Growth in Value-Added Downstream Sector Counters El Niño Impacts for Golden Agri

Growth in Value-Added Downstream Sector Counters El Niño Impacts for Golden Agri

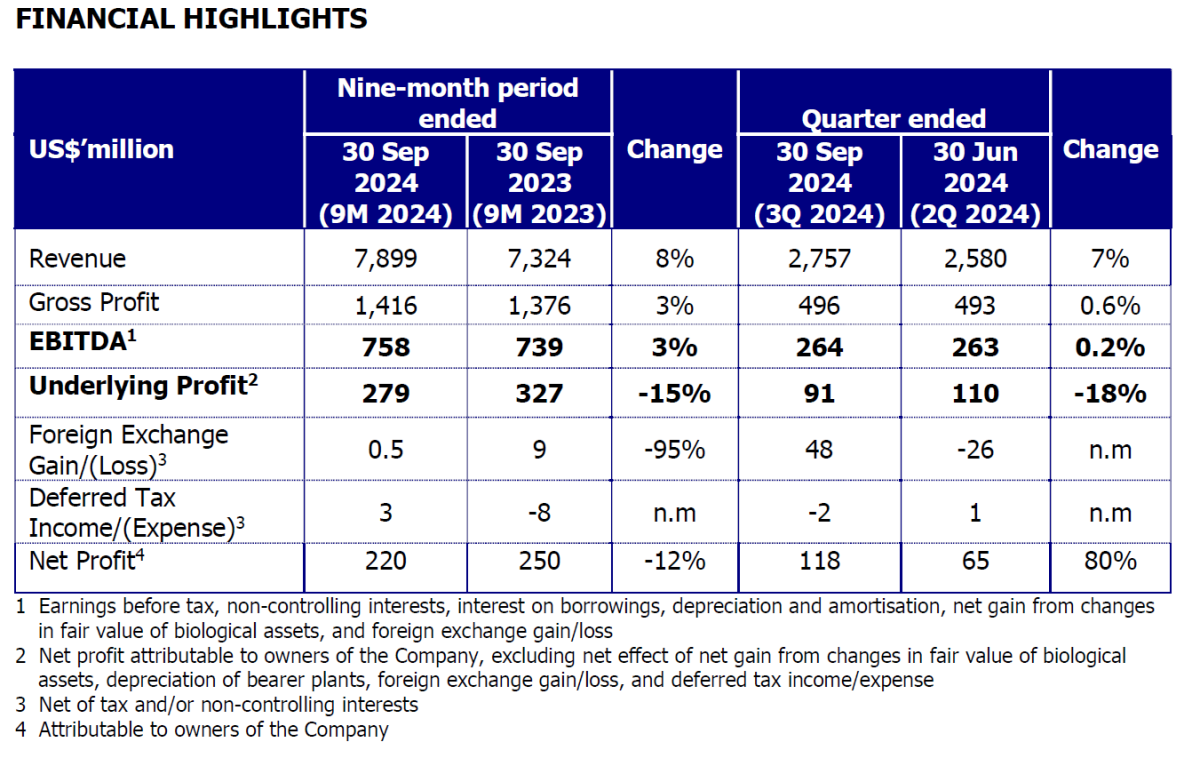

- Nine-month 2024 revenue grew by 8% year-on-year while EBITDA increased to US$758 million with a margin of 9.6%

- Downstream business growth mitigated the impact of lower production caused by El Niño conditions

- Underlying profit impacted by increased financial expenses and income tax

- 2024年前9个月营业收入同比增长8%,EBITDA增至75800万美元,边际为9.6%

- 下游-脑机业务增长缓解了厄尔尼诺现象导致的生产减少影响

- 基础利润受到财务费用增加和所得税的影响

Singapore, 14 November 2024 – Golden Agri-Resources Ltd ("GAR" or the "Company") recorded an 8% growth in revenue for the nine months ending September 2024, reaching almost US$7.9 billion. Weaker plantation output caused by the ongoing effects of 2023's El Niño conditions was mitigated by slightly higher crude palm oil (CPO) prices and expanded sales volumes during this period.

