P/E Ratio Insights for Constellation Energy

P/E Ratio Insights for Constellation Energy

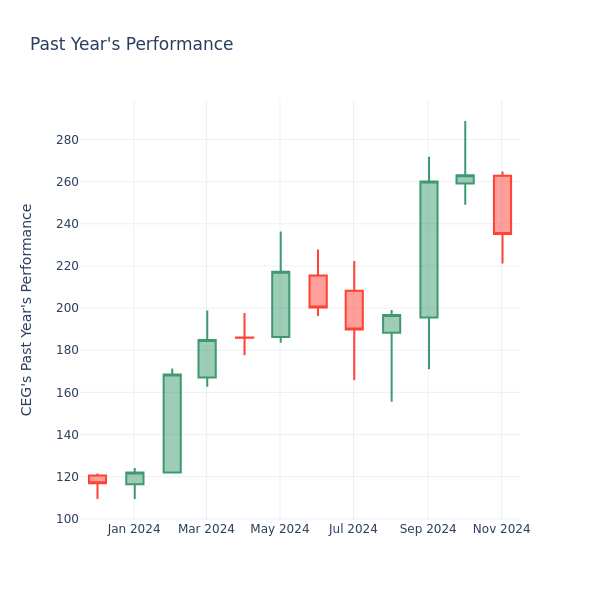

In the current market session, Constellation Energy Inc. (NASDAQ:CEG) share price is at $235.82, after a 0.53% spike. Moreover, over the past month, the stock fell by 11.63%, but in the past year, went up by 89.81%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

在当前市场交易中,康斯特尔能源公司(纳斯达克:CEG)的股价为235.82美元,上涨了0.53%。此外,在过去一个月里,该股票下跌了11.63%,但在过去一年中,上涨了89.81%。股东可能想知道这只股票是否被高估,即便公司在当前交易中表现良好。

Evaluating Constellation Energy P/E in Comparison to Its Peers

评估康斯特尔能源的市盈率与其同行的比较

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

长期股东使用市盈率来评估公司的市场表现,与市场数据、历史收益以及整个行业板块进行对比。较低的市盈率可能表明股东们不指望该股票未来表现更好,也可能意味着公司被低估了。

Compared to the aggregate P/E ratio of 18.53 in the Electric Utilities industry, Constellation Energy Inc. has a higher P/E ratio of 25.86. Shareholders might be inclined to think that Constellation Energy Inc. might perform better than its industry group. It's also possible that the stock is overvalued.

与公用股行业的整体市盈率18.53相比,康斯特尔能源公司的市盈率为25.86,较高。股东可能会倾向于认为康斯特尔能源公司的表现会优于其行业组。也有可能这只股票被高估了。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

总之,市盈率是分析公司市场表现的有用指标,但它也有局限性。较低的市盈率可能表明公司被低估,但也可能暗示股东不期望未来增长。此外,市盈率不应孤立使用,因为其他因素如行业趋势和业务周期也会影响公司的股价。因此,投资者应该将市盈率与其他财务指标和定性分析结合起来,做出明智的投资决策。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.