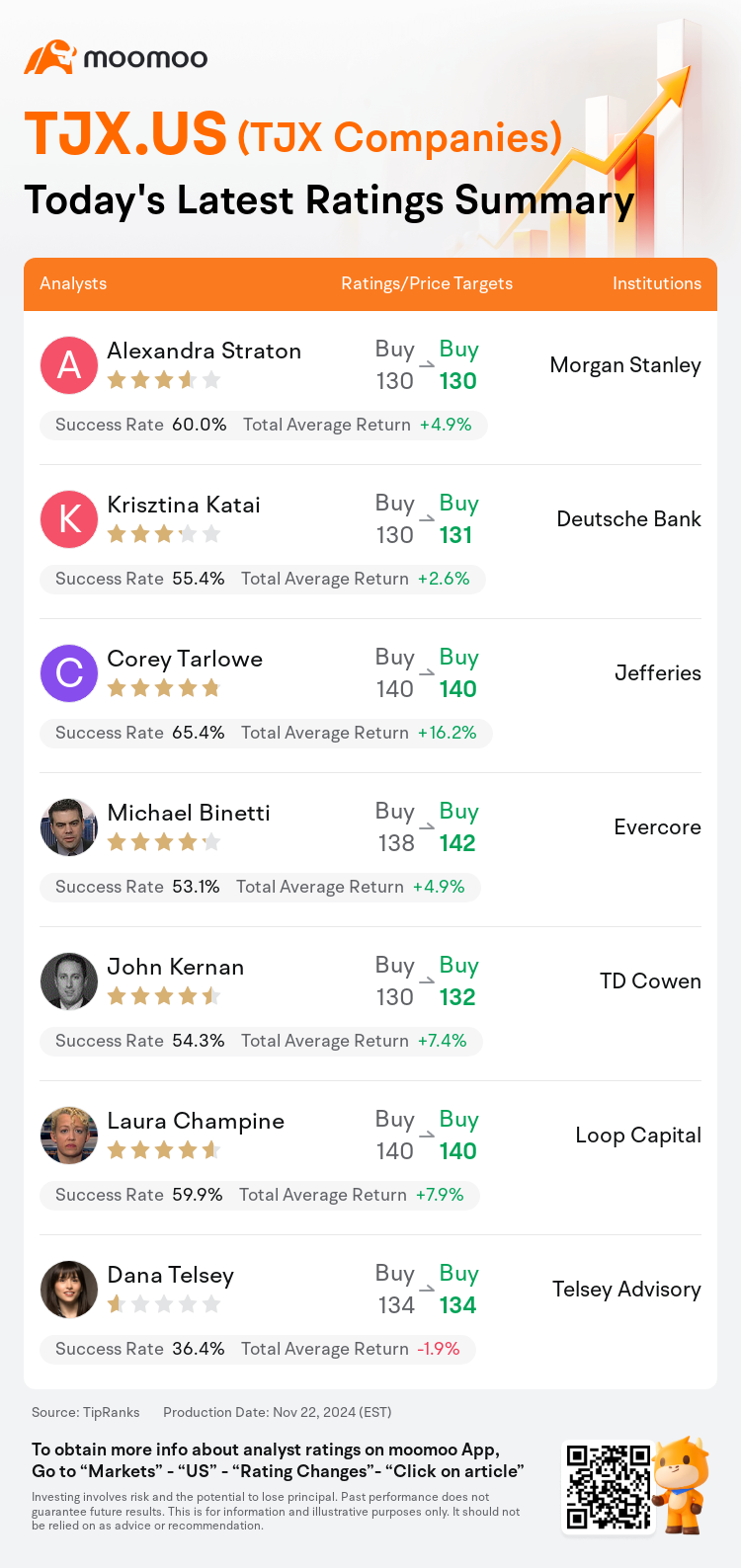

On Nov 22, major Wall Street analysts update their ratings for $TJX Companies (TJX.US)$, with price targets ranging from $130 to $142.

Morgan Stanley analyst Alexandra Straton maintains with a buy rating, and maintains the target price at $130.

Deutsche Bank analyst Krisztina Katai maintains with a buy rating, and adjusts the target price from $130 to $131.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $140.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $140.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $138 to $142.

TD Cowen analyst John Kernan maintains with a buy rating, and adjusts the target price from $130 to $132.

Furthermore, according to the comprehensive report, the opinions of $TJX Companies (TJX.US)$'s main analysts recently are as follows:

TJX is positioned to successfully manage through a shorter holiday season as weather patterns return to normal. The company's ability to maintain valuation premiums is seen as favorable, especially within the Off-Price sector which could be advantaged in navigating potential inflationary impacts if tariffs are implemented.

The firm describes TJX's recent quarter as very reassuring. Typically, a higher contribution to comparable sales from International relative to Marmaxx could diminish the perceived quality of the quarter. However, the strong commencement of Q4 should alleviate any concerns from Q3. Moreover, this strength is not anticipated to be widely reported across the sector in upcoming reports before Black Friday.

Despite some challenges related to weather conditions, TJX maintains strong merchant execution and continues to appeal due to its value. The valuation is considered reasonable and, with a clear path to high single-digit percentage earnings growth, the shares present a balanced opportunity of risk and reward.

