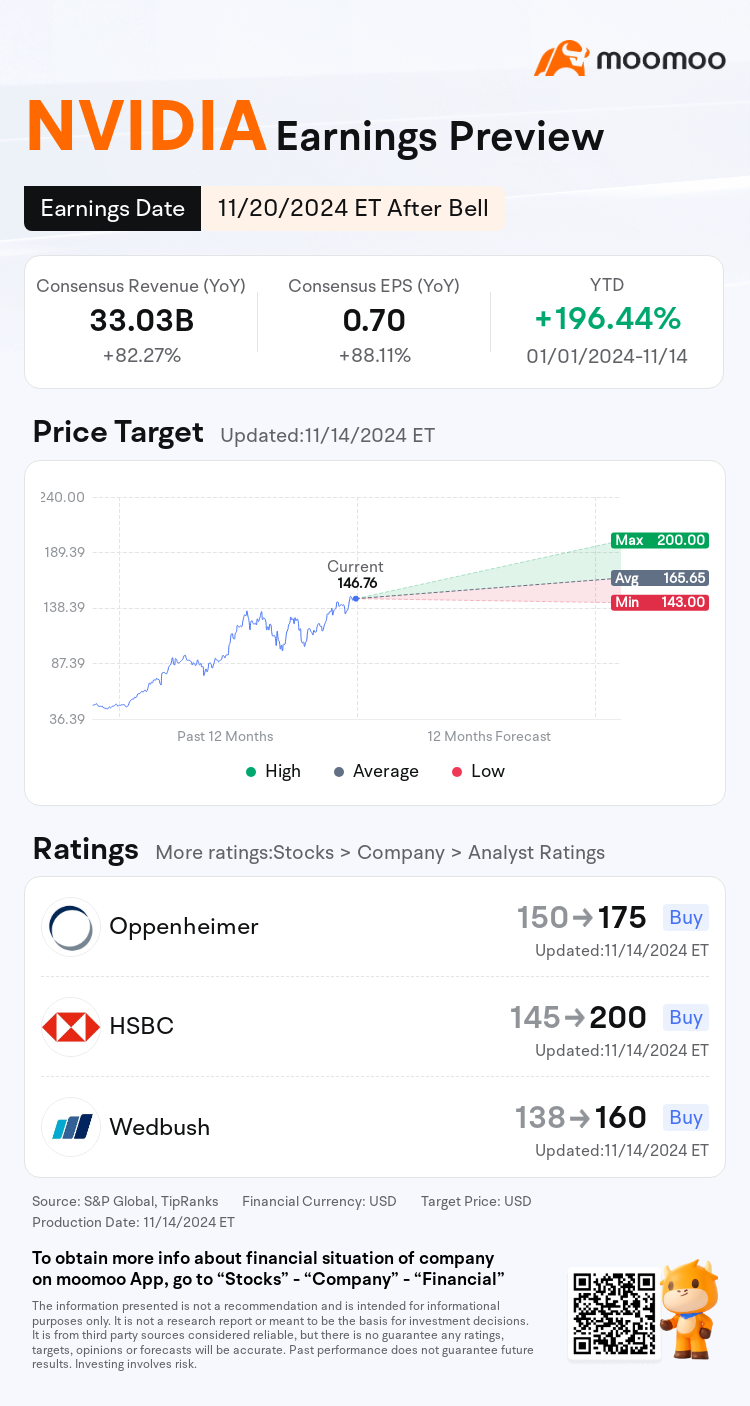

● The analyst consensus has Nvidia reporting revenue of $33.03 billion, up 82% year-over-year. The world's most valuable company’s stock has nearly tripled in 2024 driven by demand for the company’s family of AI chips—including its next generation Blackwell graphics processing units.

● 分析师共识预计英伟达的营业收入为330.3亿,较去年同期增长82%。全球最有价值公司的股票在2024年几乎翻了三倍,这主要得益于对该公司人工智能芯片系列的需求,包括其下一代Blackwell图形处理单元。

● Earnings are expected to be $0.70 per share in the third quarter, up 88.11% from the year-ago quarter.

