Dow's Options: A Look at What the Big Money Is Thinking

Dow's Options: A Look at What the Big Money Is Thinking

Deep-pocketed investors have adopted a bearish approach towards Dow (NYSE:DOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DOW usually suggests something big is about to happen.

资金雄厚的投资者采取了对纽交所DOW看淡的态度,这是市场参与者不应忽视的事情。我们在Benzinga对公开期权记录的跟踪揭示了今天的这一重大举动。这些投资者的身份仍然未知,但DOW的如此重大变动通常意味着即将发生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Dow. This level of activity is out of the ordinary.

我们从观察到的信息中获得了这些消息,当Benzinga的期权扫描器突出Dow的13次非凡期权活动时。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 38% bearish. Among these notable options, 5 are puts, totaling $1,267,514, and 8 are calls, amounting to $278,560.

这些重量级投资者之间的整体情绪存在分歧,30%偏向看涨,38%看淡。在这些显着的期权交易中,有5笔看跌期权,总额为$1,267,514,和8笔看涨期权,总额为$278,560。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Dow over the recent three months.

根据交易活动看,这些重量级投资者似乎瞄准了Dow在最近三个月内的价格区间,从$25.0到$47.5。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

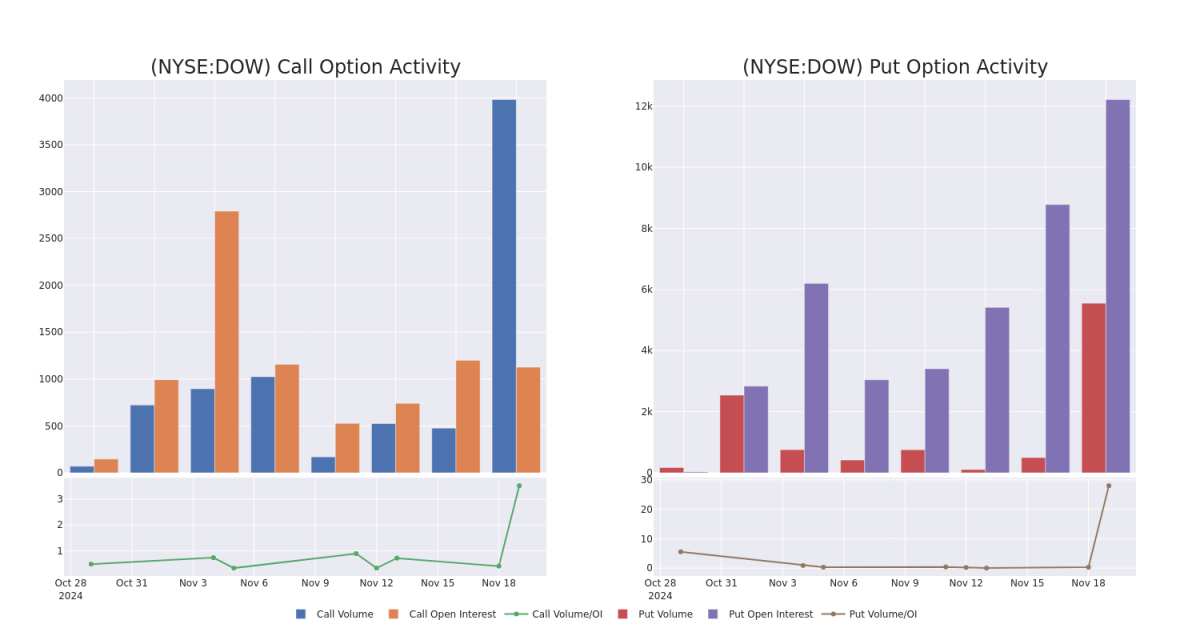

In terms of liquidity and interest, the mean open interest for Dow options trades today is 1667.75 with a total volume of 9,530.00.

就流动性和兴趣而言,Dow期权交易的平均未平仓合约数量为1667.75,总成交量为9,530.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dow's big money trades within a strike price range of $25.0 to $47.5 over the last 30 days.

