Decoding Amgen's Options Activity: What's the Big Picture?

Decoding Amgen's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Amgen. Our analysis of options history for Amgen (NASDAQ:AMGN) revealed 8 unusual trades.

金融巨头在安进表现出明显的看好动作。我们对安进(纳斯达克:AMGN)期权历史的分析揭示了8笔飞凡的交易。

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $172,165, and 4 were calls, valued at $144,495.

深入细节,我们发现37%的交易者看好,而37%则表现出看淡的倾向。在我们观察到的所有交易中,有4笔看跌,价值172,165美元,4笔看涨,价值144,495美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $280.0 and $350.0 for Amgen, spanning the last three months.

在评估成交量和未平仓合约后,显然主要市场参与者正关注安进的价格区间在280.0美元到350.0美元之间,持续了三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

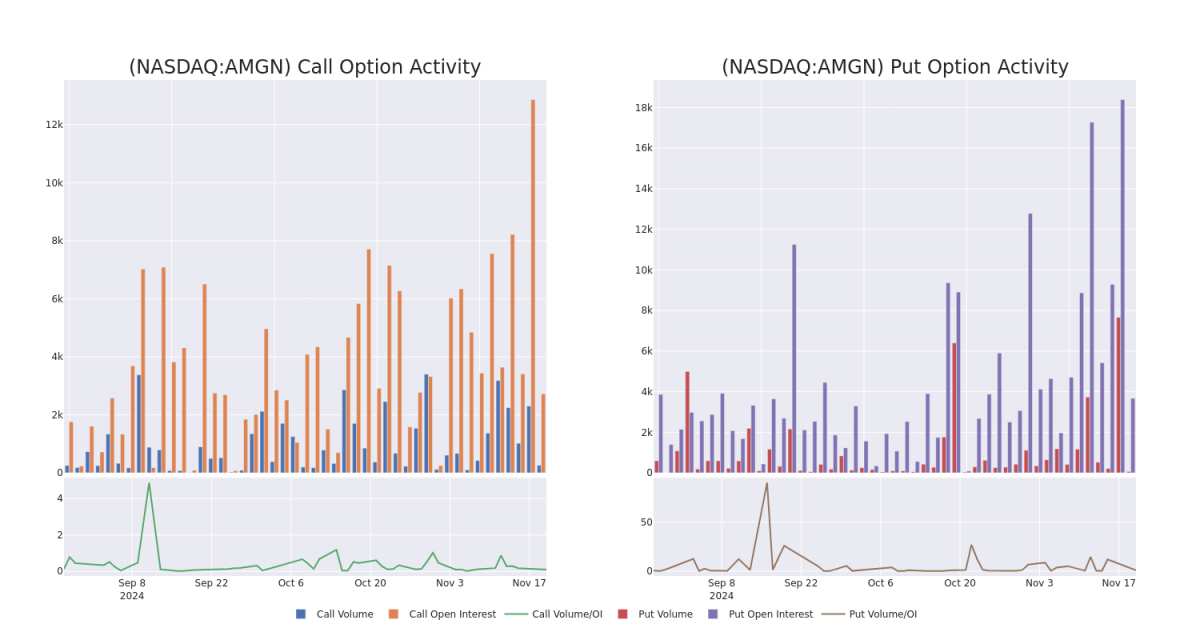

In today's trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.

在今天的交易环境中,安进期权的平均未平仓合约为1066.0,总成交量达到267.00。附带的图表描绘了安进中高价值交易的看涨和看跌期权成交量及未平仓合约的进展,位于280.0美元到350.0美元的行权价区间,持续了过去30天。

Amgen Option Volume And Open Interest Over Last 30 Days

安进期权成交量和未平仓量在过去30天内的情况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | TRADE | BULLISH | 12/20/24 | $22.0 | $21.4 | $21.55 | $292.50 | $60.3K | 70 | 51 |

| AMGN | PUT | SWEEP | BEARISH | 12/20/24 | $21.8 | $21.4 | $21.5 | $292.50 | $45.1K | 70 | 51 |

| AMGN | CALL | SWEEP | BEARISH | 12/20/24 | $18.0 | $17.4 | $17.44 | $282.50 | $43.7K | 703 | 113 |

| AMGN | CALL | SWEEP | BULLISH | 01/17/25 | $20.5 | $19.85 | $20.5 | $280.00 | $40.9K | 1.7K | 7 |

| AMGN | PUT | TRADE | NEUTRAL | 01/17/25 | $56.1 | $53.95 | $55.05 | $335.00 | $38.5K | 310 | 7 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 看跌 | 交易 | BULLISH | 12/20/24 | $22.0 | $21.4 | $21.55 | $292.50 | $60.3K | 70 | 51 |

| AMGN | 看跌 | SWEEP | 看淡 | 12/20/24 | $21.8美元 | $21.4 | 21.5美元 | $292.50 | $45.1K | 70 | 51 |

| AMGN | 看涨 | SWEEP | 看淡 | 12/20/24 | $18.0 | $17.4 | 17.44美元 | $282.50 | $43.7千美元 | 703 | 113 |

| AMGN | 看涨 | SWEEP | BULLISH | 01/17/25 | $20.5 | $19.85 | $20.5 | $280.00 | $40.9千 | 1.7K | 7 |

| AMGN | 看跌 | 交易 | 中立 | 01/17/25 | $56.1 | $53.95 | $55.05 | 335.00美元 | $38.5K | 310 | 7 |

About Amgen

关于安进

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安进是生物技术制药领域的领导者。旗舰药物包括增加红细胞计数的艾普毕与阿拉尼许、增强免疫系统的奈帕姆和奈乌细胞移植因子、以及针对炎症性疾病的恩布瑞尔和欧特兹拉。安进在2006年推出了首个癌症治疗药物Vectibix,并推出了增强骨密度的药物Prolia/Xgeva(于2010年获批)和Evenity(于2019年获批)。对Onyx的收购增强了该公司在治疗肿瘤领域的药物组合,其中包括Kyprolis。最近推出的药物包括Repatha(降低胆固醇)、Aimovig(缓解偏头痛)、Lumakras(治疗肺癌)以及Tezspire(治疗哮喘)。2023年Horizon收购带来了几种罕见疾病药物,其中包括治疗甲状腺眼病的Tepezza。安进还拥有不断增长的生物类似物组合。

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

在我们对安进的期权活动进行分析后,我们转向更仔细地观察公司自身的表现。

Where Is Amgen Standing Right Now?

目前安进的处境如何?

- With a trading volume of 2,464,150, the price of AMGN is up by 1.67%, reaching $284.63.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 76 days from now.

- 在成交量为2,464,150的情况下,AMGN的价格上涨了1.67%,达到284.63美元。

- 当前RSI值表明该股票可能即将超卖。

- 下一个财报预计在76天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amgen options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个因子和密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒了解最新的安进期权交易。

In today's trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.