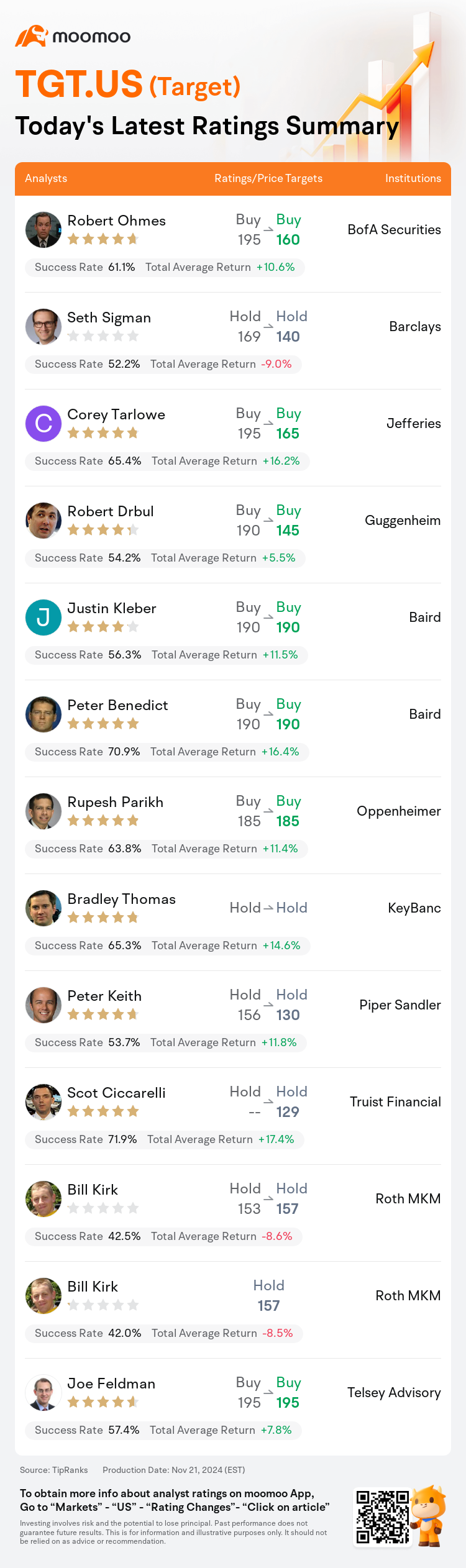

On Nov 21, major Wall Street analysts update their ratings for $Target (TGT.US)$, with price targets ranging from $129 to $195.

BofA Securities analyst Robert Ohmes maintains with a buy rating, and adjusts the target price from $195 to $160.

Barclays analyst Seth Sigman maintains with a hold rating, and adjusts the target price from $169 to $140.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and adjusts the target price from $195 to $165.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and adjusts the target price from $195 to $165.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $190 to $145.

Baird analyst Justin Kleber maintains with a buy rating, and maintains the target price at $190.

Furthermore, according to the comprehensive report, the opinions of $Target (TGT.US)$'s main analysts recently are as follows:

Following Target's Q3 earnings shortfall and subdued outlook, the EPS forecast for FY25 was reduced, reflecting the Q3 miss and anticipated ongoing challenges in Q4. It's expected that the level performance in Q4 will demonstrate persistent weakness in discretionary categories and the effects of calendar timing, with most of the cost challenges from Q3 likely impacting the quarter.

Target's Q3 results did not meet earlier conservative estimates regarding margins due to the buildup of inventories around early receipts and increased discounting. This situation was exacerbated by a higher proportion of sales taking place during promotional periods, along with challenges from warm weather affecting apparel sales. While these are mostly seen as cyclical challenges, it is indicated that the responsibility to demonstrate improvement now rests with the company.

The firm's recent quarterly report highlighted three main concerns including subdued sales, reduced gross margins, and elevated SG&A costs, prompting a significant reaction in the stock today. 'Much of this appears to be a case of wrong place, wrong time,' which furthers discussions around market share and strategies for improving top-line results. There's an anticipation that sales improvements, which were not evident in this quarter, might materialize in the subsequent one.

Following Target's less than favorable Q3 results and a Q4 outlook that fell below expectations, estimates for FY24-FY26 have been reduced. The decelerating comp trends observed are partly attributed by the company to a cautious consumer spending environment. However, it appears there is an underperformance when compared to major competitors such as large wholesale and retail players.

Despite the disappointing Q3 performance, analysts see several options and strategies for the company to achieve a 6% operating margin. They adjusted their FY24 and FY25 EPS estimates to $8.60 and $9.50, respectively, based on recent results and the updated perspective on discretionary spending at the company.

Here are the latest investment ratings and price targets for $Target (TGT.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月21日,多家华尔街大行更新了$塔吉特 (TGT.US)$的评级,目标价介于129美元至195美元。

美银证券分析师Robert Ohmes维持买入评级,并将目标价从195美元下调至160美元。

巴克莱银行分析师Seth Sigman维持持有评级,并将目标价从169美元下调至140美元。

富瑞集团分析师Corey Tarlowe维持买入评级,并将目标价从195美元下调至165美元。

富瑞集团分析师Corey Tarlowe维持买入评级,并将目标价从195美元下调至165美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从190美元下调至145美元。

贝雅分析师Justin Kleber维持买入评级,维持目标价190美元。

此外,综合报道,$塔吉特 (TGT.US)$近期主要分析师观点如下:

在Target第三季度盈利不达预期且前景黯淡后,FY25的每股收益预测下调,反映了第三季度的失利和第四季度预期持续面临挑战。预计第四季度的表现水平将展示在自由分类中持久的疲弱以及日历时间的影响,第三季度大部分的成本挑战可能会继续影响该季度。

由于库存的积压和增加折扣,导致Target第三季度的结果未能达到早期对利润率的保守估计。这种情况进一步恶化,因为销售的较高比例发生在促销期间,另外温暖天气影响服装销售。虽然大多数被视为周期性挑战,但公司现在收到改善的责任。

公司最近的季度报告突出了三个主要问题,包括低迷的销售、减少的毛利率和提高的销售管理费用,引发了今天股票的显著反应。'很大程度上这似乎是一个时间和地点错配的情况',这进一步推动了市场份额和改善营收结果的策略讨论。人们期待销售的改善,尽管在这个季度尚不明显,但可能会在随后的一个季度实现。

在Target令人失望的第三季度表现以及低于预期的第四季度展望后,将FY24至FY26的估计值下调。公司称缓慢的同比增长趋势部分归因于谨慎的消费者支出环境。但与大型批发和零售行业主要竞争对手相比,出现了弱于预期的表现。

尽管第三季度表现令人失望,分析师看到公司实现6%营业利润率的几种期权和策略。他们基于最近的结果和对公司自由支出的更新视角调整了他们对FY24和FY25的每股收益估算分别为8.60美元和9.50美元。

以下为今日13位分析师对$塔吉特 (TGT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Corey Tarlowe维持买入评级,并将目标价从195美元下调至165美元。

富瑞集团分析师Corey Tarlowe维持买入评级,并将目标价从195美元下调至165美元。

Jefferies analyst Corey Tarlowe maintains with a buy rating, and adjusts the target price from $195 to $165.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and adjusts the target price from $195 to $165.