新加坡,2024年11月14日 – 金农资源有限公司("GAR"或"公司")在截至2024年9月份的九个月内实现了营业收入增长8%,接近79亿美元。由于2023年厄尔尼诺现象持续影响导致的种植园产量下降,通过略高的粗棕榈油(CPO)价格和在该期间扩大的成交量得以弥补。

EBITDA rose by 3% year-on-year to US$758 million, preserving a healthy margin of 9.6%. Meanwhile, underlying profit and net profit for the period decreased to US$279 million and US$220 million respectively. This was driven by increased financial expenses, in line with a higher interest rate environment, and greater income tax expenses attributed to several subsidiaries operating in higher income tax countries.

EBITDA同比增长3%,达到75800万美元,保持了9.6%的健康利润率。同时,该期间的基础利润和净利润分别降至27900万美元和22000万美元。这是由于金融费用增加,与利率环境上升相关,以及由于若干子公司位于高税率国家导致的更高所得税费用。

GAR's financial position remained strong with a low gearing ratio of 0.61 times and net debt to EBITDA of 0.53 times.

GAR的财务状况依然强劲,负债率低至0.61倍,净债务与EBITDA之比为0.53倍。

On the outlook, Mr Franky O. Widjaja, GAR Chairman and Chief Executive Officer, commented: "The impact of the El Niño phenomenon in the second half of 2023 on Indonesia's palm oil output this year is worse than initially estimated by the industry. Sunflower oil and rapeseed oil production have also been disrupted by some crop losses due to unfavourable weather conditions. The recent increase in production of soybean oil has alleviated the tightness in global rapeseed and sunflower oil supply, although prices remain elevated. The market anticipates a seasonally low production period for palm oil in the first half of next year, while Indonesia is planning for the implementation of an increased B40 biodiesel blending mandate."

GAR董事长兼首席执行官Franky O. Widjaja先生对前景表示:"2023年下半年厄尔尼诺现象对印尼今年的棕榈油产量影响比行业最初预计的更严重。葵花籽油和菜籽油的生产也受到一些作物损失的影响,原因是不利的天气条件。近期豆油产量的增加缓解了全球菜籽油和葵花籽油供应紧张的局面,尽管价格仍然居高不下。市场预计明年上半年棕榈油将迎来季节性低产期,而印尼正计划增加B40生物柴油混合比例的实施。"

Mr. Widjaja added: "Unpredictable weather conditions in key producing countries and escalating geopolitical tensions remain critical factors likely to support vegetable oil prices. Nevertheless, the possibility of demand rationing, especially in price-sensitive markets, amidst the current high prices is an important factor to monitor."

Widjaja先生补充道:“主要生产国不可预测的天气条件和不断升级的地缘政治紧张局势仍然是可能支持植物油价格的关键因素。然而,在当前高价格的背景下,尤其是在对价格敏感的市场中,需求配额的可能性是一个重要的监测因素。”

OPERATIONAL HIGHLIGHTS

运营亮点

As of 30 September 2024, GAR's planted area was almost 534,000 hectares, of which 486,000 hectares were mature. Nucleus and plasma estates made up 417,000 and 117,000 hectares of this area respectively.

