Unpacking the Latest Options Trading Trends in AbbVie

Unpacking the Latest Options Trading Trends in AbbVie

Whales with a lot of money to spend have taken a noticeably bullish stance on AbbVie.

投入大量资金的大型投资者对艾伯维公司采取了明显的看好态度。

Looking at options history for AbbVie (NYSE:ABBV) we detected 8 trades.

查看艾伯维(纽交所:ABBV)期权历史,我们检测到8笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有50%的投资者持有看好期望,而37%的人持有看淡期望。

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.

在所有已发现的交易中,3笔为看跌期权,总金额为$1,433,900,而5笔为看涨期权,总金额为$514,031。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $190.0 for AbbVie over the recent three months.

根据交易活动,显然重要投资者瞄准艾伯维在最近三个月内的价格区间,从$150.0至$190.0。

Volume & Open Interest Trends

成交量和未平仓量趋势

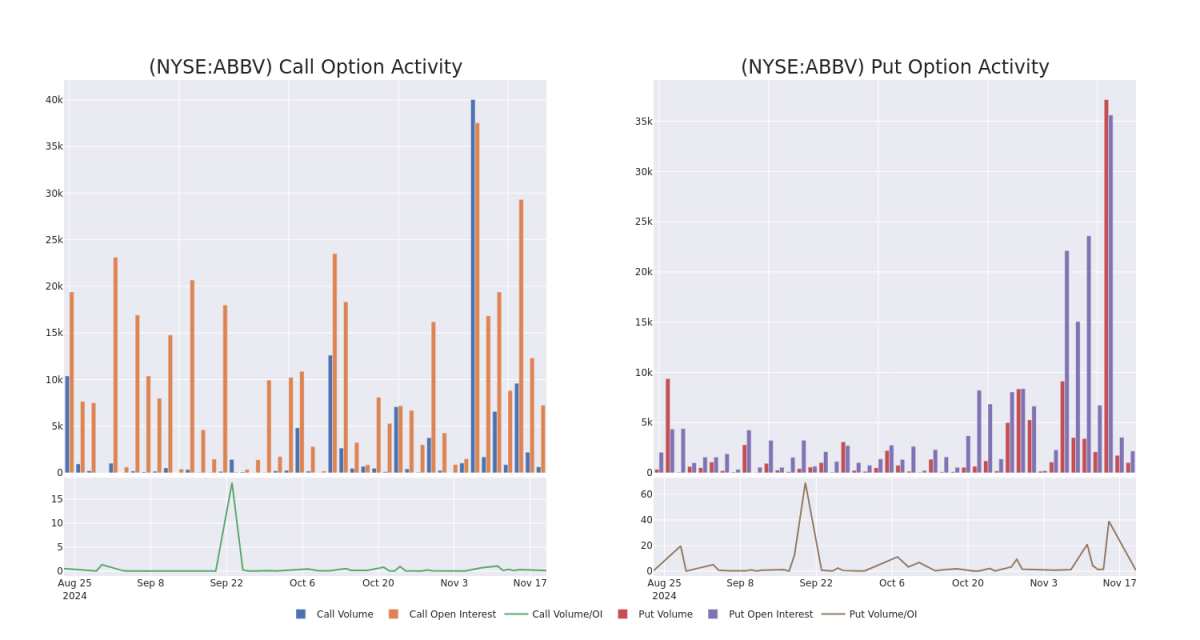

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AbbVie's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie's whale trades within a strike price range from $150.0 to $190.0 in the last 30 days.

观察成交量和未平仓合约对于期权交易是一个强大的举措。这些数据可以帮助您追踪特定行使价格下艾伯维期权的流动性和兴趣。在过去30天内,我们可以观察到所有艾伯维看涨和看跌期权的成交量和未平仓合约的演变,分别处于$150.0至$190.0的行使价格区间内。

AbbVie Call and Put Volume: 30-Day Overview

艾伯维公司看涨和看跌成交量:30天总览

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | TRADE | BULLISH | 12/20/24 | $2.06 | $1.31 | $1.38 | $160.00 | $1.2M | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | BEARISH | 05/16/25 | $21.6 | $21.55 | $21.6 | $150.00 | $254.8K | 14 | 118 |

| ABBV | PUT | SWEEP | BULLISH | 12/20/24 | $1.4 | $1.36 | $1.4 | $160.00 | $145.9K | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | NEUTRAL | 05/16/25 | $3.6 | $3.4 | $3.52 | $190.00 | $130.6K | 207 | 380 |

| ABBV | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $7.05 | $7.05 | $165.00 | $69.7K | 4.1K | 116 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | 看跌 | 交易 | BULLISH | 12/20/24 | $2.06 | $1.31 | $1.38应翻译为1.38美元 | $160.00 | 1.2百万美元 | 1.8K | 1.0千 |

| ABBV | 看涨 | SWEEP | 看淡 | 05/16/25 | $21.6 | $21.55 | $21.6 | $150.00 | $254.8千美元 | 14 | 118 |

| ABBV | 看跌 | SWEEP | BULLISH | 12/20/24 | $1.4 | $1.36 | $1.4 | $160.00 | 145.9千美元 | 1.8K | 1.0千 |

| ABBV | 看涨 | SWEEP | 中立 | 05/16/25 | $3.6 | $3.4 | $3.52 | $190.00 | $130.6K | 207 | 380 |

| ABBV | 看涨 | 交易 | 看淡 | 01/17/25 | $7.1 | $7.05 | $7.05 | $165.00 | $69.7K | 4.1千 | 279 |

About AbbVie

关于艾伯维公司

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家药品公司,其在免疫学(包括Humira、Skyrizi和Rinvoq)和肿瘤学(包括Imbruvica和Venclexta)方面拥有强大的业务。该公司于2013年初从Abbott分拆而来。2020年收购雅培使其在美容业务(包括Botox)中新增了一些产品和药品。

Present Market Standing of AbbVie

艾伯维公司目前市场地位

- Trading volume stands at 1,463,877, with ABBV's price up by 0.16%, positioned at $166.84.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 72 days.

- 交易量为1,463,877,艾伯维公司的股价上涨0.16%,位于166.84美元。

- RSI指标显示该股票可能正接近超卖。

- 盈利公告预计72天后发布。

What The Experts Say On AbbVie

艾伯维公司专家意见

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $215.0.

在过去30天里,共有5位专业分析师对这只股票发表了意见,设定了平均目标价为215.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $231. * In a cautious move, an analyst from Wolfe Research downgraded its rating to Outperform, setting a price target of $205. * Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on AbbVie with a target price of $200. * An analyst from Citigroup has decided to maintain their Buy rating on AbbVie, which currently sits at a price target of $215. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $224.

Benzinga Edge的期权异动板块提前发现潜在的市场变动。看看大资金在您最喜爱的股票中持有什么仓位。单击此处进行访问。* 摩根士丹利的分析师一直给予艾伯维公司超重评级和231美元的目标价,评估一贯。* 沃尔夫研究的分析师以谨慎的态度,将其评级降级为表现过强,设定了205美元的目标价。* 瑞银的分析师一直对艾伯维公司持有中立评级,并设定了200美元的目标价,评估上一致。* 花旗集团的分析师决定维持对艾伯维公司的买入评级,目标价目前为215美元。* 摩根士丹利的分析师一直给予艾伯维公司超重评级,目标价为224美元,评估一贯。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.