● 第三季度每股收益预计为0.70美元,比去年同期增长88.11%。

Nvidia’s data center business is still the only segment that matters

英伟达的数据中心业务仍然是唯一重要的部门

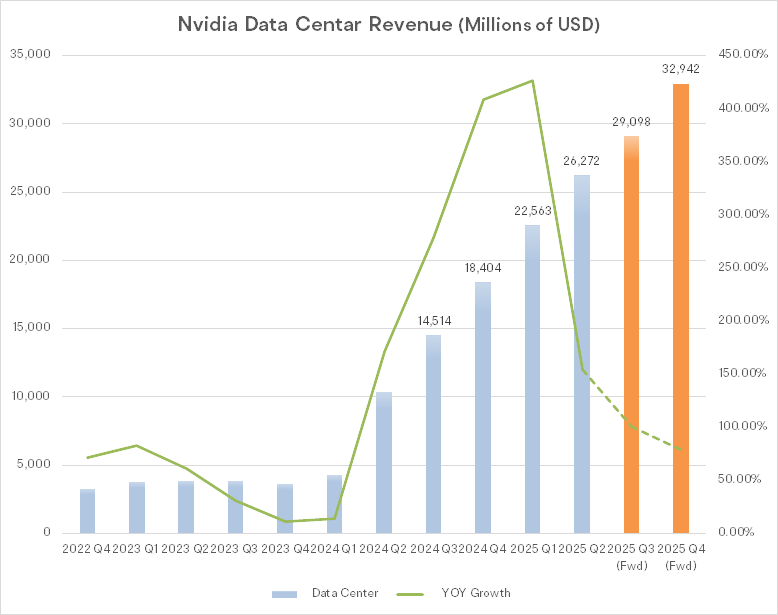

Nvidia's performance has been dominated by its Data Center segment, which accounts for nearly 90% of total revenue (as of Q2 2025). This segment has been showing remarkable growth, which is expected to continue for the next few years.

英伟达的业绩主要由其idc概念部门主导,该部门占总营业收入的近90%(截至2025年第二季度)。该部门显示出显著的增长,预计在未来几年将继续保持。

According to Bloomberg consensus forecasts, Nvidia’s Data Center Q3 revenue is expected to reach $29.098 billion, representing a year-over-year increase of 100.48%.“We see Nvidia remaining the leader in the AI training and inference chips for data center applications,” analysts at Mizuho wrote, estimating that the company holds a dominant market share of nearly 95% in the space.

根据彭博社的共识预测,英伟达的idc概念第三季度营业收入预计将达到290.98亿,同比增加100.48%。“我们认为英伟达将在数据中心应用的人工智能训练和推理芯片领域保持领导地位,”瑞穗分析师写道,估计该公司在这个领域的市场份额接近95%。

Based on Nvidia’s strong forecast for fiscal 2025, Morningstar analysts predict that Data Center revenue will rise by 133% to $111 billion in fiscal 2025. They also forecast a 23% compound annual growth rate for the three years thereafter, as strong growth in capital expenditures in data centers at leading enterprise and cloud computing customers.

根据英伟达对2025财年的强劲预测,晨星分析师预计数据中心的营业收入将在2025财年增长133%,达到1110亿。分析师还预测,随后三年的复合年增长率为23%,因为领先的企业和云计算客户在数据中心的资本支出将持续强劲增长。

Nvidia's other segments have shown modest but stable growth

英伟达的其他部门显示出适度但稳定的增长。

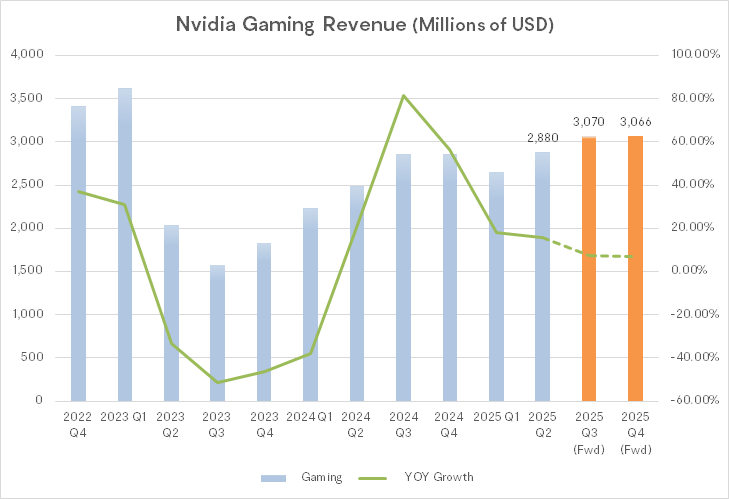

The Gaming segment reported 16% year-over-year (YoY) growth in Q2 2025, while the Professional Visualization segment grew by 20%. Both segments are expected to maintain similar growth rates in Q3, though they remain overshadowed by the dominant Data Center segment's performance.

