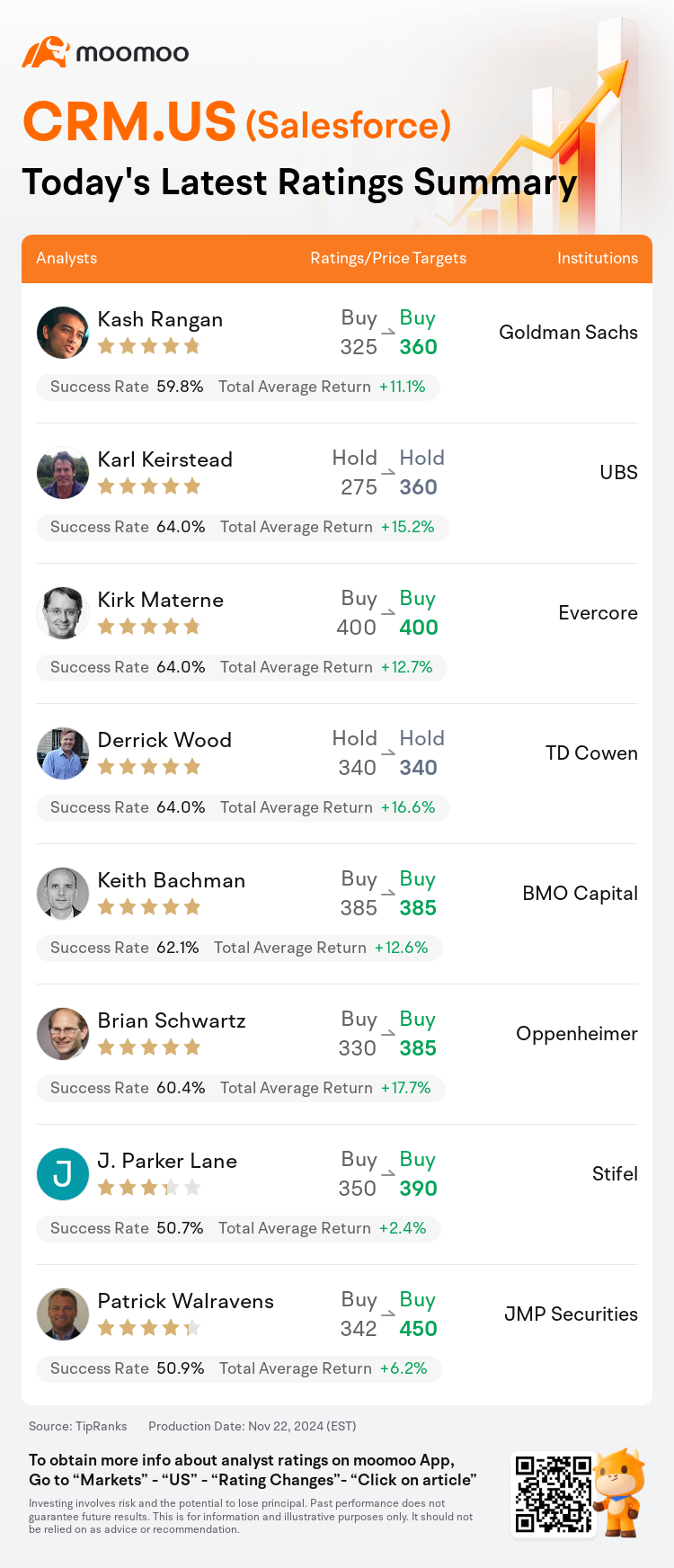

On Nov 22, major Wall Street analysts update their ratings for $Salesforce (CRM.US)$, with price targets ranging from $340 to $450.

Goldman Sachs analyst Kash Rangan maintains with a buy rating, and adjusts the target price from $325 to $360.

UBS analyst Karl Keirstead maintains with a hold rating, and adjusts the target price from $275 to $360.

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $400.

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $400.

TD Cowen analyst Derrick Wood maintains with a hold rating, and maintains the target price at $340.

BMO Capital analyst Keith Bachman maintains with a buy rating, and maintains the target price at $385.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Consultations with customers about Agentforce revealed a distinctly positive reception, emphasizing it as a meaningful improvement with genuine customer interest. It is believed that Salesforce maintains a resilient business model, capable of weathering challenging macroeconomic conditions affecting the software sector. The company is expected to find upside by shifting towards an efficiency strategy, managing slower growth with enhanced profitability and free cash flow, while integrating generative AI into its services.

The firm is optimistic about the early reception surrounding Agentforce and the potential for a more robust new AI-driven product cycle. However, they believe expectations may have become somewhat inflated, suggesting a need for patience to observe significant impacts.

The firm expresses a slightly positive outlook for Salesforce's Q3 earnings, influenced by various research insights. The analysis of Q3 hiring data and an earnings preview underscore Salesforce's potential for consistent earnings growth. With the anticipation of a Q4 IT budget increase, the outlook for Salesforce appears favorable.

