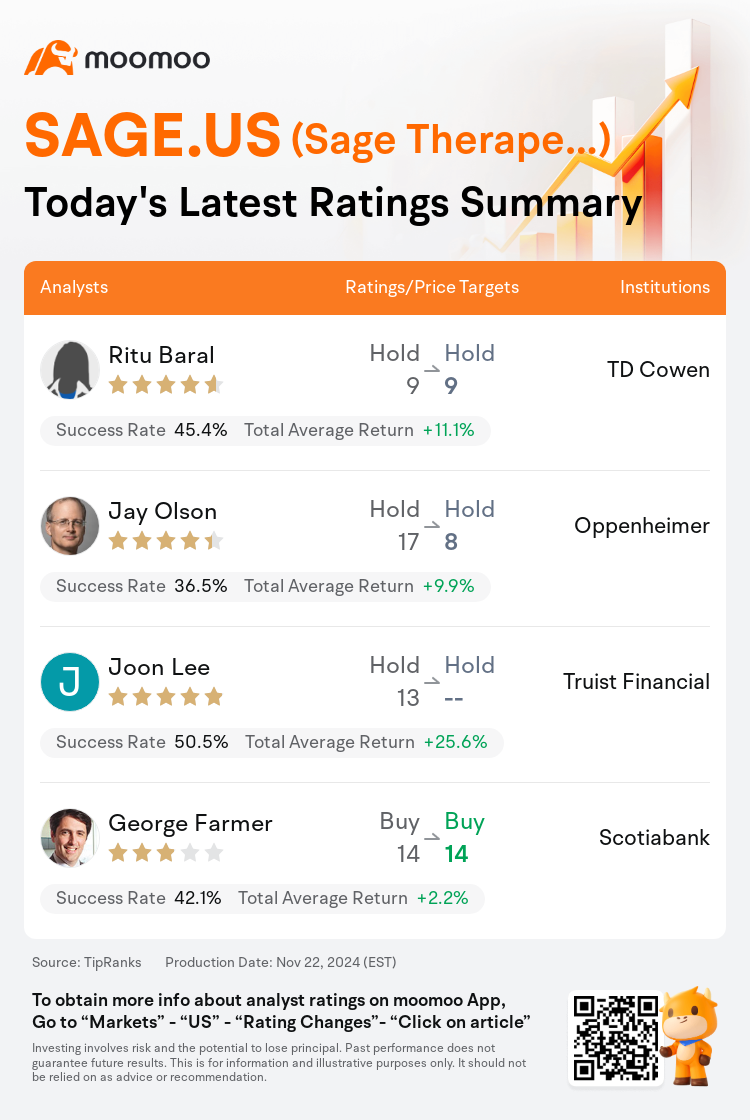

On Nov 22, major Wall Street analysts update their ratings for $Sage Therapeutics (SAGE.US)$, with price targets ranging from $8 to $14.

TD Cowen analyst Ritu Baral maintains with a hold rating, and maintains the target price at $9.

Oppenheimer analyst Jay Olson maintains with a hold rating, and adjusts the target price from $17 to $8.

Truist Financial analyst Joon Lee maintains with a hold rating.

Truist Financial analyst Joon Lee maintains with a hold rating.

Scotiabank analyst George Farmer maintains with a buy rating, and maintains the target price at $14.

Furthermore, according to the comprehensive report, the opinions of $Sage Therapeutics (SAGE.US)$'s main analysts recently are as follows:

Following the announcement that the phase 2 DIMENSION trial evaluating dalzanemdor in cognitive impairment associated with Huntington's disease failed to achieve the primary endpoint, the value assigned to this pipeline has been adjusted by removing $75M. The company has emphasized other assets in the early-stage pipeline; however, it is noted that significant clinical validation will be required before additional value can be attributed to these assets.

Sage Therapeutics announced that dalzanemdor did not meet the primary endpoint of change from baseline on the Symbol Digit Modalities Test at day 84 in the Phase 2 Huntington's cognitive impairment study. No statistically significant or clinically meaningful differences were observed on secondary endpoints.

Here are the latest investment ratings and price targets for $Sage Therapeutics (SAGE.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月22日,多家华尔街大行更新了$Sage Therapeutics (SAGE.US)$的评级,目标价介于8美元至14美元。

TD Cowen分析师Ritu Baral维持持有评级,维持目标价9美元。

奥本海默控股分析师Jay Olson维持持有评级,并将目标价从17美元下调至8美元。

储亿银行分析师Joon Lee维持持有评级。

储亿银行分析师Joon Lee维持持有评级。

丰业银行分析师George Farmer维持买入评级,维持目标价14美元。

此外,综合报道,$Sage Therapeutics (SAGE.US)$近期主要分析师观点如下:

在宣布评估dalzanemdor用于亨廷顿舞蹈症相关认知障碍的第二阶段DIMENSION试验未能达到主要终点后,该管线的价值被调整,减少了7500万美元。公司强调了早期管线中的其他资产;然而,需要进行重大临床验证,才能在这些资产上加上额外的价值。

sage therapeutics宣布,在第二阶段亨廷顿认知障碍研究中,dalzanemdor未能达到基线变化的主要终点,即在第84天的符号数字模态测试中。未观察到次要终点在统计学上显著或临床上有意义的差异。

以下为今日4位分析师对$Sage Therapeutics (SAGE.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

储亿银行分析师Joon Lee维持持有评级。

储亿银行分析师Joon Lee维持持有评级。

Truist Financial analyst Joon Lee maintains with a hold rating.

Truist Financial analyst Joon Lee maintains with a hold rating.