Singapore's Life Insurance Slated for $43b Premiums in 2029

Singapore's Life Insurance Slated for $43b Premiums in 2029

Due to the ageing population, health awareness, and consumer spending.

由于人口老龄化、健康意识和消费者支出。

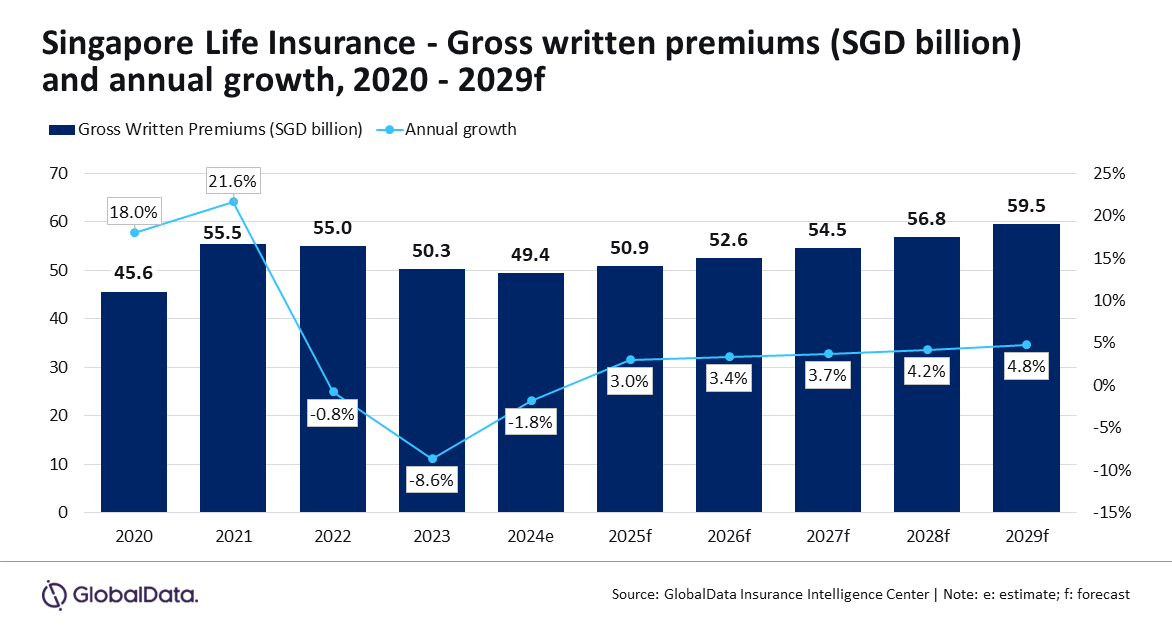

The life insurance sector in Singapore is forecast to bag $43.6b in gross written premiums (GWP) by 2029, possibly recording a compound annual growth rate (CAGR) of 4.0% beginning 2025, according to GlobalData.

根据GlobalData的数据,预计到2029年,新加坡的人寿保险业总承保保费(GWP)将达到436亿美元,从2025年开始,复合年增长率(CAGR)可能达到4.0%。

This growth is expected to be driven by an ageing population, increased health awareness, and a rebound in consumer spending.

预计这种增长将受到人口老龄化、健康意识提高和消费者支出的反弹的推动。

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

预计该行业将在2025年增长3.0%,从2024年的下降中恢复过来,这归因于全球经济的不确定性、通货膨胀和市场波动。

"The industry is expected to gain momentum in 2025, supported by changing demographics and increasing health awareness that will drive the demand for personal accident and health (PA&H), and whole life insurance policies," analyst from GlobalData, Manogna Vangari, said in the report.

GlobalData分析师Manogna Vangari在报告中表示:“在人口结构变化和健康意识提高的支持下,该行业预计将在2025年获得动力,这将推动对人身意外和健康(PA&H)以及终身寿险保单的需求。”

Whole life insurance is the largest segment, accounting for an estimated 44.0% of GWP in 2024.

终身寿险是最大的细分市场,估计占2024年全球总产值的44.0%。

Although demand is expected to decline by 4.1% in 2024 due to inflation and rising interest rates, the segment is predicted to rebound with a 2.1% growth in 2025 and achieve a 3.1% CAGR over 2025 to 2029.

尽管由于通货膨胀和利率上升,预计2024年的需求将下降4.1%,但预计该细分市场将在2025年反弹,增长2.1%,并在2025年至2029年期间实现3.1%的复合年增长率。

This growth will be supported by Singapore's ageing population, which is projected to make up 18.0% of the total population by 2030.

这一增长将得到新加坡人口老龄化的支持,预计到2030年新加坡人口将占总人口的18.0%。

Endowment insurance, the second-largest segment, is expected to account for 32.8% of GWP in 2024 and grow at a 3.7% CAGR through 2029, driven by rising interest rates and a shift toward wealth-focused products.

受利率上升和向财富产品转变的推动,第二大细分市场捐赠保险预计将在2024年占GWP的32.8%,到2029年将以3.7%的复合年增长率增长。

PA&H insurance, which is projected to hold a 14.2% market share in 2024, is expected to grow at a CAGR of 6.6% over the same period due to increasing healthcare costs and heightened health awareness.

PA&H保险预计将在2024年占有14.2%的市场份额,由于医疗成本增加和健康意识的提高,预计同期将以6.6%的复合年增长率增长。

The remaining 8.9% of the market in 2024 will comprise term life, general annuity, and other insurance products.

2024年剩余的8.9%的市场份额将包括定期寿险、普通年金和其他保险产品。

"The life insurance industry growth in Singapore is largely attributed to demographic shifts, bolstering demand for life and health insurance products, particularly amongst an increasingly affluent population," Vangari said.

万加里说:“新加坡人寿保险业的增长在很大程度上归因于人口结构的变化,增加了对人寿和健康保险产品的需求,尤其是在日益富裕的人口中。”

"The development of products tailored to the needs of the rapidly ageing demographic is expected to be a significant area of focus for the insurers over the next five years," concluded Vangari.

Vangari总结说:“针对快速老龄化人口需求量身定制的产品的开发预计将成为保险公司未来五年关注的重要领域。”

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.