Super Micro Computer Shares Soar 32% As It Avoids Getting Booted Off Nasdaq, But Analysts Are Not Convinced: Here's What's Coming Next For SMCI

Super Micro Computer Shares Soar 32% As It Avoids Getting Booted Off Nasdaq, But Analysts Are Not Convinced: Here's What's Coming Next For SMCI

Shares of Super Micro Computer Inc (NASDAQ:SMCI) closed 31.24% higher in trade on Tuesday at $28.27 apiece. This happened after it announced the appointment of BDO USA as its Independent Auditor and also filed a compliance plan with Nasdaq, according to its press release.

超级微电脑公司(纳斯达克股票代码:SMCI)的股价周二收盘上涨31.24%,至每股28.27美元。根据其新闻稿,这是在美国宣布任命BDO USA为其独立审计师并向纳斯达克提交合规计划之后发生的。

The aforementioned update has prevented the company shares from being delisted from Nasdaq, however, company insiders loaded up on the shares of SMCI before this update. Furthermore, despite the rise in shares, analysts tracking the company have mostly downgraded the stock.

上述更新阻止了该公司股票从纳斯达克退市,但是,在本次更新之前,公司内部人士大量购买了SMCI的股票。此外,尽管股价上涨,但追踪该公司的分析师大多下调了该股的评级。

What Happened: Super Micro Computer shares have waded through a flurry in 2024 since it has been riddled with several troubles. It missed filing the Form 10-K with the SEC, the annual financial report for the company's year ending June 30.

发生了什么:自从经历了几次麻烦以来,超级微电脑的股价在2024年经历了波动。它错过了向美国证券交易委员会提交10-k表格,即该公司截至6月30日的年度财务报告。

It was followed by the release of the short-seller Hindenburg's report on Aug. 27 stating that the company was involved in accounting manipulation along with the allegations of self-dealing and evading sanctions.

随后,卖空者兴登堡于8月27日发布了报告,称该公司参与了会计操纵以及自我交易和逃避制裁的指控。

Ernst & Young resigned as the auditor of the company on Oct. 30 and it delayed filing the Form 10-Q with the SEC for the first quarter of fiscal 2025, ending Sept. 30.

安永会计师事务所于10月30日辞去了该公司审计师的职务,并推迟了向美国证券交易委员会提交截至9月30日的2025财年第一季度的10-Q表格。

Also read: Why Super Micro's Future May Hinge On Nvidia Earnings, Nasdaq Deadline

另请阅读:为什么超级微的未来可能取决于Nvidia的收益,纳斯达克截止日期

Why It Matters: The stock was nearly 64% up at $28.27 per share from its 52-week low of $17.25 apiece. But still down 77% from its 52-week high at $122.90 apiece. On a year-to-date basis, the stock was down by nearly 1%.

为何重要:该股从每股17.25美元的52周低点上涨了近64%,至每股28.27美元。但仍较每股122.90美元的52周高点下跌了77%。今年迄今为止,该股下跌了近1%。

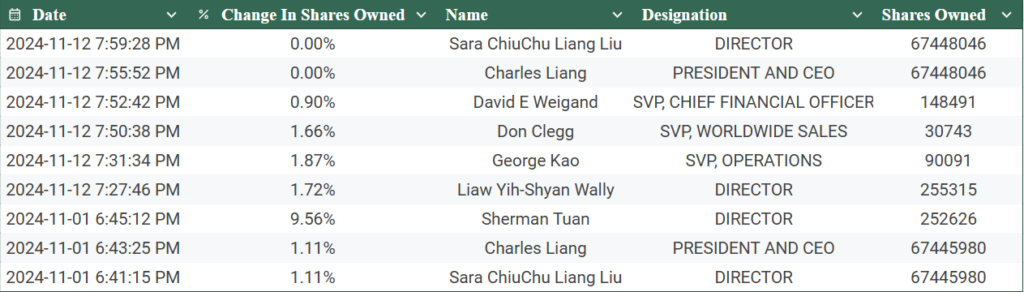

The relative strength index at 45.26 implies that the stock is not overbought or oversold. The recent trade by company insiders, as per Benzinga Pro shows that they bought the stocks before announcing the appointment of the new Independent Auditor between Nov. 1 to Nov. 12.

