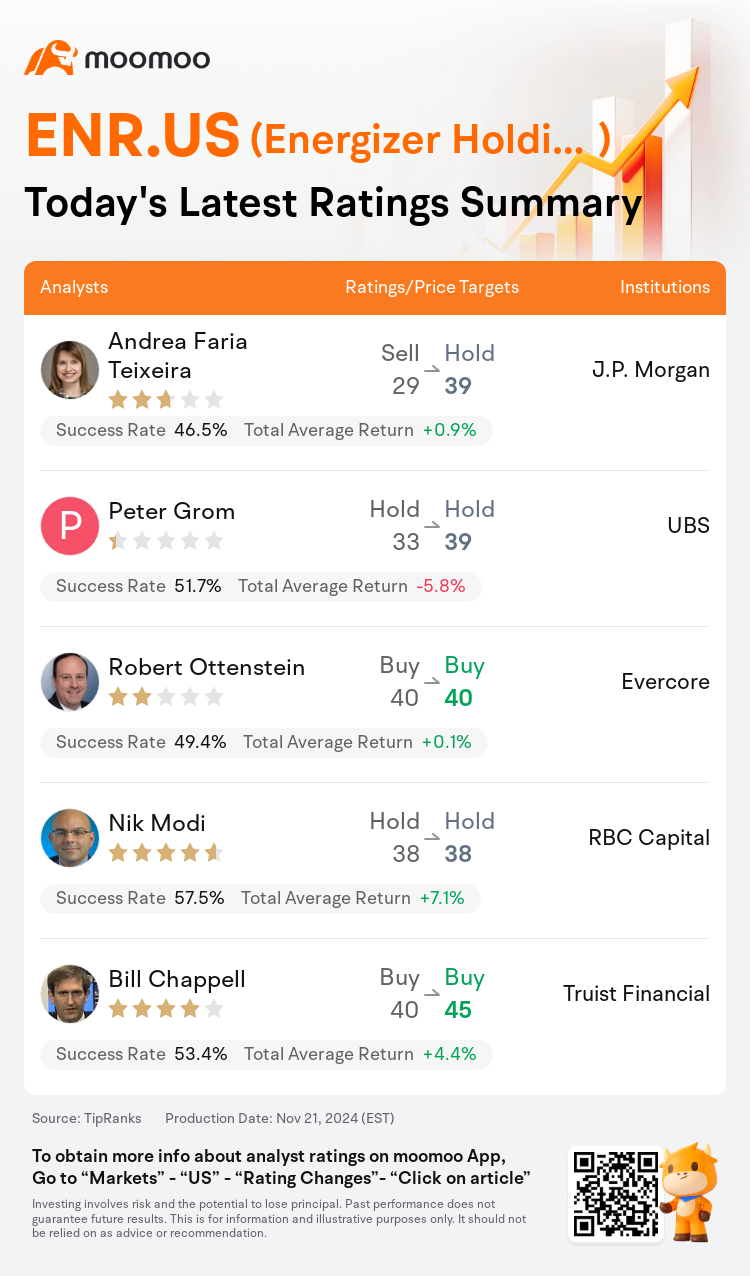

On Nov 21, major Wall Street analysts update their ratings for $Energizer Holdings (ENR.US)$, with price targets ranging from $38 to $45.

J.P. Morgan analyst Andrea Faria Teixeira upgrades to a hold rating, and adjusts the target price from $29 to $39.

UBS analyst Peter Grom maintains with a hold rating, and adjusts the target price from $33 to $39.

Evercore analyst Robert Ottenstein maintains with a buy rating, and maintains the target price at $40.

Evercore analyst Robert Ottenstein maintains with a buy rating, and maintains the target price at $40.

RBC Capital analyst Nik Modi maintains with a hold rating, and maintains the target price at $38.

Truist Financial analyst Bill Chappell maintains with a buy rating, and adjusts the target price from $40 to $45.

Furthermore, according to the comprehensive report, the opinions of $Energizer Holdings (ENR.US)$'s main analysts recently are as follows:

Energizer's slight Q4 EPS upside was driven by margins and elements below the profit line, and the guidance for FY25 is aligned with consensus expectations, which is considered favorable in a challenging staples environment.

Energizer is considered 'fundamentally on solid footing,' indicating robust underlying business performance. The company demonstrated favorable outcomes in its fiscal Q4 and has presented an optimistic projection for fiscal 2025, which includes continued margin expansion, reduction of debt, and an expected resurgence in organic sales growth. However, the current valuation of the shares suggests that they are fully priced, and prospective returns could be minimal.

Energizer is anticipated to achieve a more consistent sales and earnings performance going forward. The boost in sales momentum is attributed to volume growth, as the company expands its shelf presence. This growth has been supported by recent storm impacts and by channeling some savings from 'Project Momentum' into advertising and promotional activities to stimulate further volume growth. This scenario has contributed to a more optimistic sales outlook.

Here are the latest investment ratings and price targets for $Energizer Holdings (ENR.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月21日,多家华尔街大行更新了$劲量控股 (ENR.US)$的评级,目标价介于38美元至45美元。

摩根大通分析师Andrea Faria Teixeira上调至持有评级,并将目标价从29美元上调至39美元。

瑞士银行分析师Peter Grom维持持有评级,并将目标价从33美元上调至39美元。

Evercore分析师Robert Ottenstein维持买入评级,维持目标价40美元。

Evercore分析师Robert Ottenstein维持买入评级,维持目标价40美元。

加皇资本市场分析师Nik Modi维持持有评级,维持目标价38美元。

储亿银行分析师Bill Chappell维持买入评级,并将目标价从40美元上调至45美元。

此外,综合报道,$劲量控股 (ENR.US)$近期主要分析师观点如下:

安能杰四季度每股收益小幅超出预期,这得益于利润率和利润线以下的因素,而2025财年的指引与市场共识预期一致,这在艰难的日用消费品环境下被认为是有利的。

安能杰被认为是“基本面稳固”,这表明其业务业绩强劲。公司在其2024财年表现出积极的结果,并对2025财年提出了乐观的预测,包括持续的利润率扩张、减债和预计有机销售增长的复苏。然而,当前股份的估值表明它们的价格已完全反映,未来回报可能有限。

预计安能杰未来将实现更稳定的销售和盈利表现。销售势头的提升归因于成交量的增长,因公司扩大了其货架存在。这一增长得到了最近风暴影响的支持,并通过将部分“项目势能”的节省投入广告和促销活动以刺激进一步的成交量增长。这种情况促成了更乐观的销售前景。

以下为今日5位分析师对$劲量控股 (ENR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Robert Ottenstein维持买入评级,维持目标价40美元。

Evercore分析师Robert Ottenstein维持买入评级,维持目标价40美元。

Evercore analyst Robert Ottenstein maintains with a buy rating, and maintains the target price at $40.

Evercore analyst Robert Ottenstein maintains with a buy rating, and maintains the target price at $40.