Here are the latest investment ratings and price targets for $Salesforce (CRM.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

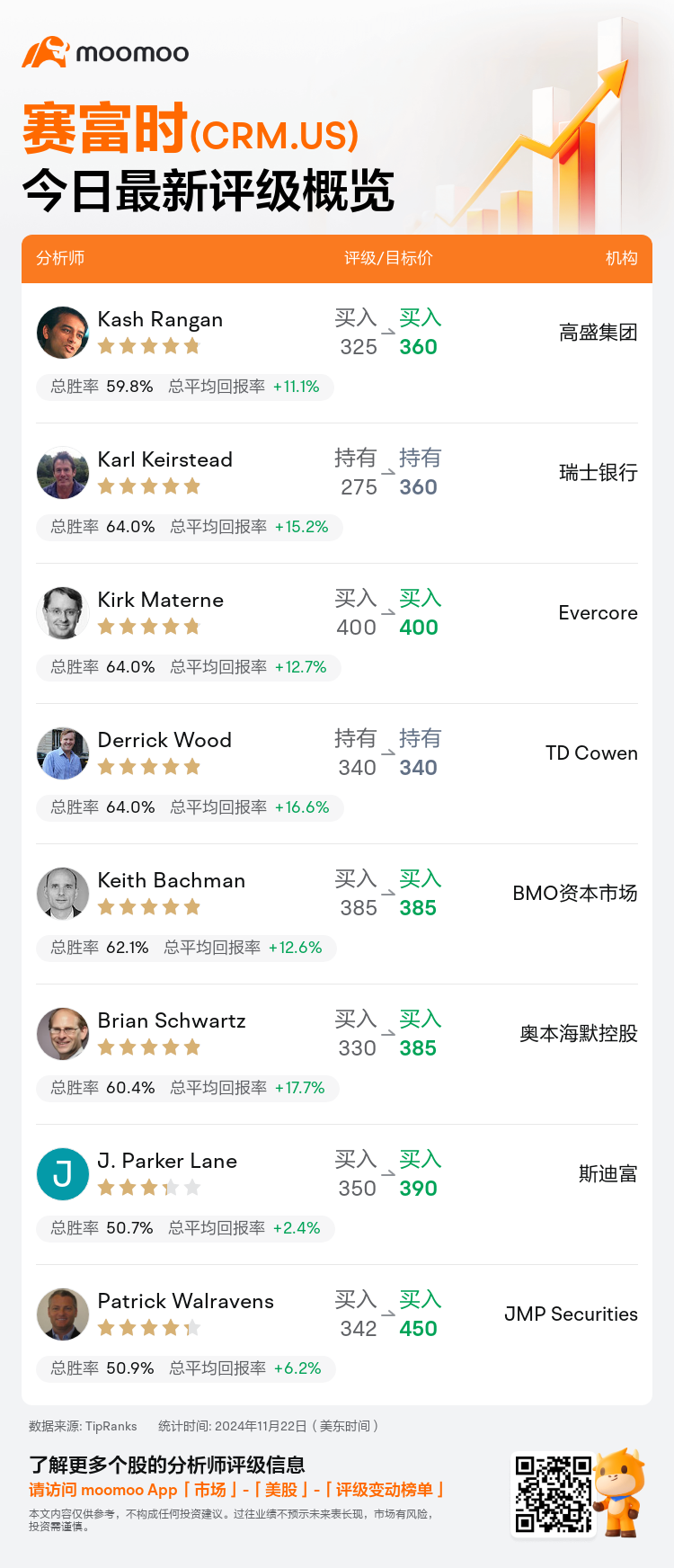

美东时间11月22日,多家华尔街大行更新了$赛富时 (CRM.US)$的评级,目标价介于340美元至450美元。

高盛集团分析师Kash Rangan维持买入评级,并将目标价从325美元上调至360美元。

瑞士银行分析师Karl Keirstead维持持有评级,并将目标价从275美元上调至360美元。

Evercore分析师Kirk Materne维持买入评级,维持目标价400美元。

Evercore分析师Kirk Materne维持买入评级,维持目标价400美元。

TD Cowen分析师Derrick Wood维持持有评级,维持目标价340美元。

BMO资本市场分析师Keith Bachman维持买入评级,维持目标价385美元。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

与客户就赛富时进行的咨询表明,受到了明显的积极回应,强调它是一项有意义的改进,受到真正客户的兴趣。相信赛富时保持着一个有韧性的业务模型,能够经受影响软件板块的具有挑战性的宏观经济条件。预计公司将通过转向效率策略,管理较慢增长与增强的盈利能力和自由现金流,同时将生成的人工智能整合到其服务中找到增长空间。

公司对围绕赛富时的早期反馈以及更加强劲的新人工智能驱动产品周期的潜力感到乐观。然而,他们认为预期可能有些过高,暗示需要耐心观察显著影响。

公司对赛富时第三季度的收益表现表现出稍微乐观的态度,受各种研究见解的影响。第三季度招聘数据的分析和收益预览突显了赛富时稳定盈利增长的潜力。随着对第四季度IT预算增加的期待,赛富时的前景看好。

以下为今日8位分析师对$赛富时 (CRM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Kirk Materne维持买入评级,维持目标价400美元。

Evercore分析师Kirk Materne维持买入评级,维持目标价400美元。

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $400.

Evercore analyst Kirk Materne maintains with a buy rating, and maintains the target price at $400.