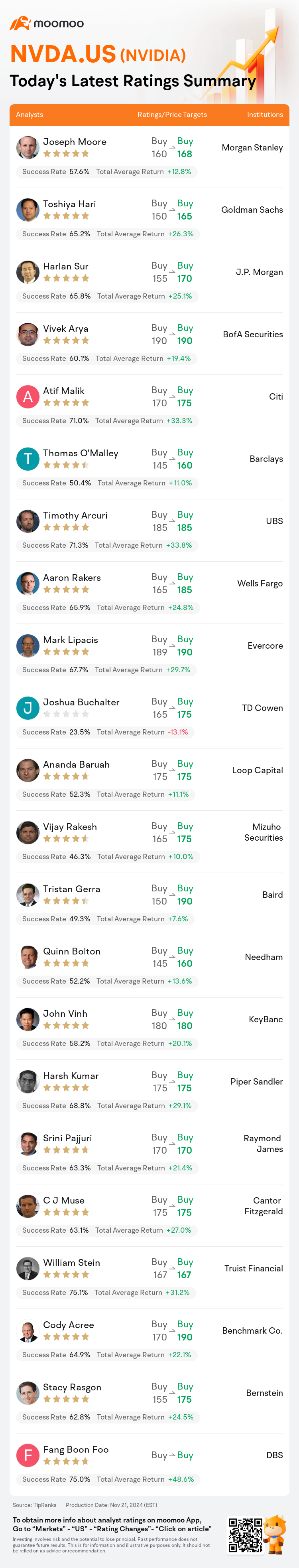

On Nov 21, major Wall Street analysts update their ratings for $NVIDIA (NVDA.US)$, with price targets ranging from $160 to $190.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $160 to $168.

Goldman Sachs analyst Toshiya Hari maintains with a buy rating, and adjusts the target price from $150 to $165.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

BofA Securities analyst Vivek Arya maintains with a buy rating, and maintains the target price at $190.

Citi analyst Atif Malik maintains with a buy rating, and adjusts the target price from $170 to $175.

Furthermore, according to the comprehensive report, the opinions of $NVIDIA (NVDA.US)$'s main analysts recently are as follows:

Nvidia surpassed Q3 Street expectations primarily due to robust data center compute performance, which compensated for an unexpected sequential decrease in data center networking. Despite Q4 revenue projections only meeting Street forecasts and anticipated near-term gross margin challenges linked to Blackwell lasting up to the April quarter, growing demand for artificial intelligence infrastructure among all customer groups, alongside improvements in supply and anticipated gross margin normalization in the second half of 2025, are expected to spearhead substantial sequential earnings growth and favorable revisions in the coming year.

The company's October quarter results were above consensus estimates and, starting from a higher revenue base, it forecasted a 7% increase for the January quarter, aligning with consensus but somewhat below market expectations. Analysts note that the company maintains a significant advantage over competitors with its comprehensive suite of silicon, hardware, and software platforms. The earnings report was seen as robust, bolstered by ongoing demand for artificial intelligence solutions.

Following Nvidia's recent quarterly report, expectations for the next two quarters have improved due to modest guidance and positive gross margin commentary. The company is now focusing on ramping up Blackwell, demonstrating successful management of its transition.

The complexity of system implementation in Nvidia is noted, but it does not severely affect demand due to issues like overheating. Additionally, the demand for Blackwell remains extremely strong. Analysts see no signs of a demand slowdown, as Nvidia anticipates that the global data center modernization for AI development will continue to expand over the next five years. Furthermore, the advent of generative AI is expected to introduce a new layer of demand.

The firm considers that any significant decline in the shares should be seized as an opportunity to buy, driven by the company's optimistic outlook on Blackwell demand.

Here are the latest investment ratings and price targets for $NVIDIA (NVDA.US)$ from 22 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

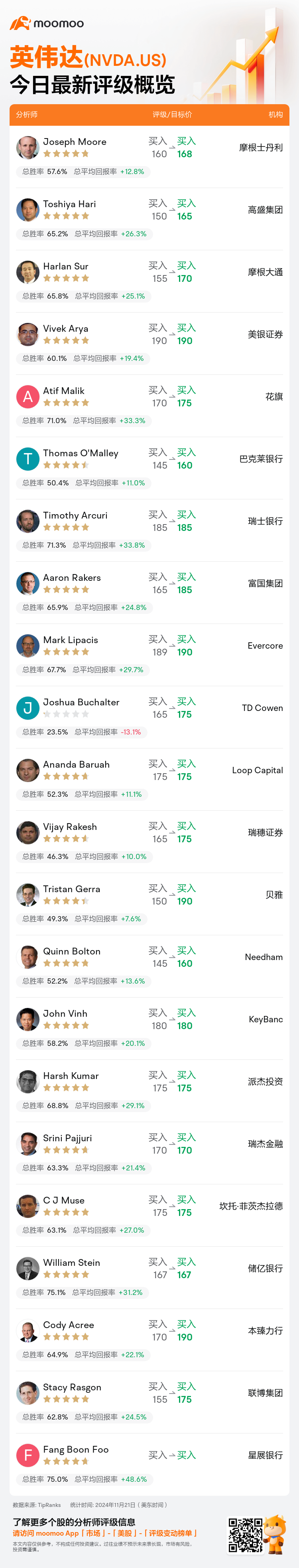

美东时间11月21日,多家华尔街大行更新了$英伟达 (NVDA.US)$的评级,目标价介于160美元至190美元。

摩根士丹利分析师Joseph Moore维持买入评级,并将目标价从160美元上调至168美元。

高盛集团分析师Toshiya Hari维持买入评级,并将目标价从150美元上调至165美元。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从155美元上调至170美元。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从155美元上调至170美元。

美银证券分析师Vivek Arya维持买入评级,维持目标价190美元。

花旗分析师Atif Malik维持买入评级,并将目标价从170美元上调至175美元。

此外,综合报道,$英伟达 (NVDA.US)$近期主要分析师观点如下:

英伟达超出了第三季度的华尔街预期,主要是由于数据中心计算性能强劲,弥补了数据中心网络意外出现的连续下降。尽管第四季度的营业收入预测仅符合华尔街的预期,并预计与Blackwell相关的近期毛利率挑战将持续到四月季度,但所有客户群体对人工智能基础设施的需求增长,加上供应的改善和预计到2025年下半年毛利率的正常化,预计将推动可观的连续盈利增长和未来一年的良好修正。

该公司的十月季度业绩超过了市场共识估计,从较高的营业收入基数出发,预测一月季度将增长7%,符合共识但略低于市场预期。分析师指出,该公司凭借其全面的硅、硬件和软件平台保持了对竞争对手的显著优势。财报被视为强劲,受到对人工智能解决方案持续需求的支持。

在英伟达最近的季度报告之后,由于温和的指引和积极的毛利率评论,未来两个季度的预期有所改善。该公司现在专注于提升Blackwell,展示了成功管理其过渡的能力。

英伟达的系统实施复杂性已被提到,但由于过热等问题并没有严重影响需求。此外,Blackwell的需求仍然非常强劲。分析师没有看到需求放缓的迹象,英伟达预计全球数据中心对人工智能开发的现代化需求将在未来五年继续扩大。此外,生成性人工智能的出现预计将带来新的需求层次。

该公司认为,任何显著的股价下跌应被视为买入的机会,推动因素是公司对Blackwell需求的乐观展望。

以下为今日22位分析师对$英伟达 (NVDA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从155美元上调至170美元。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从155美元上调至170美元。

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $155 to $170.