arvr游戏部门在2025年第二季度报告了16%的同比增长,而专业可视化部门增长了20%。虽然这两个部门在第三季度预计会保持类似的增长率,但仍然受到主导的数据中心部门表现的压制。

According to Bloomberg consensus forecasts, the Gaming segment is expected to achieve revenue of $3.07 billion in Q3, up 7.5% from the year-ago quarter.

根据彭博社的共识预测,arvr游戏部门预计在第三季度实现营业收入30.7亿,同比增长7.5%。

How's the $50 billion buyback progressing?

500亿的股票回购进展如何?

Nvidia announced in August that its board of directors approved $50 billion of buybacks.

英伟达在8月宣布,其董事会批准了500亿的股票回购计划。

On the surface, Nvidia increasing its share buyback program could be viewed as a bullish sign for investors. Generally speaking, companies buy back stock when management believes shares are undervalued. Based on the past two years, Nvidia stock trades below its average price-to-earnings (P/E) and price-to-free cash flow (P/FCF) multiples.

从表面上看,英伟达增加其股票回购计划可以被视为对投资者的看好信号。一般而言,当管理层认为股票被低估时,公司会回购股票。基于过去两年的数据,英伟达股票的交易价格低于其平均市盈率(P/E)和市值自由现金流(P/FCF)倍数。

Since the company's new Blackwell GPU is shaping up to be a massively successful product launch, there's reason to believe Nvidia stock is poised to break out. Such a move would come with valuation expansion and, therefore, a more pricey stock.

由于公司的新Blackwell gpu芯片-云计算即将推出,有理由相信英伟达股票将迎来突破。这一举动将伴随着估值的扩张,从而使股价更加昂贵。

For these reasons, investors are closely watching to see if the company repurchased any stock during the fiscal third quarter at more reasonable valuations, prior to any Blackwell-driven tailwinds.