截至2024年9月30日,全球货币种植面积几乎达到534,000公顷,其中486,000公顷为成熟种植区。核心和核心外种园分别占据该区域的417,000公顷和117,000公顷。

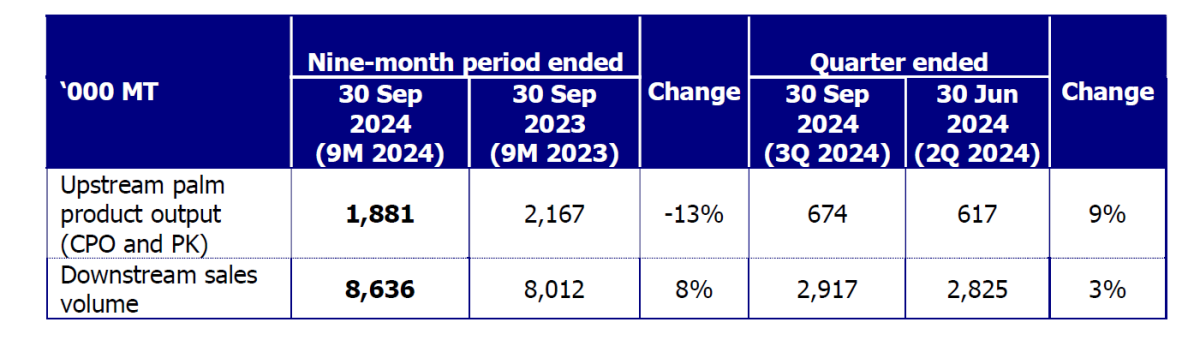

Fruit yield for the period decreased year-on-year from 14.4 tonnes per hectare in 2023 to 12.8 tonnes per hectare, as a result of land preparation for replanting and the impact of El Niño conditions in late 2023. While palm product output remains below last year's levels, it has recovered consistently each quarter and GAR expects the peak crop season to shift to the fourth quarter this year.

该期间的水果产量从2023年的每公顷14.4吨下降至每公顷12.8吨,这是由于为重新种植进行土地准备和2023年年底厄尔尼诺现象的影响导致的。尽管棕榈产品产量仍低于去年水平,但每个季度都在稳步恢复,全球货币预计本年度的高产季节将转移到第四季度。

Elsewhere, sales volume in GAR's downstream business expanded by 8% during the nine months of 2024, demonstrating the efficacy of the Company's integrated business model and focus on pursuing higher value-added products.

另外,在2024年前9个月,全球货币下游-脑机业务的销售数量增加了8%,展示了公司一体化业务模式和专注于追求更高附加值产品的高效性。

ONGOING INVESTMENT IN SUSTAINABILITY

持续投资于可持续性

GAR can trace 100% of the palm produced on its estates to plantation level. As of the third quarter of 2024, the company has extended Traceability to the Plantation (TTP) to 99% of its total palm oil supply chain in Indonesia, including independent smallholder farmers. GAR continues to provide capacity building and training to ensure smallholders, who make up around 40% of the country's production, are not left out of traceable, sustainable supply chains.

GAR可以追溯其庄园生产的100%棕榈油至种植水平。截至2024年第三季度,该公司已将追溯延伸至占印尼总棕榈油供应链99%的种植园(TTP),包括独立小农户。GAR继续提供能力建设和培训,以确保约占全国产量40%的小农户不会被排除在可追溯、可持续的供应链之外。

The Company has built on this foundation to extend traceability to its global supply chains for palm and other commodities. GAR can now trace 100% of its soy, sugar, and coconut and 50% of sunflower oil supplies to mill level. This commitment to traceability across its supply chains is fundamental to ensure GAR can meet growing customer and regulatory demands. The Company will continue to prioritise EU Deforestation-free Regulation (EUDR) readiness and is working closely with customers on compliance despite the potential delay to implementation.

公司在此基础上将追溯延伸至其全球棕榈油和其他大宗商品供应链。GAR现在可以追溯其100%的大豆、糖和椰子,以及50%的葵花籽油供应至工厂级别。跨其供应链的追溯承诺对确保GAR能够满足不断增长的客户和监管需求至关重要。公司将继续优先考虑欧盟无毁林法规(EUDR)的准备工作,并尽管实施可能会延迟,但仍在与客户密切合作以确保符合法规。

For media enquiries, please contact:

communications@sinarmas-agri.com

媒体查询请联系:

通信-半导体@sinarmas-agri.com

On the outlook,

On the outlook,