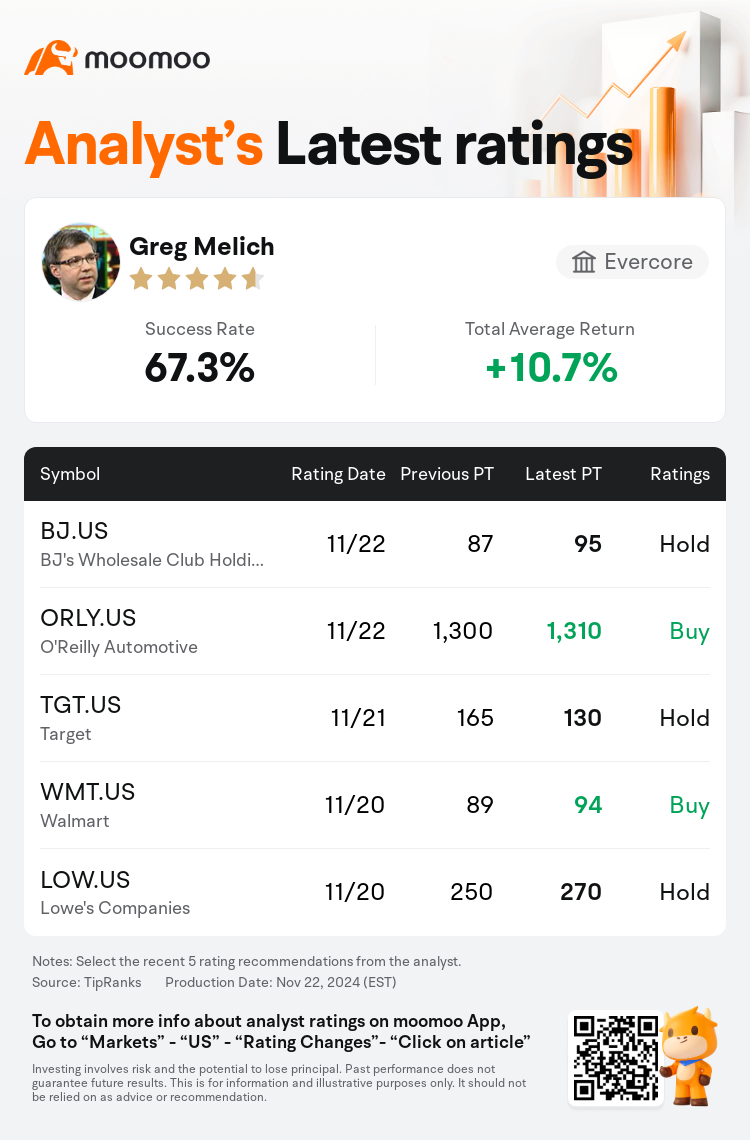

Evercore analyst Greg Melich maintains $BJ's Wholesale Club Holdings (BJ.US)$ with a hold rating, and adjusts the target price from $87 to $95.

According to TipRanks data, the analyst has a success rate of 67.3% and a total average return of 10.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $BJ's Wholesale Club Holdings (BJ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $BJ's Wholesale Club Holdings (BJ.US)$'s main analysts recently are as follows:

There were multiple positives noted from BJ's 3Q earnings results, including significantly higher-than-expected core same-store sales and strong member engagement. Although the club's choice not to adjust a one-time legal settlement has introduced challenges in achieving high single to low double-digit earnings growth in the upcoming year, BJ's long-term financial plans up to fiscal 2025 still appear achievable based on underlying trends.

Strong Q3 performance stands in contrast to the company's rather conservative Q4 margin guidance. Despite being encouraged by the membership momentum and a fee increase, the requirement for additional labor due to new club openings, digital growth, and the Fresh 2.0 initiative might restrict the margin upside.

BJ's Wholesale experienced a solid Q3 performance and the announcement of a fee increase effective January 1 was well received. However, the reduction in the Q4 guidance due to re-investments and sales moderation, along with decreased renewal intent revealed in recent surveys and the potential disruptions from tariffs and/or port strikes, indicate that risks still persist.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Evercore分析师Greg Melich维持$BJ批发俱乐部 (BJ.US)$持有评级,并将目标价从87美元上调至95美元。

根据TipRanks数据显示,该分析师近一年总胜率为67.3%,总平均回报率为10.7%。

此外,综合报道,$BJ批发俱乐部 (BJ.US)$近期主要分析师观点如下:

此外,综合报道,$BJ批发俱乐部 (BJ.US)$近期主要分析师观点如下:

BJ的第三季度盈利结果引发了多个积极的注意点,包括显著高于预期的核心同店销售额和强劲的会员参与度。尽管俱乐部选择不调整一次性法律和解所带来的挑战,可能会影响到未来一年实现高个位数到低两位数的盈利增长,但根据基本趋势,BJ的长期财务计划直至2025财年仍然可实现。

强劲的第三季度表现与公司相对保守的第四季度边际指导形成鲜明对比。尽管会员增长势头和费用增加令人鼓舞,但由于新店开业、数字增长和Fresh 2.0计划需要额外劳动力,可能会限制边际的增长潜力。

BJ的批发业务经历了一个稳健的第三季度表现,宣布自1月1日起的会费增加受到了良好回应。然而,由于再投资和销售减速,加上最近调查中显示的续约意愿降低以及可能出现的关税或港口罢工所带来的潜在干扰,第四季度指引的下调表明风险仍然存在。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$BJ批发俱乐部 (BJ.US)$近期主要分析师观点如下:

此外,综合报道,$BJ批发俱乐部 (BJ.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of