因此,投资者密切关注该公司是否在财政第三季度以更合理的估值回购了任何股票,以应对黑韦尔驱动的顺风。

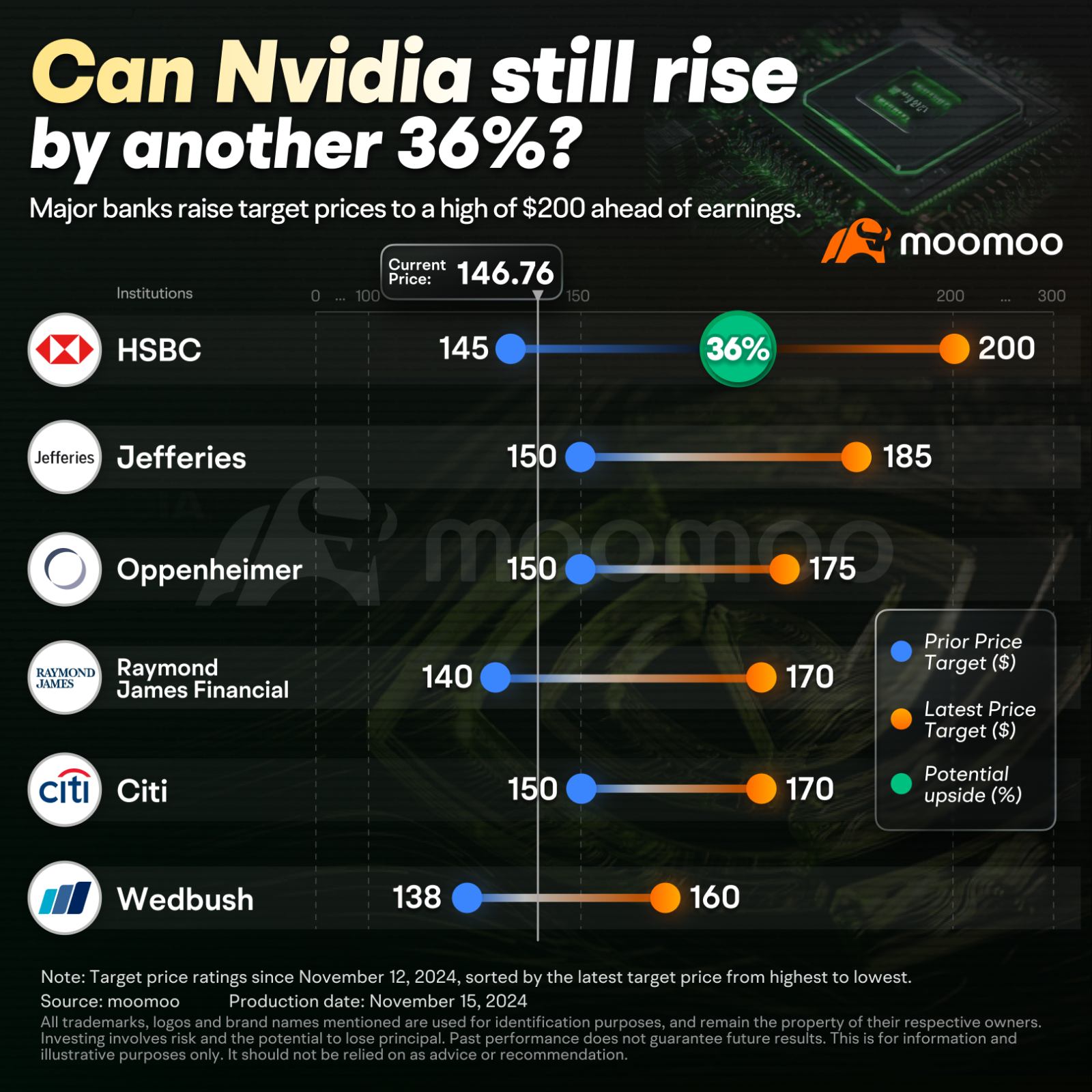

Analysts are bullish on Nvidia stock ahead of earnings next week

分析师对英伟达股票在下周财报发布前持看好态度。

Analysts are growing increasingly confident in the artificial intelligence chip behemoth's prospects. At least five research firms raised their price targets on Nvidia ahead of earnings.

分析师们对这家人工智能芯片巨头的前景越来越有信心。至少有五家研究公司在财报前调高了对英伟达的目标价格。

Susquehanna Financial Group analyst Christopher Rolland reiterated his positive rating on Nvidia stock and raised his price target to 180 from 160.

Susquehanna Financial Group的分析师克里斯托弗·罗兰德重申了对英伟达股票的积极评级,并将其目标价格从160提升至180。

Rolland said his industry checks indicated sustained demand for Nvidia's current-generation Hopper series products, H100 and H200, ahead of the Blackwell series launch.

Rolland表示,他的行业调查显示,英伟达当前一代的Hopper系列产品H100和H200在Blackwell系列发布之前,需求持续旺盛。

Robust capital equipment spending plans by hyperscale cloud service providers such as $亚马逊(AMZN.US)$ and $Meta Platforms(META.US)$ are driving AI data center processor demand, Rolland said.

Rolland表示,超大规模云计算服务商的强劲资本设备支出计划正在推动人工智能数据中心处理器的需求。 亚马逊(AMZN.US) 和Meta platforms涨幅为35%。

"We expect another strong quarter driven by healthy Hopper demand and early Blackwell ramps," Raymond James analyst Srini Pajjuri said in a client note. "Supply remains a wild card, which could limit near-term upside."

Raymond James分析师Srini Pajjuri在一份客户报告中表示:"我们预计下一个季度将会再次强劲,受健康的Hopper需求和Blackwell系列的早期启动驱动。供应仍是一个变量,可能限制短期的上涨空间。"

Pajjuri kept his strong buy rating on Nvidia stock and increased his price target to 170 from 140.

Pajjuri维持对英伟达股票的强烈买入评级,并将价格目标从140提高到170。

Additionally, Morgan Stanley’s Joseph Moore raised his target from $150 to $160, citing the impact of the upcoming Blackwell chips, which CEO Jensen Huang noted are experiencing intense demand.

