On Nov 21, major Wall Street analysts update their ratings for $BellRing Brands (BRBR.US)$, with price targets ranging from $75 to $86.

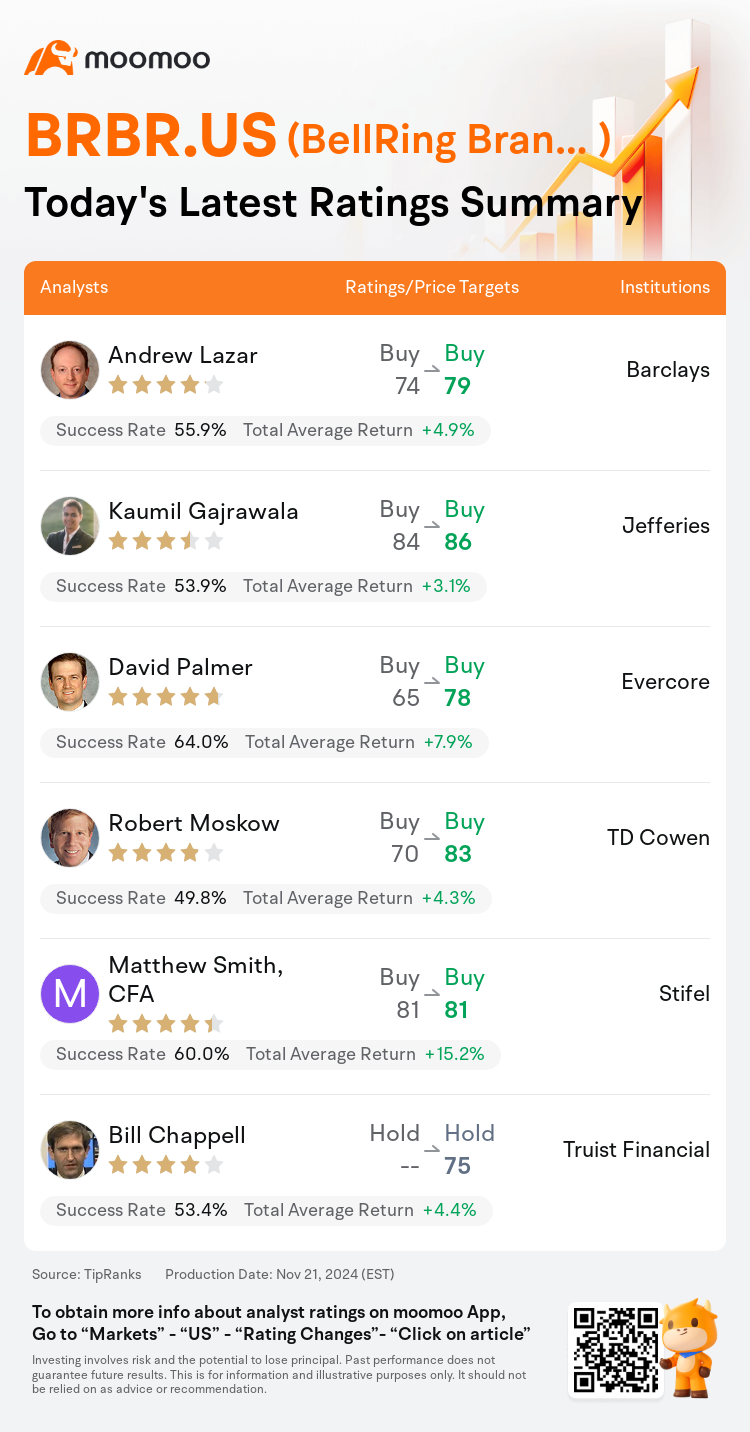

Barclays analyst Andrew Lazar maintains with a buy rating, and adjusts the target price from $74 to $79.

Jefferies analyst Kaumil Gajrawala maintains with a buy rating, and adjusts the target price from $84 to $86.

Evercore analyst David Palmer maintains with a buy rating, and adjusts the target price from $65 to $78.

