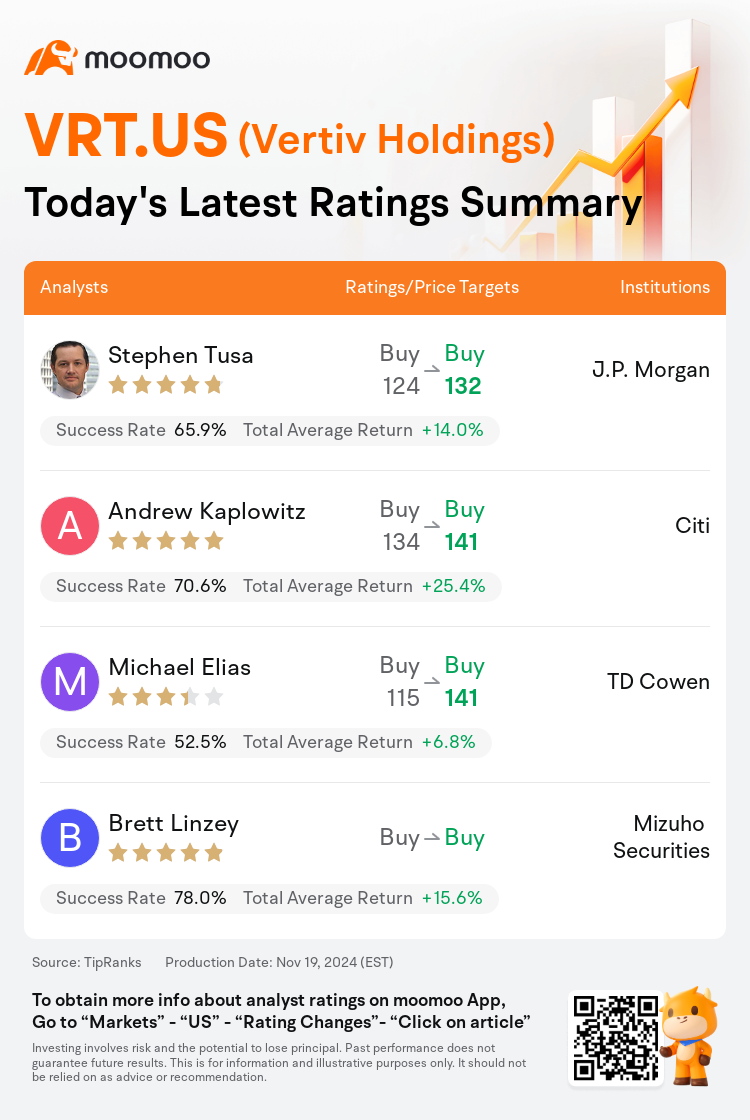

On Nov 19, major Wall Street analysts update their ratings for $Vertiv Holdings (VRT.US)$, with price targets ranging from $132 to $141.

J.P. Morgan analyst Stephen Tusa maintains with a buy rating, and adjusts the target price from $124 to $132.

Citi analyst Andrew Kaplowitz maintains with a buy rating, and adjusts the target price from $134 to $141.

TD Cowen analyst Michael Elias maintains with a buy rating, and adjusts the target price from $115 to $141.

TD Cowen analyst Michael Elias maintains with a buy rating, and adjusts the target price from $115 to $141.

Mizuho Securities analyst Brett Linzey maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Vertiv Holdings (VRT.US)$'s main analysts recently are as follows:

Following attendance at an investor day, there's optimism surrounding Vertiv Holdings' future prospects, with an updated roadmap that includes accelerated organic growth, significant opportunities for margin expansion, and a flexible capital strategy to potentially sustain continued outperformance of its shares. The company's goal for a long-lasting target of 12%-14% annual organic growth through 2029, as compared to anticipated market growth of 9%-12%, appears feasible owing to its comprehensive service model, robust customer and partnership foundations, and extensive global service capabilities.

Vertiv Holdings has increased its long-term growth, margin, and cash generation targets, and also projected its FY25 EPS slightly above market expectations while maintaining a consistent revenue outlook. The company is effectively leveraging infrastructure bottlenecks to enhance its competitive position, potentially outperforming end-markets by 200-300 basis points.

The evaluation of Vertiv Holdings' 2025 guidance as conservative suggests potential for upside through the observed period. There is a view by analysts that the long-term guidance represents an optimistic scenario, assuming a steady demand for HSP over a five-year stretch, which is met with some skepticism.

Here are the latest investment ratings and price targets for $Vertiv Holdings (VRT.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月19日,多家华尔街大行更新了$Vertiv Holdings (VRT.US)$的评级,目标价介于132美元至141美元。

摩根大通分析师Stephen Tusa维持买入评级,并将目标价从124美元上调至132美元。

花旗分析师Andrew Kaplowitz维持买入评级,并将目标价从134美元上调至141美元。

TD Cowen分析师Michael Elias维持买入评级,并将目标价从115美元上调至141美元。

TD Cowen分析师Michael Elias维持买入评级,并将目标价从115美元上调至141美元。

瑞穗证券分析师Brett Linzey维持买入评级。

此外,综合报道,$Vertiv Holdings (VRT.US)$近期主要分析师观点如下:

参加投资者日后,对vertiv holdings未来前景感到乐观,更新的路线图包括加快有机增长、扩大利润空间的重大机会,以及灵活的资本策略,可能有助于持续超越其股票表现。公司计划通过2029年实现12%-14%的年度有机增长目标,相比9%-12%的预期市场增长,由于其全面的服务模式、强大的客户和伙伴基础,以及广泛的全球服务能力,这一目标似乎是可行的。

vertiv holdings已经提高了其长期增长、利润和现金生成目标,并将其2025财年每股收益预期略高于市场预期,同时保持稳定的营业收入前景。该公司正在有效利用基础设施瓶颈来增强其竞争地位,有可能以200-300个基点的优势跑赢终端市场。

对vertiv holdings 2025年财务指导的保守评估表明,观察期内存在上行潜力。分析师普遍认为,长期指导代表了一个乐观的情景,假设对HSP的稳定需求在一个五年时期内得到满足,这令人存疑。

以下为今日4位分析师对$Vertiv Holdings (VRT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Michael Elias维持买入评级,并将目标价从115美元上调至141美元。

TD Cowen分析师Michael Elias维持买入评级,并将目标价从115美元上调至141美元。

TD Cowen analyst Michael Elias maintains with a buy rating, and adjusts the target price from $115 to $141.

TD Cowen analyst Michael Elias maintains with a buy rating, and adjusts the target price from $115 to $141.