相对强度指数为45.26,这意味着该股票没有超买或超卖。根据Benzinga Pro的说法,公司内部人士最近的交易显示,他们在11月1日至11月12日宣布任命新的独立审计师之前买入了这些股票。

Analyst Snapshot

分析师快照

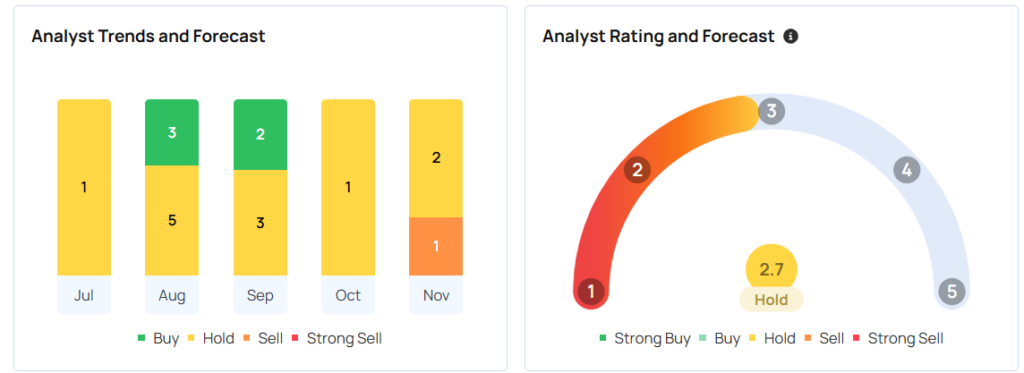

Many brokerages have lowered their ratings and target prices on SMCI. According to MarketBeat, Bank of America downgraded it to a 'neutral' rating and decreased their target price to $70.00 per share and Rosenblatt Securities reissued a 'buy' rating and set a $130.00 target price, in August.

许多经纪商降低了对SMCI的评级和目标价格。根据MarketBeat的数据,美国银行将其评级下调至 “中性” 评级,并将目标股价下调至每股70.00美元,罗森布拉特证券在8月份重新发布了 “买入” 评级,并设定了1.3万亿美元的.rget价格。

Barclays lowered their price to $42.00 apiece and set an 'equal weight' rating in October. JPMorgan Chase & Co. lowered a "neutral" rating to an "underweight" and set a price target of $23.00 per share in November.

巴克莱将价格下调至每股42.00美元,并在10月份设定了 “同等权重” 评级。摩根大通在11月将 “中性” 评级下调至 “减持”,并将目标股价定为每股23.00美元。

According to Benzinga Pro, based on an average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there's an implied -2.65% downside for Super Micro Computer Inc. from these most recent analyst ratings. The consensus rating forecast on Benzinga, suggests a score of 2.7 out of 5 points, which implies holding the stock.

根据Benzinga Pro的数据,根据高盛、摩根大通和Wedbush的平均目标股价为27.67美元,从这些最新的分析师评级来看,超级微电脑公司的下跌幅度为-2.65%。对Benzinga的共识评级预测显示其得分为2.7分(满分5分),这意味着持有该股。

Read next: Palantir Board Member In A Deleted X Post Said Nasdaq Move Will 'Force Billions In ETF Buying And Deliver Tendies': Here's What This Meme-Stock Term Means

继续阅读:Palantir董事会成员在一篇已删除的X帖子中表示,纳斯达克的举动将 “迫使数十亿美元的ETF购买和交付趋势”:这就是这个模因股票术语的含义

Image via Shutterstock

图片来自 Shutterstock

It was followed by the release of the short-seller Hindenburg's report on Aug. 27 stating that the company was involved in accounting manipulation along with the allegations of self-dealing and evading sanctions.

It was followed by the release of the short-seller Hindenburg's report on Aug. 27 stating that the company was involved in accounting manipulation along with the allegations of self-dealing and evading sanctions.