Energy Transfer Unusual Options Activity

Energy Transfer Unusual Options Activity

Financial giants have made a conspicuous bullish move on Energy Transfer. Our analysis of options history for Energy Transfer (NYSE:ET) revealed 19 unusual trades.

金融巨头们对energy transfer进行了明显的看好操作。我们对energy transfer(纽交所:ET)的期权历史分析发现了19笔飞凡交易。

Delving into the details, we found 52% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $50,560, and 17 were calls, valued at $1,071,357.

深入分析后,我们发现52%的交易者看好,而42%的交易者则表现出看淡倾向。在所有的交易中,我们发现有2笔看跌期权,总值为50,560美元,17笔看涨期权,总值为1,071,357美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $20.0 for Energy Transfer over the last 3 months.

考虑到这些合约的成交量和未平仓合约,看来鲸鱼们在过去3个月中瞄准的energy transfer价格区间为15.0美元到20.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

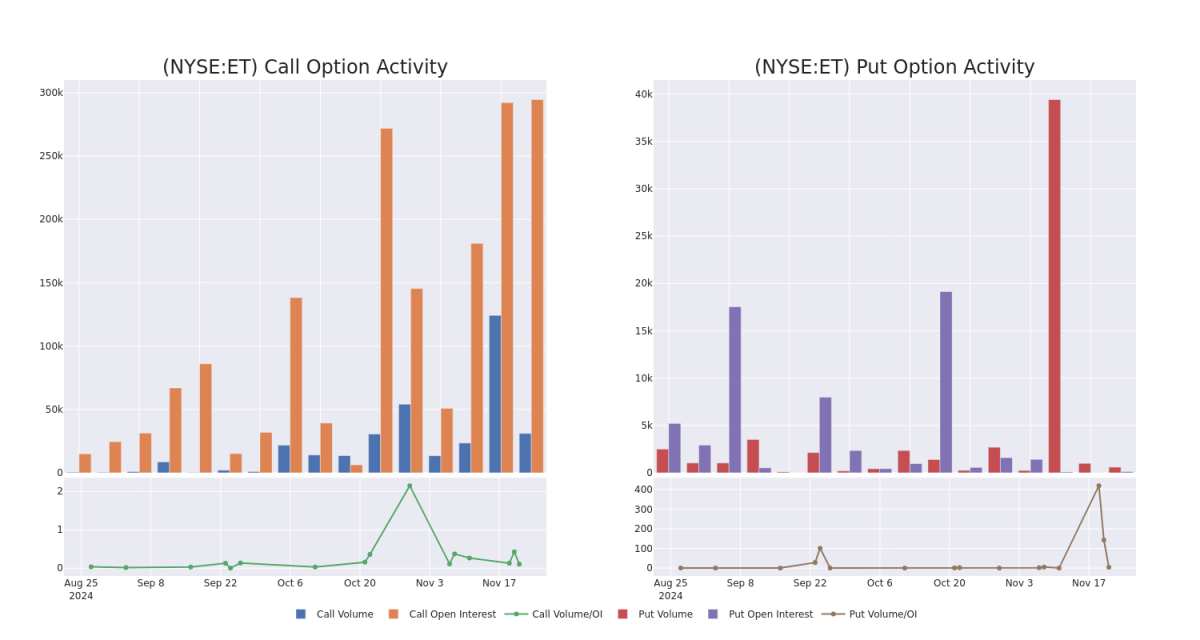

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $15.0 to $20.0 in the last 30 days.

查看成交量和未平仓合约是期权交易中的一个强有力的操作。该数据可以帮助您跟踪energy transfer特定执行价的期权的流动性和兴趣。以下,我们可以观察到在过去30天内,针对energy transfer的鲸鱼交易在15.0美元到20.0美元执行价范围内看涨期权和看跌期权的成交量和未平仓合约的演变。

Energy Transfer Option Activity Analysis: Last 30 Days

energy transfer期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | CALL | TRADE | BULLISH | 01/17/25 | $3.5 | $3.5 | $3.5 | $15.00 | $322.0K | 39.8K | 0 |

| ET | CALL | SWEEP | BEARISH | 01/17/25 | $2.0 | $1.97 | $1.97 | $17.00 | $98.5K | 75.4K | 1.1K |

| ET | CALL | TRADE | NEUTRAL | 07/18/25 | $0.56 | $0.47 | $0.52 | $20.00 | $78.4K | 632 | 3.6K |

| ET | CALL | SWEEP | BULLISH | 07/18/25 | $0.49 | $0.45 | $0.49 | $20.00 | $71.3K | 632 | 425 |

| ET | CALL | SWEEP | BULLISH | 01/16/26 | $1.0 | $0.97 | $1.0 | $20.00 | $70.6K | 39.2K | 2.0K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| energy transfer | 看涨 | 交易 | BULLISH | 01/17/25 | $3.5 | $3.5 | $3.5 | $15.00 | $322.0K | - Expiration Date: When the contract expires. One must act on the contract by this date if one wants to use it. | 0 |

| energy transfer | 看涨 | SWEEP | 看淡 | 01/17/25 | $2.0 | $1.97 | $1.97 | $17.00 | $98.5K | 75.4K | 1.1K |

| energy transfer | 看涨 | 交易 | 中立 | 07/18/25 | $0.56 | $0.47 | 0.52美元 | $20.00 | $78.4K | 632 | 3.6千 |

| energy transfer | 看涨 | SWEEP | BULLISH | 07/18/25 | $0.49 | $0.45 | $0.49 | $20.00 | $71.3K | 632 | 425 |

| energy transfer | 看涨 | SWEEP | BULLISH | 01/16/26 | $1.0 | $0.97 | $1.0 | $20.00 | $70.6K | 39.2K | 2.0千 |

About Energy Transfer

有关能源转移的信息

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer拥有美国最大的原油、天然气和天然气液体资产组合之一,主要位于得克萨斯州和美国中部地区。其管道网络总长13万英里。它还拥有采集和加工设施、美国最大的分馏设施之一、燃料分销资产以及莱克查尔斯天然气液化设施。该公司在2018年10月合并了其公开交易的有限合伙和普通合伙。

Having examined the options trading patterns of Energy Transfer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了energy transfer的期权交易模式之后,我们的注意力现在直接转向公司本身。这个转变使我们能够深入了解其当前的市场地位和表现

Present Market Standing of Energy Transfer

energy transfer的当前市场状况

- With a volume of 19,281,980, the price of ET is up 3.64% at $18.95.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 83 days.

- 成交量为19,281,980,Et的价格上涨了3.64%,现价为$18.95。

- RSI因子暗示底层股票可能被超买。

- 下一季度盈利预计将在83天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $15.0 to $20.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale trades within a strike price range from $15.0 to $20.0 in the last 30 days.