- 要闻

- 投资者看不到裕同科技公司(SZSE:002831)的出路

Investors Don't See Light At End Of ShenZhen YUTO Packaging Technology Co., Ltd.'s (SZSE:002831) Tunnel

Investors Don't See Light At End Of ShenZhen YUTO Packaging Technology Co., Ltd.'s (SZSE:002831) Tunnel

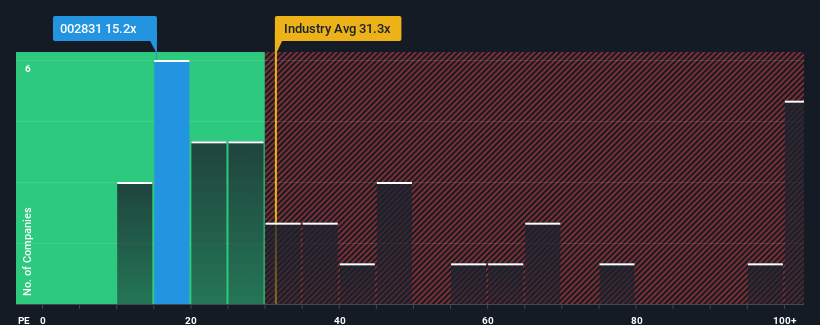

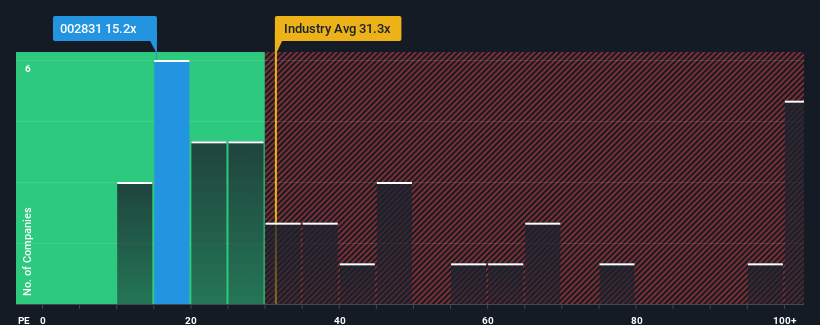

ShenZhen YUTO Packaging Technology Co., Ltd.'s (SZSE:002831) price-to-earnings (or "P/E") ratio of 15.2x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 70x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for ShenZhen YUTO Packaging Technology as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is ShenZhen YUTO Packaging Technology's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like ShenZhen YUTO Packaging Technology's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 9.1%. This was backed up an excellent period prior to see EPS up by 41% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

If we review the last year of earnings growth, the company posted a worthy increase of 9.1%. This was backed up an excellent period prior to see EPS up by 41% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 15% over the next year. That's shaping up to be materially lower than the 40% growth forecast for the broader market.

With this information, we can see why ShenZhen YUTO Packaging Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of ShenZhen YUTO Packaging Technology's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for ShenZhen YUTO Packaging Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

裕同科技有限公司(深交所代码:002831)的市盈率("P/E")为15.2倍,可能看起来是一个相对于中国市场的强劲买入,那里约有一半的公司市盈率超过36倍,甚至超过70倍的市盈率也相当常见。然而,我们需要深入研究以判断大幅降低的市盈率是否有合理的依据。

最近,裕同科技的收益增长令人满意,尽管市场的收益却在下滑。一种可能性是市盈率低是因为投资者认为公司的收益很快会像其他公司一样下降。如果你喜欢这家公司,你会希望这种情况不是如此,这样你可能可以在股票不受欢迎时买入一些股票。

裕同科技的增长趋势如何?

有一种固有的假设是,像裕同科技这样的公司必须远远低于市场表现,市盈率才会被视为合理。

如果我们回顾过去一年的盈利增长,公司的收益增长了9.1%。这一成就是在之前的优秀业绩支持下实现的,过去三年每股收益总共增长了41%。因此,我们可以开始确认公司在这段时间内做了很好的盈利增长。

如果我们回顾过去一年的盈利增长,公司的收益增长了9.1%。这一成就是在之前的优秀业绩支持下实现的,过去三年每股收益总共增长了41%。因此,我们可以开始确认公司在这段时间内做了很好的盈利增长。

展望未来,覆盖该公司的十一位分析师的估计表明,盈利将在明年增长15%。这与更广泛市场40%的增长预测相比,显著较低。

凭借这些信息,我们可以理解为什么裕同科技的市盈率低于市场。显然,许多股东对公司未来可能面临的较不景气的前景感到不安。

重要提示

虽然市盈率不应是您是否购买股票的决定性因素,但它是企业盈利预期的比较良好的指标。

正如我们所怀疑的,关于裕同科技的分析师预测的调查显示,其低迷的盈利前景正在影响其较低的市盈率。在此阶段,投资者认为盈利改善的潜力不足以证明更高的市盈率。在这种情况下,很难看出股价在近期内会有强劲上涨的可能。

在您形成观点之前,我们发现裕同科技有一个您应该注意的警示信号。

如果市盈率对您感兴趣,您可能希望查看此免费收集的其他低市盈率比率和强收益增长的公司。

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