Evercore analyst David Palmer maintains with a buy rating, and adjusts the target price from $65 to $78.

TD Cowen analyst Robert Moskow maintains with a buy rating, and adjusts the target price from $70 to $83.

Stifel analyst Matthew Smith, CFA maintains with a buy rating, and maintains the target price at $81.

Furthermore, according to the comprehensive report, the opinions of $BellRing Brands (BRBR.US)$'s main analysts recently are as follows:

The company's positioning to manage demand instead of being constrained by supply, specifically concerning Premier Protein, presents a significant opportunity, according to the analyst.

BellRing Brands posted fiscal Q4 results that aligned closely with expectations and presented fiscal 2025 guidance that considerably surpassed analysts' forecasts. The outlook conveyed a strong confidence underpinned by adequate supply chains and a robust lineup of innovation, supported extensively by full-year advertising and promotional activities. This positions the company and its stock favorably for future prospects.

The firm is revising its estimates upward following a strong fourth quarter performance and a positive fiscal year 2025 outlook. It believes that the elevated multiple applied to its 2025 EPS estimation is warranted, given BellRing's potential for future growth driven by robust consumer interest.

BellRing Brands reported fiscal fourth quarter sales and earnings that exceeded expectations, with fiscal 2025 guidance surpassing mid-point consensus. Despite the shares having rallied by 29% in three months and seeing an EBITDA margin slightly below expectations, growth in the company's profit dollars is expected to outpace previous assumptions. The sustained growth rate justifies the company's premium valuation.

BellRing Brands reported a strong conclusion to the year, with anticipated momentum continuing into FY25, fueled by enhanced marketing efforts, expanded distribution, favorable category dynamics, and inventory replenishments. As supply constraints diminish and marketing efforts intensify, the company is well-positioned to capitalize on the sustained demand for protein shakes.

Here are the latest investment ratings and price targets for $BellRing Brands (BRBR.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月21日,多家华尔街大行更新了$BellRing Brands (BRBR.US)$的评级,目标价介于75美元至86美元。

