- 投资产品

- 交易功能

- 市场分析

- 费用和利率

- 优惠活动

- 资源

- 选择Moomoo

- 关于我们

- Moomoo 桌面端

- Moomoo 基金会

- 新闻中心

- 红人计划

- 投资者关系您即将从moomoo.com跳转至富途控股官方网站。

- 帮助中心

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

- 要闻

- 每日跳空缺口排名 星期三:BUD、TGT、HMC等

Top Gap Ups and Downs on Wednesday: WSM, TGT, ROKU and More

Top Gap Ups and Downs on Wednesday: WSM, TGT, ROKU and More

Welcome to the Daily Gap column!

In the realm of technical analysis, gaps are often viewed as critical indicators of potential price movements. Particularly those that emerge at market open, these gaps can signify dramatic shifts in market sentiment. The directionality of these gaps provides traders with insights into short-term trends, allowing them to develop corresponding trading strategies.

Here is the showcase of the top 10 stocks with the largest gap sizes as of yesterday's close. The "Gap %chg" metric indicates the magnitude of these gaps, with all included stocks reaching a market capitalization of $5 billion.

Additionally, we highlight stocks that have exhibited the longest streak of consecutive gaps in either up or down direction over the past 250 trading days. These stocks are also filtered with the same market capitalization criterion.

Additionally, we highlight stocks that have exhibited the longest streak of consecutive gaps in either up or down direction over the past 250 trading days. These stocks are also filtered with the same market capitalization criterion.

Technical traders believe that gaps can provide directional clues, but the accuracy of a single indicator is not sufficient to predict stock movements. Investors still need to incorporate various factors, including board market sentiment, company fundamental factors, technical indicators, and so on.