此外,摩根士丹利的约瑟夫·摩尔将目标价从150美元上调至160美元,指出即将推出的Blackwell芯片正在经历强劲的需求,首席执行官黄仁勋对此表示关注。

However, Moore warned that the company might be impacted by supply chain constraints,“we are back to fully supply constrained on new products, which could limit upside on current quarter and outlook,” said Moore.

然而,摩尔警告称,公司可能会受到供应链限制的影响,“我们在新产品方面完全受限,这可能会限制当前季度和前景的上行空间,”摩尔说道。

Beyond NVIDIA earnings report: Upcoming U.S. stock market highlights in the rest of 2024?

英伟达财报发布后:2024年下半年美国股市的重点是什么?

Black Friday: Opportunity for U.S. consumer stocks?

黑色星期五:美国消费股票的机会?

The Thanksgiving to Christmas period is a traditional shopping peak, with the Friday following Thanksgiving, known as "Black Friday," often triggering a significant retail uptick. This annual event is crucial for retail companies, as it may boost their business performance and stock prices due to the substantial consumer spending it generates. However, investor confidence could be at risk if retail sales on Black Friday do not meet market expectations and this may lead to a drop in stock prices.

感恩节到圣诞节期间是传统购物高峰期,感恩节后周五被称为“黑色星期五”,通常会引发零售业的显著增长。这一年度事件对零售公司至关重要,因为它可能由于大量消费支出而提升他们的业务表现和股票价格。然而,如果黑色星期五的零售销售未能达到市场预期,投资者信心可能会受到影响,这可能导致股票价格下跌。

As the holiday season draws near, U.S. consumer stocks could be in the spotlight. According to the National Retail Federation, holiday spending reached a record of over $964 billion in 2023, which was up 3.8% from 2022. This growth trend is expected to continue, with Morgan Stanley forecasting that holiday spending will rise from last year's record high. Additionally, retail sales data for October revealed a stronger-than-anticipated 0.4% month-over-month increase, with September's figure revised to a substantial 0.8%. This trend could signal a robust foundation for the upcoming holiday shopping season.

随着假日季节的临近,美国消费股票可能会受到关注。根据全国零售联合会的数据,2023年假日消费达到了超过9640亿的创纪录水平,比2022年增长了3.8%。预计这一增长趋势将持续,摩根士丹利预测假日消费将从去年的历史高点继续上升。此外,十月份的零售销售数据揭示出环比增长超过预期的0.4%,九月份的数字则修订为显著的0.8%。这个趋势可能为即将到来的假日购物季奠定坚实的基础。

Stocks to watch: $Walmart (WMT.US)$, $Amazon (AMZN.US)$, and $Target (TGT.US)$.

关注的股票: $沃尔玛 (WMT.US)$, $亚马逊 (AMZN.US)$,和 $塔吉特 (TGT.US)$.

