Why Investors Shouldn't Be Surprised By Hainan Development HoldingsNanhai Co., Ltd.'s (SZSE:002163) 28% Share Price Surge

Why Investors Shouldn't Be Surprised By Hainan Development HoldingsNanhai Co., Ltd.'s (SZSE:002163) 28% Share Price Surge

Despite an already strong run, Hainan Development HoldingsNanhai Co., Ltd. (SZSE:002163) shares have been powering on, with a gain of 28% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.1% over the last year.

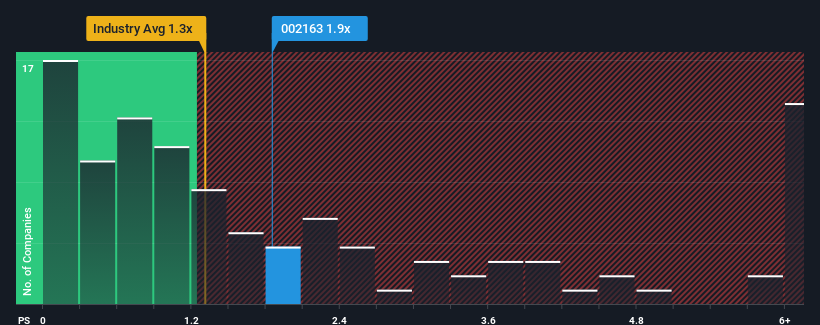

Following the firm bounce in price, you could be forgiven for thinking Hainan Development HoldingsNanhai is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in China's Construction industry have P/S ratios below 1.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Hainan Development HoldingsNanhai Performed Recently?

Hainan Development HoldingsNanhai's negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hainan Development HoldingsNanhai's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hainan Development HoldingsNanhai's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hainan Development HoldingsNanhai's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Looking ahead now, revenue is anticipated to climb by 64% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

With this information, we can see why Hainan Development HoldingsNanhai is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Hainan Development HoldingsNanhai's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Hainan Development HoldingsNanhai shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hainan Development HoldingsNanhai with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.