Preview: Nano X Imaging's Earnings

Preview: Nano X Imaging's Earnings

Nano X Imaging (NASDAQ:NNOX) is set to give its latest quarterly earnings report on Thursday, 2024-11-21. Here's what investors need to know before the announcement.

Nano X Imaging(纳斯达克股票代码:NNOX)定于2024-11-21年星期四发布其最新的季度收益报告。以下是投资者在宣布之前需要了解的内容。

Analysts estimate that Nano X Imaging will report an earnings per share (EPS) of $-0.15.

分析师估计,Nano X Imaging将公布的每股收益(EPS)为-0.15美元。

The announcement from Nano X Imaging is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

Nano X Imaging的宣布备受期待,投资者正在寻求超出预期的消息以及对下一季度的有利指导。

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

对于新投资者来说,值得注意的是,指导可能是股价走势的关键决定因素。

Overview of Past Earnings

过去的收益概述

Last quarter the company beat EPS by $0.08, which was followed by a 7.29% increase in the share price the next day.

上个季度,该公司每股收益高出0.08美元,随后第二天股价上涨7.29%。

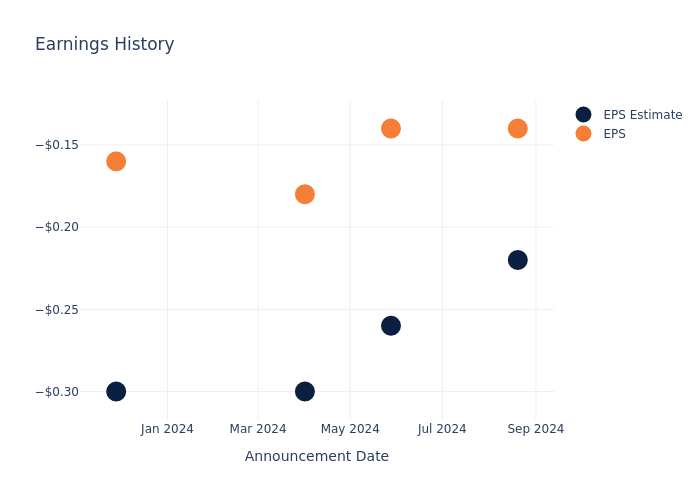

Here's a look at Nano X Imaging's past performance and the resulting price change:

以下是Nano X Imaging过去的表现以及由此产生的价格变化:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.22 | -0.26 | -0.30 | -0.30 |

| EPS Actual | -0.14 | -0.14 | -0.18 | -0.16 |

| Price Change % | 7.000000000000001% | -1.0% | -4.0% | 4.0% |

| 季度 | 2024 年第二季度 | 2024 年第一季度 | 2023 年第四季度 | 2023 年第三季度 |

|---|---|---|---|---|

| 每股收益估算 | -0.22 | -0.26 | -0.30 | -0.30 |

| 实际每股收益 | -0.14 | -0.14 | -0.18 | -0.16 |

| 价格变动% | 7.000000000000001% | -1.0% | -4.0% | 4.0% |

Market Performance of Nano X Imaging's Stock

Nano X Imaging股票的市场表现

Shares of Nano X Imaging were trading at $5.69 as of November 19. Over the last 52-week period, shares are down 12.08%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

截至11月19日,Nano X Imaging的股票交易价格为5.69美元。在过去的52周中,股价下跌了12.08%。鉴于这些回报率通常为负数,长期股东在本财报发布时可能会看跌。

To track all earnings releases for Nano X Imaging visit their earnings calendar on our site.

要追踪Nano X Imaging的所有财报,请访问我们网站上的财报日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成,并由编辑审阅。

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.