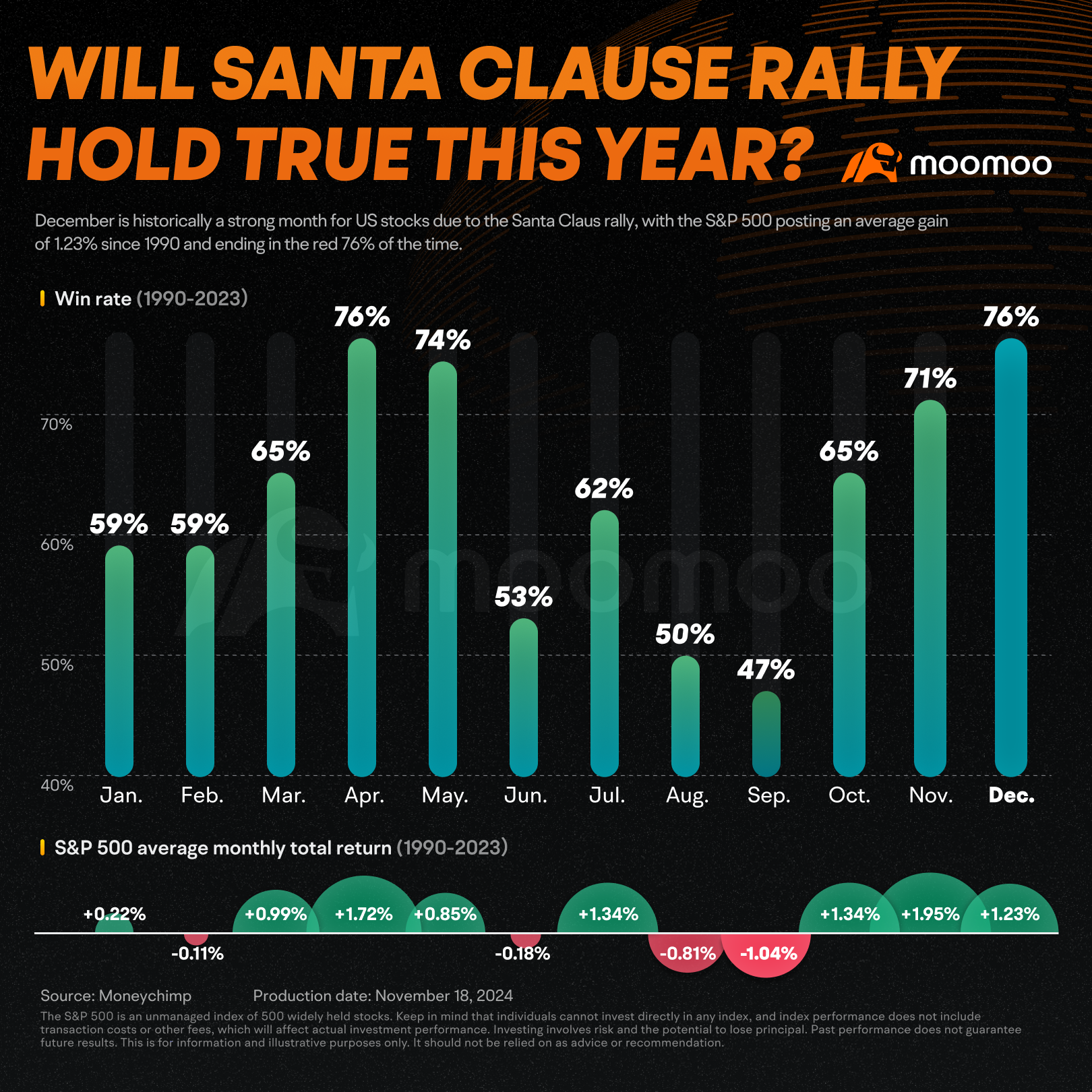

Santa Claus Rally

圣诞老人行情

Wall Street typically refers to the market performance during the last five trading days of the year and the first two trading days of January as the "Santa Claus rally." During this period, the stock market often exhibits unusually strong performance. Since 1990, the S&P 500 has achieved a win rate of 71% in November, with an average monthly gain of 1.95%. In December, the win rate is even higher at 76%, with an average monthly gain of 1.23%.

华尔街通常将年度最后五个交易日和一月的前两个交易日的市场表现称为“圣诞老人行情”。在此期间,股市通常表现异常强劲。自1990年以来,标准普尔500指数在11月的胜率为71%,平均月收益为1.95%。在12月,胜率甚至更高,达到76%,平均月收益为1.23%。

According to statistics from the Almanac Trader, the U.S. stock market experienced a "Santa Claus rally" in each of the past seven years. From 2016 to 2022, the S&P 500 index rose by 0.4%, 1.1%, 1.3%, 0.3%, 1.0%, 1.4%, and 0.8% during the Santa Claus rally period. However, the S&P 500 index declined 0.88% in the past year. Therefore, despite historical data showing the Santa Claus Rally has occurred often in the past, its recurrence is unpredictable for investors, as it is influenced by a multitude of factors that can vary from year to year.

根据《年鉴交易者》的统计数据,过去七年中,美国股市每年都经历了 "圣诞老人反弹"。从2016年到2022年,标准普尔500指数在圣诞老人反弹期间上涨了0.4%、1.1%、1.3%、0.3%、1.0%、1.4%和0.8%。然而,标准普尔500指数在过去一年下跌了0.88%。因此,尽管历史数据表明圣诞老人反弹在过去经常发生,但其再次出现对投资者来说是不可预测的,因为它受多种因素的影响,每年都可能有所不同。

Source: IBD, Investopedia, Market Chameleon, Business Insider

来源:IBD,Investopedia,Market Chameleon,Business Insider

From the perspective of implied volatility skew, market sentiment is

From the perspective of implied volatility skew, market sentiment is