Tradepulse Power Inflow Alert: Arista Networks Inc. Moves Up Over 10 Points After Alert

Tradepulse Power Inflow Alert: Arista Networks Inc. Moves Up Over 10 Points After Alert

STOCK CLOSES 2.5% HIGHER AFTER SIGNAL

股价信号后收涨2.5%

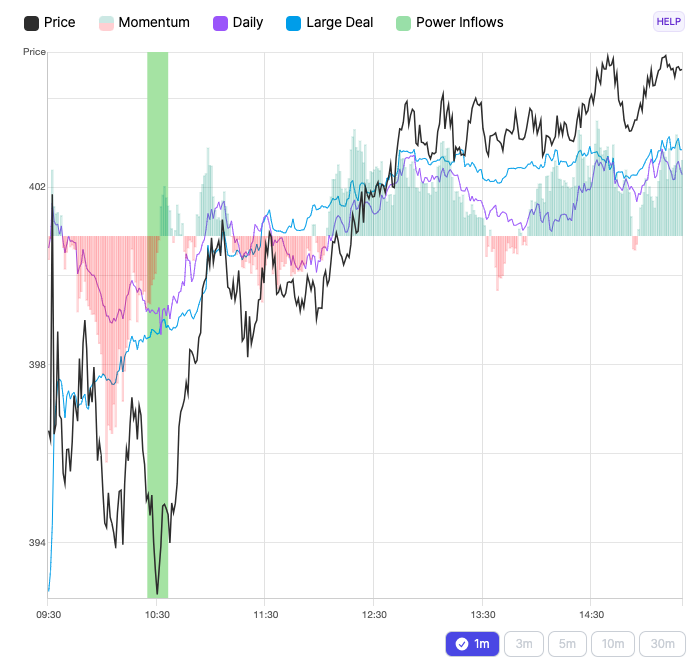

Yesterday, at 10:34 AM on November 21st, a significant trading signal occurred for Arista Networks, Inc. (NYSE:ANET) as it demonstrated a Power Inflow at a price of $394.96. This indicator is crucial for traders who want to know directionally where institutions and so-called "smart money" moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Arista's stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Arista's stock price, interpreting this event as a bullish sign.

昨天11月21日上午10:34,Arista Networks, Inc. (纽交所:ANET) 出现重要交易信号,显示价格为394.96美元的大规模流入买单。这个指标对于想了解机构和所谓的"聪明钱"在市场中的行动方向的交易者至关重要。他们认为利用订单流分析指导交易决策具有价值。大规模流入买单指向Arista股票可能的上升趋势,为寻找机会参与预期上涨运动的交易者标记了一个潜在入场点。具有这一信号的交易者密切关注Arista股票价格的持续动能,解读这一事件为看好迹象。

Signal description

信号描述

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted by active traders as a bullish signal.

订单流分析,又称交易或市场流分析,分析零售和机构订单(流)的交易量速率。它涉及分析买卖订单的流动,以及大小、时间和其他相关特征和模式,以获得见解并做出更明智的交易决策。这一特定指标被积极交易者解释为看涨信号。

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock's overall direction, powered by institutional activity in the stock, for the remainder of the day.

流入力量发生在市场开盘的前两个小时内,并且通常会预示帮助判断股票作为一整天的整体方向的趋势,由股票中的机构活动推动。

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let's not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

通过将订单流分析纳入他们的交易策略,市场参与者可以更好地解读市场条件,识别交易机会,并有可能改善其交易绩效。但让我们不要忘记,尽管观察智慧资金流动可以提供宝贵的见解,但将有效的风险管理策略纳入非常重要,以保护资金并降低潜在风险。采用一致且有效的风险管理计划有助于交易者以更加受控和计算的方式应对市场的不确定性,提高长期成功的可能性。

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

市场新闻和数据由Benzinga APIs带给您,包括像Finit USA这样的公司,它负责本文中部分数据的处理。

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024年Benzinga.com保留版权所有,Benzinga.com不提供投资建议。

After Market Close UPDATE:

收盘后更新:

The price at the time of the Power Inflow was $394.86. The returns on the High price ($404.96) and Close price ($404.65) after the Power Inflow were respectively 2.6% and 2.5%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case, the high of the day and close were very close but that is not always the case

在资金流入时的价格为394.86美元。资金流入后高价(404.96美元)和收盘价(404.65美元)的收益分别为2.6%和2.5%。这就是为什么拥有一个包括盈利目标和止损的交易计划非常重要,这些应反映您的风险偏好。在这种情况下,当天的高点和收盘价非常接近,但这并不总是如此。

Past Performance is Not Indicative of Future Results

过往表现并不代表未来结果

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions.

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions.