On Nov 19, major Wall Street analysts update their ratings for $Guidewire Software (GWRE.US)$, with price targets ranging from $215 to $220.

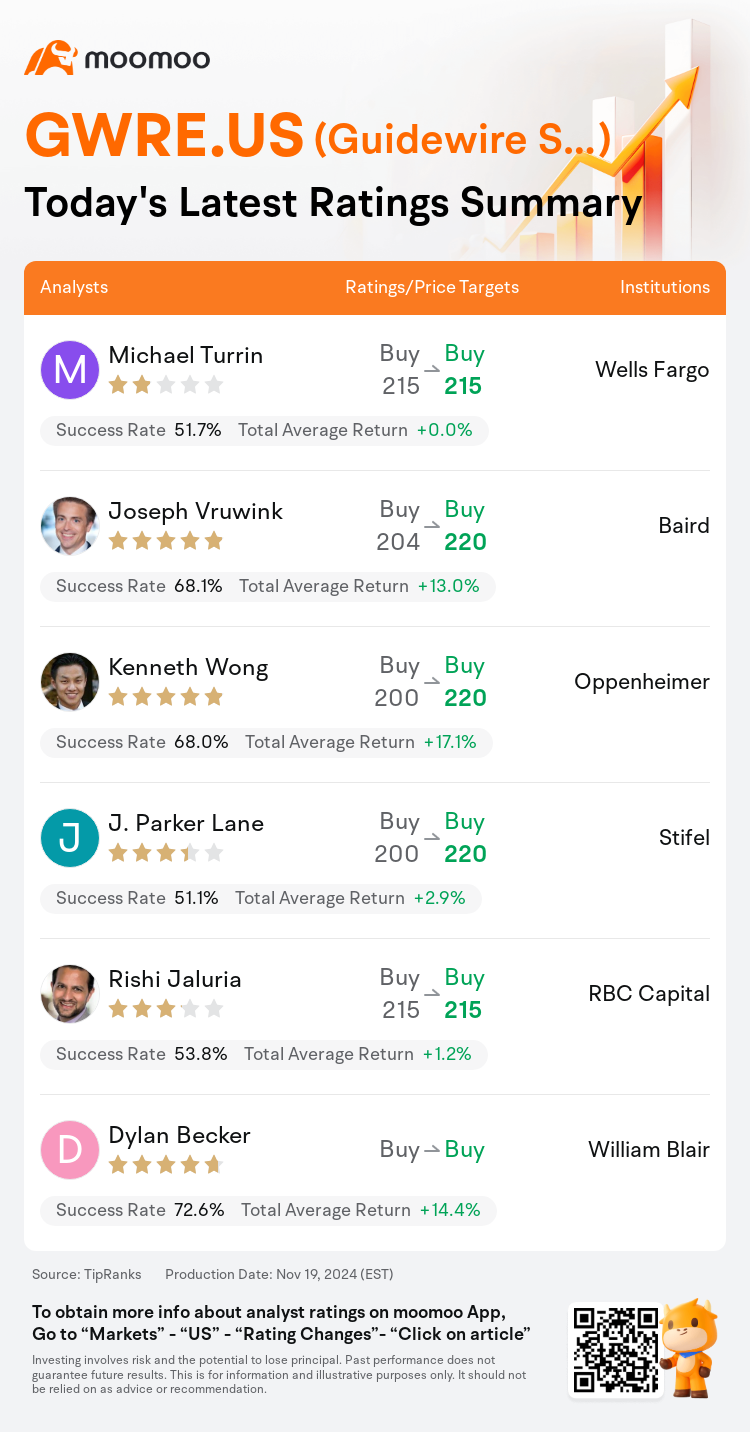

Wells Fargo analyst Michael Turrin maintains with a buy rating, and maintains the target price at $215.

Baird analyst Joseph Vruwink maintains with a buy rating, and adjusts the target price from $204 to $220.

Oppenheimer analyst Kenneth Wong maintains with a buy rating, and adjusts the target price from $200 to $220.

Oppenheimer analyst Kenneth Wong maintains with a buy rating, and adjusts the target price from $200 to $220.

Stifel analyst J. Parker Lane maintains with a buy rating, and adjusts the target price from $200 to $220.

RBC Capital analyst Rishi Jaluria maintains with a buy rating, and maintains the target price at $215.

Furthermore, according to the comprehensive report, the opinions of $Guidewire Software (GWRE.US)$'s main analysts recently are as follows:

After attending Guidewire's annual customer and partner meeting, the Connections conference in Nashville, it was noted that management advocated strongly for transitioning from on-premise solutions to its latest upgrades. The move to the cloud is being embraced, as nearly half of core customers are now committed to cloud solutions. This trend is expected to accelerate with the integration of AI features in future releases.

The firm maintains its strong outlook on the shares as recent partner surveys indicate an improving demand for cloud services from an already robust environment anticipated for FY23-24. This is particularly notable in migrations and areas of the market that are currently under-penetrated.

During a full day at Guidewire Connections, analysts engaged in product sessions, interacted with partners and customers, and connected with management, gaining insights into the company's operations. The CEO emphasized a strong commitment to driving customer success and furthering the transition to cloud-based solutions.

The firm recently gathered insights from customers and key partners at Guidewire Connections in Nashville. They continue to observe evidence suggesting a consistent increase in cloud momentum.

Here are the latest investment ratings and price targets for $Guidewire Software (GWRE.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月19日,多家华尔街大行更新了$Guidewire Software (GWRE.US)$的评级,目标价介于215美元至220美元。

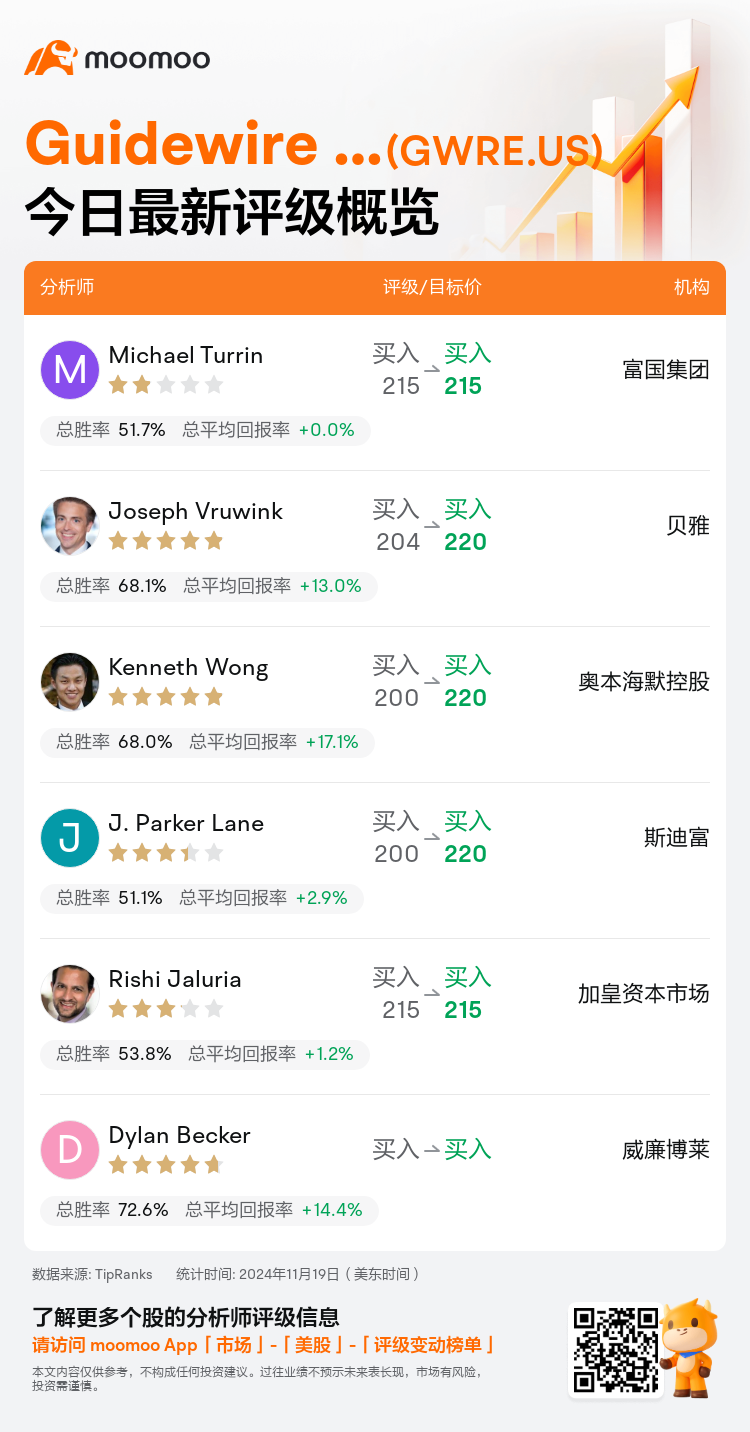

富国集团分析师Michael Turrin维持买入评级,维持目标价215美元。

贝雅分析师Joseph Vruwink维持买入评级,并将目标价从204美元上调至220美元。

奥本海默控股分析师Kenneth Wong维持买入评级,并将目标价从200美元上调至220美元。

奥本海默控股分析师Kenneth Wong维持买入评级,并将目标价从200美元上调至220美元。

斯迪富分析师J. Parker Lane维持买入评级,并将目标价从200美元上调至220美元。

加皇资本市场分析师Rishi Jaluria维持买入评级,维持目标价215美元。

此外,综合报道,$Guidewire Software (GWRE.US)$近期主要分析师观点如下:

在参加了Guidewire在纳什维尔举办的年度客户和合作伙伴大会Connections会议后,我们注意到管理层强烈倡导从本地解决方案过渡到最新升级版本。几乎一半的核心客户现在已经致力于云解决方案。这一趋势预计会随着将人工智能功能整合到未来版本中而加速。

公司对股票持续看好,因为最近的合作伙伴调查显示,对云服务的需求有所提升,而对FY23-24年度预期中已经强劲的环境更是如此。这在迁移和市场目前渗透率较低的领域尤其值得注意。

在Guidewire Connections度过整整一天的时间,分析师参与了产品讲座,与合作伙伴和客户互动,并与管理层联系,深入了解了公司的运营情况。CEO强调了对推动客户成功和进一步推动向基于云的解决方案转变的坚定承诺。

公司最近在纳什维尔的Guidewire Connections会议上收集了来自客户和重要合作伙伴的见解。他们继续观察到迹象表明云动能的持续增加。

以下为今日6位分析师对$Guidewire Software (GWRE.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

奥本海默控股分析师Kenneth Wong维持买入评级,并将目标价从200美元上调至220美元。

奥本海默控股分析师Kenneth Wong维持买入评级,并将目标价从200美元上调至220美元。

Oppenheimer analyst Kenneth Wong maintains with a buy rating, and adjusts the target price from $200 to $220.

Oppenheimer analyst Kenneth Wong maintains with a buy rating, and adjusts the target price from $200 to $220.