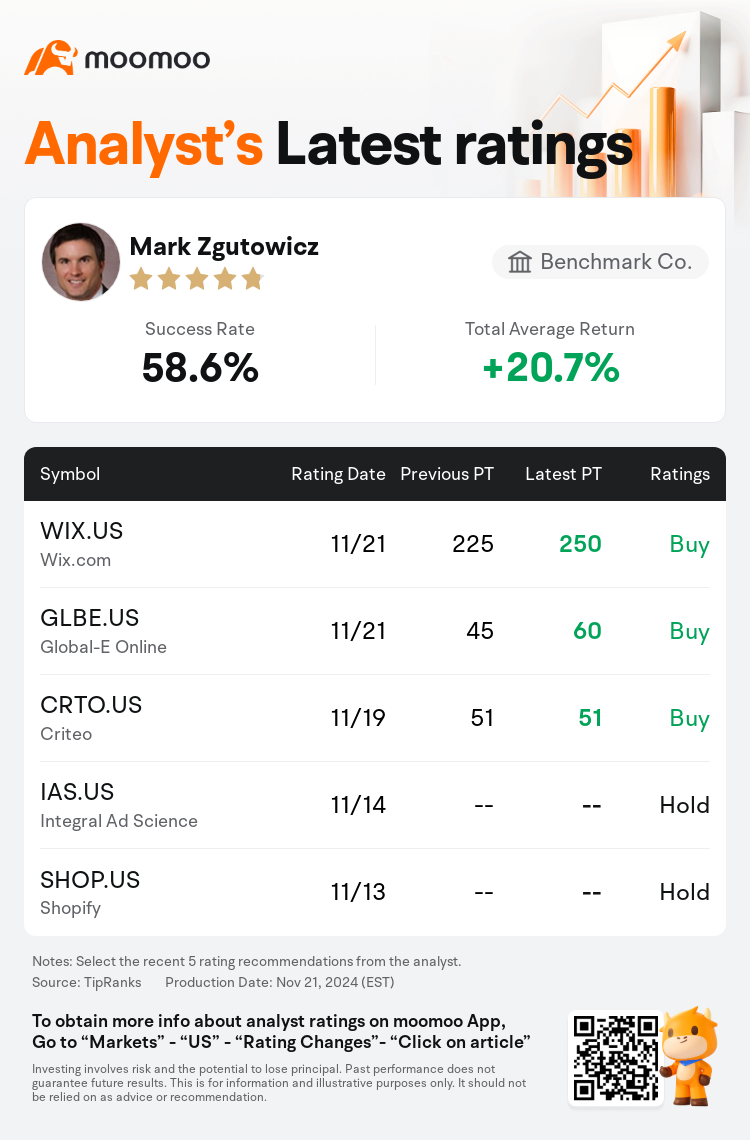

Benchmark Co. analyst Mark Zgutowicz maintains $Wix.com (WIX.US)$ with a buy rating, and adjusts the target price from $225 to $250.

According to TipRanks data, the analyst has a success rate of 58.6% and a total average return of 20.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Wix.com (WIX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Wix.com (WIX.US)$'s main analysts recently are as follows:

Q3 results surpassed expectations, accompanied by increases in revenue, billings, and free cash flow that suggest robust end-of-year figures for FY24 and maintain momentum into FY25. Core initiatives, such as Studio, bolstering Partners, and AI enhancements aiding Self-Creators, suggest potential for continued growth in 2025.

While Wix.com delivered another robust quarterly performance, there was an expectation for quicker growth in their self-creator segment. Despite challenging comparisons, both partner and business solutions segments showed acceleration. Additionally, the company's free cash flow margin is on the verge of reaching 30%. It is also noted that Wix is on track to generate $500 million in free cash flow by 2024, surpassing earlier long-term forecasts.

Wix.com demonstrated robust growth in Q3 and provided Q4 guidance that exceeded expectations for bookings growth and free cash flow. This performance has led to revised expectations based on the company's highly recurring revenue stream, introduction of new AI-infused products, and an elevated outlook for growth and margins.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

本臻力行分析师Mark Zgutowicz维持$Wix.com (WIX.US)$买入评级,并将目标价从225美元上调至250美元。

根据TipRanks数据显示,该分析师近一年总胜率为58.6%,总平均回报率为20.7%。

此外,综合报道,$Wix.com (WIX.US)$近期主要分析师观点如下:

此外,综合报道,$Wix.com (WIX.US)$近期主要分析师观点如下:

Q3的业绩超出预期,营业收入、账单和自由现金流增长,预示着FY24年底的强劲数据,并在FY25延续势头。核心业务,如Studio、支持合作伙伴和增强人工智能助力自创作者,表明2025年有持续增长的潜力。

尽管Wix.com取得了另一个强劲的季度业绩,但人们对其自创者部分的增长预期更高。尽管存在挑战性的比较,合作伙伴和业务解决方案部门均显示加速。此外,公司的自由现金流边际几乎接近达到30%。还指出Wix有望在2024年实现50000万美元的自由现金流,超过之前的长期预测。

Wix.com在Q3表现出强劲增长,并提供了超出预期的Q4指导,包括预订增长和自由现金流。这种表现导致根据公司高度重复的营收来源、推出新的人工智能产品、以及对增长和利润率的提高前景做出修订的预期。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Wix.com (WIX.US)$近期主要分析师观点如下:

此外,综合报道,$Wix.com (WIX.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of