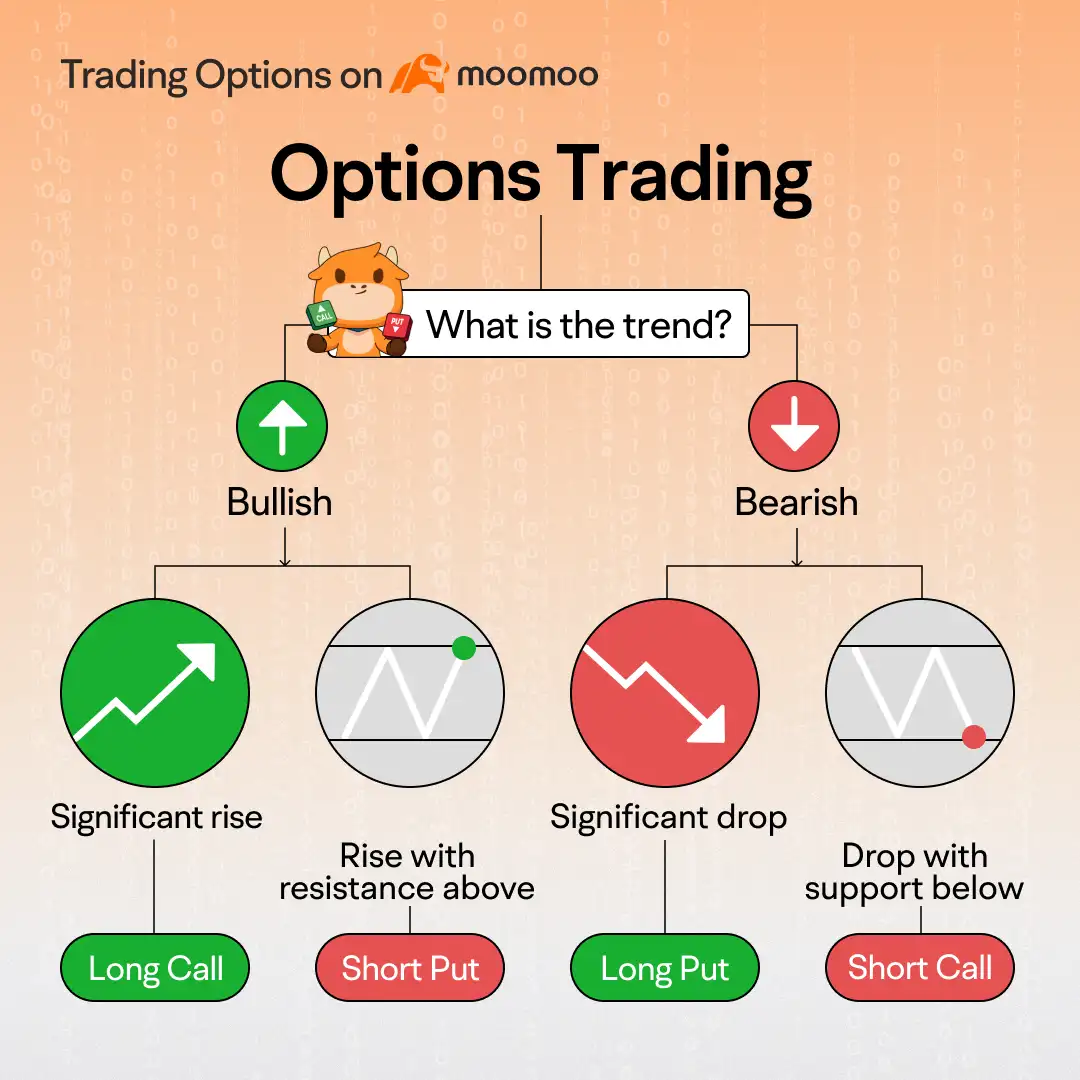

Options strategies can be an effective way to capitalize on anticipated price movements in different trending scenarios.

For investors optimistic about a stock's upward trajectory, some commonly utilized options strategies include the Long Call, the Bull Call Spread, and the Cash-Secured Put, each with different risk levels.

The Long Call involves purchasing a call option, limiting risk to the premium paid while offering potentially unlimited profit if the stock rises. The Bull Call Spread is a more conservative approach, where investors buy a call at a lower strike and sell another at a higher strike, reducing costs and capping both gains and losses. Alternatively, the Cash-Secured Put involves selling a put option while holding enough cash to buy the stock at the strike price if assigned, allowing investors to potentially acquire the stock at a discount while generating premium income.

For investors anticipating a downward trend in a stock, several options strategies can be employed, each with varying risk levels.

The Long Put strategy involves purchasing a put option, granting the right to sell the stock at a specified strike price before expiration. This strategy offers significant profit potential if the stock price declines, with risk limited to the premium paid for the option. The Bull Put Spread combines selling a put option at a higher strike price while simultaneously buying another put option at a lower strike price, allowing traders to collect premium income while capping potential losses, thus providing a more balanced risk-reward profile. Another strategy is the Short Call, where an investor sells a call option, obligating them to sell the stock at the strike price if the option is exercised. While this can yield profits if the stock price falls, it carries unlimited risk if the stock rises sharply, making it more suitable for experienced traders who can manage the associated risks effectively.

What are gaps?

Price charts sometimes have blank spaces known as gaps (up gaps and down gaps), where the price of a stock moves sharply up or down, with little or no shares traded in between. This is why the asset's chart shows a gap in the normal price pattern. Normally this occurs between the close of the market on one day and the next day's open.

For an up gap, the low price of the day must be higher than the high price of the previous day. A down gap is just the opposite of an up gap.

Gaps can show signals that something important has happened to the fundamental or the psychology of traders that accompanies this market movement.

For example, if an unexpectedly high earnings report comes out after the market has closed for the day, a lot of buying interest could be generated overnight, leading to an imbalance between supply and demand. When the market opens the next morning, the stock price will likely rise in response to the increased demand from buyers. If the stock price remains above the previous day's high throughout the day, then an up gap is formed.

什么是缺口?

缺口是指股价在快速大幅变动中有一段价格没有任何交易,显示在股价趋势图上是一个真空区域,这个区域称之“缺口”,通常又称为跳空。K线图中的缺口是指由于受到利好或者利空消息的影响,股价大幅上涨或者大幅下跌,导致日K线图出现当日最低价超过前一交易日最高价或者当日最高价低于前一交易日最低价的图形形态的一种现象。

缺口是指股价在快速大幅变动中有一段价格没有任何交易,显示在股价趋势图上是一个真空区域,这个区域称之“缺口”,通常又称为跳空。K线图中的缺口是指由于受到利好或者利空消息的影响,股价大幅上涨或者大幅下跌,导致日K线图出现当日最低价超过前一交易日最高价或者当日最高价低于前一交易日最低价的图形形态的一种现象。

对于上涨缺口,当天的最低价必须高于前一天的最高价;向下的缺口正好与向上的缺口相反。

随着市场的走势,缺口的产生在一定程度上表明了交易员对基本面或消息面的一致性看法。

例如,如果在当天市场收盘后,一份出乎意料的亮眼报告出炉,一夜之间就会产生大量的购买兴趣,导致供需失衡;当第二天早上市场开盘时,股票价格可能会随着买家需求的增加而上涨;如果股票价格一整天都高于前一天的高点,那么就形成了一个向上的缺口。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