On Nov 20, major Wall Street analysts update their ratings for $Fortinet (FTNT.US)$, with price targets ranging from $98 to $110.

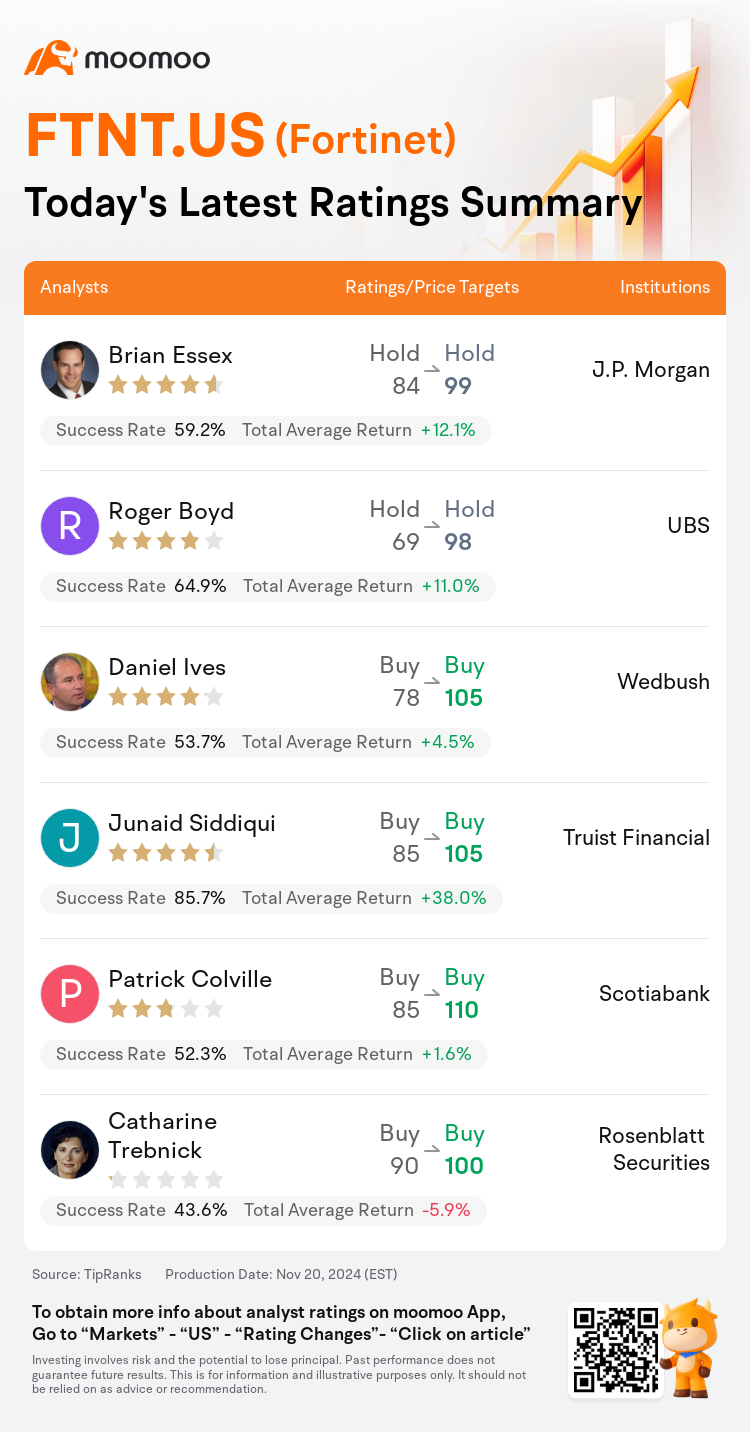

J.P. Morgan analyst Brian Essex maintains with a hold rating, and adjusts the target price from $84 to $99.

UBS analyst Roger Boyd maintains with a hold rating, and adjusts the target price from $69 to $98.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Truist Financial analyst Junaid Siddiqui maintains with a buy rating, and adjusts the target price from $85 to $105.

Scotiabank analyst Patrick Colville maintains with a buy rating, and adjusts the target price from $85 to $110.

Furthermore, according to the comprehensive report, the opinions of $Fortinet (FTNT.US)$'s main analysts recently are as follows:

After management provided long-term guidance targets, supported by a 2026 and 2027 firewall end-of-support cycle, as well as improved traction for Unified SASE and Security Operations at the company's analyst day meeting, some uncertainty remains about the magnitude of the upcoming firewall refresh cycle due to the lack of guidance for 2025. However, the three- to five-year guidance targets are regarded as solid, indicating potential for further upside.