Here are the latest investment ratings and price targets for $TJX Companies (TJX.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

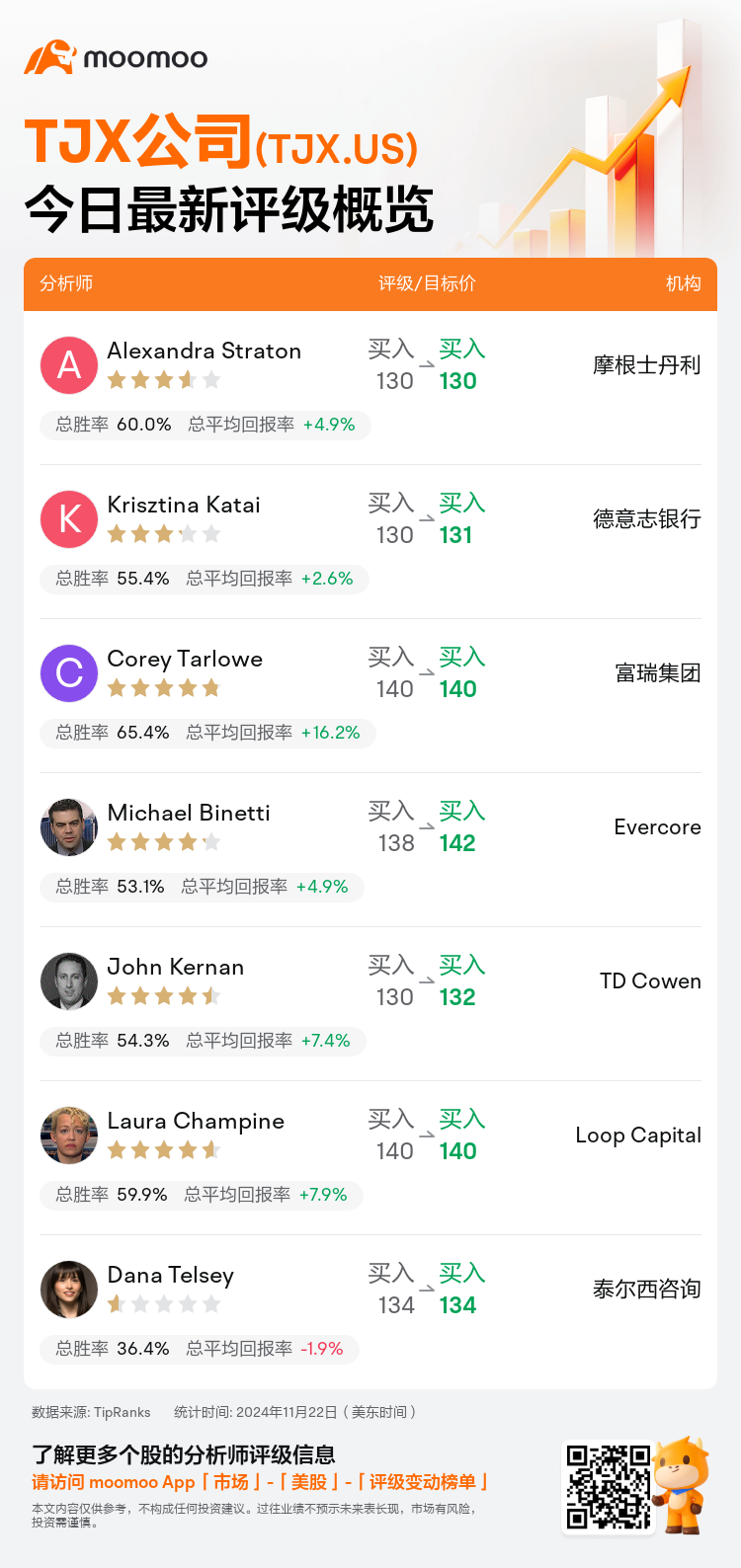

美东时间11月22日,多家华尔街大行更新了$TJX公司 (TJX.US)$的评级,目标价介于130美元至142美元。

摩根士丹利分析师Alexandra Straton维持买入评级,维持目标价130美元。

德意志银行分析师Krisztina Katai维持买入评级,并将目标价从130美元上调至131美元。

富瑞集团分析师Corey Tarlowe维持买入评级,维持目标价140美元。

富瑞集团分析师Corey Tarlowe维持买入评级,维持目标价140美元。

Evercore分析师Michael Binetti维持买入评级,并将目标价从138美元上调至142美元。

TD Cowen分析师John Kernan维持买入评级,并将目标价从130美元上调至132美元。

此外,综合报道,$TJX公司 (TJX.US)$近期主要分析师观点如下:

TJX被定位为成功应对较短的假日季节,随着天气模式恢复正常。公司在维持估值溢价方面的能力被视为有利,特别是在Off-Price板块内,如果实施关税,可能有利于应对潜在的通胀影响。

该公司将TJX最近的一个季度描述为非常令人放心。相对于Marmaxx,从国际业务对可比销售的贡献更高,可能会降低季度的质量,然而,Q4的强劲开局应该会缓解对Q3的任何担忧。此外,这种强劲预计不会在接下来的报告中被广泛报道,在黑色星期五之前。

尽管受天气条件影响,TJX保持了强大的商家执行力,并因其价值而继续吸引人。这种估值被认为是合理的,并且,有明确通向高个位数盈利增长的路径,这些股票提供了一种均衡的风险和回报机会。

以下为今日7位分析师对$TJX公司 (TJX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Corey Tarlowe维持买入评级,维持目标价140美元。

富瑞集团分析师Corey Tarlowe维持买入评级,维持目标价140美元。

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $140.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $140.