Investors Appear Satisfied With Guangzhou Goaland Energy Conservation Tech. Co., Ltd.'s (SZSE:300499) Prospects As Shares Rocket 25%

Investors Appear Satisfied With Guangzhou Goaland Energy Conservation Tech. Co., Ltd.'s (SZSE:300499) Prospects As Shares Rocket 25%

Guangzhou Goaland Energy Conservation Tech. Co., Ltd. (SZSE:300499) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

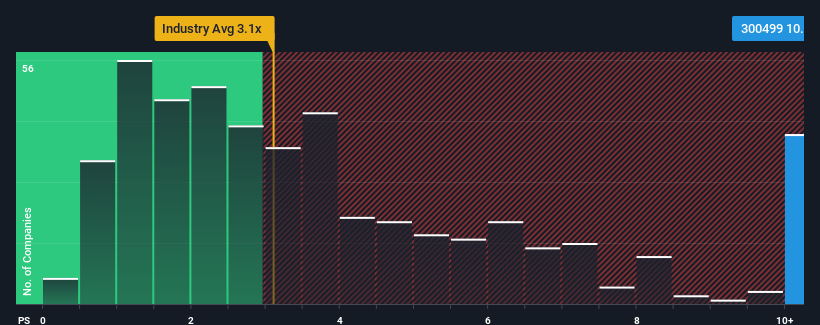

Following the firm bounce in price, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Guangzhou Goaland Energy Conservation Tech as a stock not worth researching with its 10.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Guangzhou Goaland Energy Conservation Tech's P/S Mean For Shareholders?

Guangzhou Goaland Energy Conservation Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Guangzhou Goaland Energy Conservation Tech will help you uncover what's on the horizon.How Is Guangzhou Goaland Energy Conservation Tech's Revenue Growth Trending?

In order to justify its P/S ratio, Guangzhou Goaland Energy Conservation Tech would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Guangzhou Goaland Energy Conservation Tech would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. As a result, revenue from three years ago have also fallen 64% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 90% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Guangzhou Goaland Energy Conservation Tech's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Guangzhou Goaland Energy Conservation Tech's P/S?

Shares in Guangzhou Goaland Energy Conservation Tech have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Guangzhou Goaland Energy Conservation Tech shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 1 warning sign for Guangzhou Goaland Energy Conservation Tech that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.