Following an in-person analyst event hosted by the company, it was conveyed that there's great emphasis on its broader platform strategy across Secure Networking, SASE, and SecOps, spurred by the forthcoming firewall refresh cycle. Although the mid-term targets primarily aligned with prior expectations, there's perceived potential for surpassing these targets.

Fortinet's strategy and vision were effectively communicated during its analyst day, highlighting several inherent advantages of its platform in driving technology convergence to capitalize on a significant market opportunity valued at $284B. However, growth drivers for Fortinet still represent a minor component of its business mix, with persistent risks that competitive pressures could impede growth and profit margins.

During the company's Analyst Day, management provided 3- to 5-year financial targets and updates to its projected product refresh cycle for 2026 and beyond. Fortinet anticipates that about a quarter of its current installed base for firewalls will face end of service by the end of 2026. The company expects customer engagement primarily in early 2025, with the majority anticipated in the second half of 2025. This timing aligns with more enterprises seeking vendor consolidation within security, which presents significant opportunities for cross and up-selling. The event was regarded as overall positive.

The company's Analyst Day presentation effectively emphasized its opportunities and customer journey across Secure Networking, Unified SASE, and Ai-Driven SecOps, while also discussing potential product refreshes and laying out medium-term targets. The outlook presented was mixed compared to investor expectations. The compelling opportunities displayed will be further clarified with initial 2025 guidance expected early next year, providing insights on expected revenue and margin evolution towards the Rule of 45.

Here are the latest investment ratings and price targets for $Fortinet (FTNT.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月20日,多家华尔街大行更新了$飞塔信息 (FTNT.US)$的评级,目标价介于98美元至110美元。

摩根大通分析师Brian Essex维持持有评级,并将目标价从84美元上调至99美元。

瑞士银行分析师Roger Boyd维持持有评级,并将目标价从69美元上调至98美元。

韦德布什分析师Daniel Ives维持买入评级,并将目标价从78美元上调至105美元。

韦德布什分析师Daniel Ives维持买入评级,并将目标价从78美元上调至105美元。

储亿银行分析师Junaid Siddiqui维持买入评级,并将目标价从85美元上调至105美元。

丰业银行分析师Patrick Colville维持买入评级,并将目标价从85美元上调至110美元。

此外,综合报道,$飞塔信息 (FTNT.US)$近期主要分析师观点如下:

在管理层提供了长期指导目标后,支持2026年和2027年防火墙的结束支持周期,以及在公司分析师日会议上对统一SASE和安防-半导体运营改善的吸引力,关于即将到来的防火墙更新周期的规模仍然存在一些不确定性,因为缺乏2025年的指导。然而,三到五年的指导目标被视为稳固,表明可能进一步上升的潜力。

在公司举办的面对面分析师活动后,传达了对其在安全网络、SASE和安防-半导体运营的广泛平台策略的高度重视,这一策略受到即将到来的防火墙更新周期的推动。尽管中期目标主要与之前的预期一致,但被认为有潜力超越这些目标。

飞塔信息的策略和愿景在其分析师日上有效传达,突出其平台在推动科技融合以利用价值2840亿市场机遇方面的几项固有优势。然而,飞塔信息的增长驱动因素仍然占其业务组合的微小组成部分,持续存在竞争压力可能阻碍增长和利润率的风险。

在公司的分析师日上,管理层提供了3到5年的财务目标和对2026年及以后的预计产品更新周期的更新。飞塔信息预计到2026年底,其当前防火墙的约四分之一安装基数将面临服务结束。公司预计客户主要在2025年初参与,预计大多数将在2025年下半年。这个时机与更多企业寻求在安防-半导体领域进行供应商整合相一致,这为交叉和向上销售提供了重大机遇。此次活动被认为总体上是积极的。

公司的分析师日演示有效地强调了其在安全网络、统一SASE和人工智能驱动的安防-半导体运营等方面的机会和客户旅程,同时也讨论了潜在的产品更新,并概述了中期目标。呈现的前景与投资者预期相比显得复杂。展示的有吸引力的机会将在明年初的2025年初步指导时进一步阐明,提供关于预计营业收入和利润率演变到45规则的见解。

以下为今日6位分析师对$飞塔信息 (FTNT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

韦德布什分析师Daniel Ives维持买入评级,并将目标价从78美元上调至105美元。

韦德布什分析师Daniel Ives维持买入评级,并将目标价从78美元上调至105美元。

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.

Wedbush analyst Daniel Ives maintains with a buy rating, and adjusts the target price from $78 to $105.