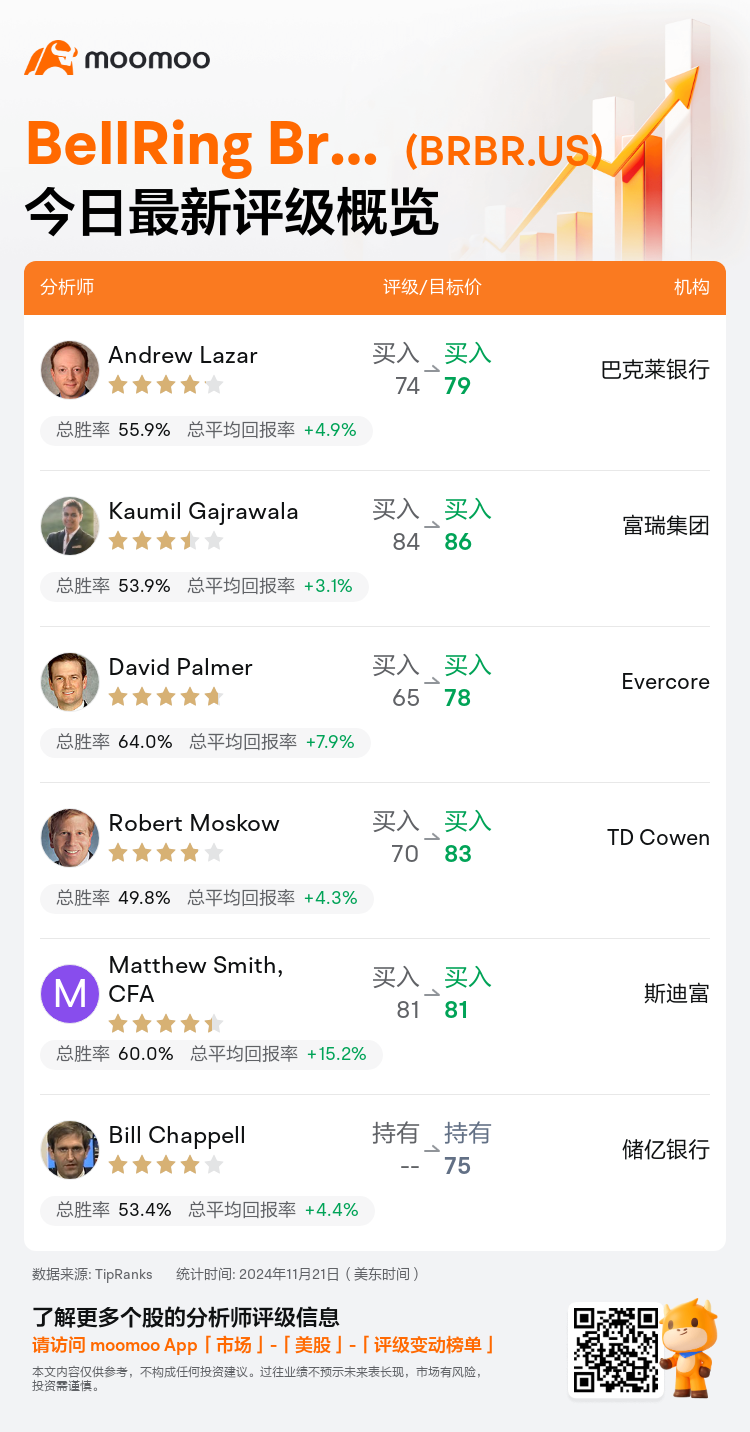

巴克莱银行分析师Andrew Lazar维持买入评级,并将目标价从74美元上调至79美元。

富瑞集团分析师Kaumil Gajrawala维持买入评级,并将目标价从84美元上调至86美元。

Evercore分析师David Palmer维持买入评级,并将目标价从65美元上调至78美元。

Evercore分析师David Palmer维持买入评级,并将目标价从65美元上调至78美元。

TD Cowen分析师Robert Moskow维持买入评级,并将目标价从70美元上调至83美元。

斯迪富分析师Matthew Smith, CFA维持买入评级,维持目标价81美元。

此外,综合报道,$BellRing Brands (BRBR.US)$近期主要分析师观点如下:

根据分析师的说法,公司的定位是管理需求,而不是受制于供应,特别是针对Premier Protein,这为公司提供了一个重大机会。

bellring brands公布的财政第四季度业绩与预期密切对齐,并提供的财政2025年指导远超分析师的预测。展望传达了在充分的供应链和强大的创新产品组合支持下的强信心,充分得到了全年的广告和促销活动的大力支持。这为公司的未来前景和股票做好了有利的定位。

该公司在强劲的第四季度表现和积极的财政2025年展望后,正在上调其预测。它认为,考虑到bellring在未来增长中的潜力,给予2025年每股收益的高倍数是合理的,因为消费者的兴趣强烈。

bellring brands报告的财政第四季度销售和收益超出预期,财政2025年指导也超出中位数共识。尽管股价在三个月内上涨了29%,且EBITDA利润率略低于预期,但预计公司的利润增长将超出之前的假设。持续的增长率证明了公司的高估值是合理的。

bellring brands报告了强劲的年终表现,预计势头将持续到2025财政年度,这得益于加强的营销努力、扩大的分销渠道、有利的品类动态和库存补充。随着供应限制的减弱和营销努力的加大,公司在满足蛋白质奶昔持续需求方面处于良好位置。

以下为今日6位分析师对$BellRing Brands (BRBR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师David Palmer维持买入评级,并将目标价从65美元上调至78美元。

Evercore分析师David Palmer维持买入评级,并将目标价从65美元上调至78美元。

Evercore analyst David Palmer maintains with a buy rating, and adjusts the target price from $65 to $78.

Evercore analyst David Palmer maintains with a buy rating, and adjusts the target price from $65 to $78.