在下图中,我们可以跟踪Dow大宗交易的看涨和看跌期权的成交量和未平仓合约的发展情况,涵盖了最近30天内$25.0至$47.5的行权价区间。

Dow Call and Put Volume: 30-Day Overview

道琼斯指数看涨和看跌成交量:30天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DOW | PUT | TRADE | BULLISH | 06/20/25 | $3.2 | $3.1 | $3.14 | $42.50 | $628.0K | 1.5K | 2.0K |

| DOW | PUT | SWEEP | BEARISH | 02/21/25 | $1.88 | $1.88 | $1.89 | $42.50 | $283.8K | 37 | 975 |

| DOW | PUT | SWEEP | BEARISH | 03/21/25 | $2.28 | $2.01 | $2.28 | $42.50 | $208.7K | 6.9K | 915 |

| DOW | PUT | TRADE | BULLISH | 03/21/25 | $2.29 | $2.25 | $2.25 | $42.50 | $92.0K | 6.9K | 1.4K |

| DOW | CALL | TRADE | BULLISH | 01/15/27 | $6.9 | $6.6 | $6.8 | $40.00 | $68.0K | 77 | 100 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 陶氏化学公司 | 看跌 | 交易 | BULLISH | 06/20/25 | $3.2 | $3.1 | $3.14 | $42.50 | $628.0K | 1.5千 | 2.0千 |

| 陶氏化学公司 | 看跌 | SWEEP | 看淡 | 02/21/25 | $1.88 | $1.88 | $1.89 | $42.50 | $283.8K | 37 | 975 |

| 陶氏化学公司 | 看跌 | SWEEP | 看淡 | 03/21/25 | 2.28美元 | $2.01 | 2.28美元 | $42.50 | $208.7K | 6.9千 | 915 |

| 陶氏化学公司 | 看跌 | 交易 | BULLISH | 03/21/25 | $2.29 | $2.25 | $2.25 | $42.50 | $92.0K | 6.9千 | 1.4K |

| 陶氏化学公司 | 看涨 | 交易 | BULLISH | 01/15/27 | $6.9 | $6.6 | $6.8 | $40.00 | $68.0K | 77 | 100 |

About Dow

关于陶氏化学

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

陶氏化学是一家多元化的全球化学品生产商,于2019年由陶氏化学公司和杜邦合并及后续分离而成。该公司是多种化学品的领先生产商,包括聚乙烯、环氧乙烷和硅橡胶。其产品在消费者和工业终端市场中有众多应用。

In light of the recent options history for Dow, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于道指最近的期权历史,现在适合关注公司本身。我们旨在探索其当前表现。

Present Market Standing of Dow

道指的现市场地位

- Trading volume stands at 1,898,002, with DOW's price down by -1.29%, positioned at $43.65.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 72 days.

- 成交量为1,898,002,道指价格下跌了-1.29%,位于43.65美元。

- RSI指标显示该股票可能已被超卖。

- 盈利公告预计72天后发布。

Professional Analyst Ratings for Dow

道指的专业分析师评级

3 market experts have recently issued ratings for this stock, with a consensus target price of $58.0.

最近有3名市场专家对这支股票发表了评级意见,一致目标价为58.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Piper Sandler has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60. * Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Dow with a target price of $54. * An analyst from Wells Fargo has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60.

20年期期权交易专家透露了他的一线图表技术,显示何时买入和卖出。跟随他的交易,平均每20天获利27%。单击此处查看.* 派杰投资的分析师决定维持对道指的超配评级,当前目标价为60美元。* BMO Capital的分析师在评估上保持一贯性,对道指保持市场表现评级,目标价为54美元。* 富国银行的分析师决定维持对道指的超配评级,当前目标价为60美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dow with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也提供更高利润的潜力。精明的交易者通过持续教育、战略交易调整、利用各种指标,并保持对市场动态的敏感来降低这些风险。通过Benzinga Pro及时了解道指的最新期权交易动态。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Dow over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Dow over the recent three months.