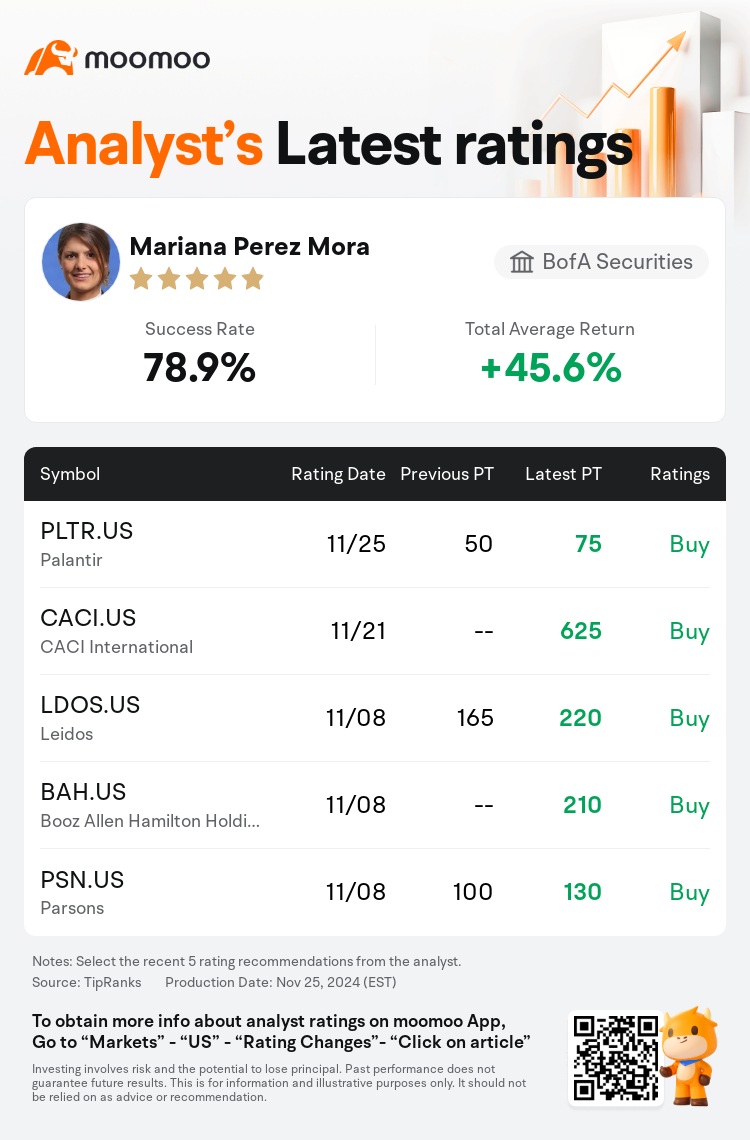

BofA Securities analyst Mariana Perez Mora maintains $Palantir (PLTR.US)$ with a buy rating, and adjusts the target price from $50 to $75.

According to TipRanks data, the analyst has a success rate of 78.9% and a total average return of 45.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Palantir (PLTR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Palantir (PLTR.US)$'s main analysts recently are as follows:

Palantir has showcased its capability to digitize various sectors from financial enterprises to defense systems including missile production, positioning itself as a pivotal player in an era where attributes such as efficiency, innovation, safety, and speed are highly prized. The importance of software, which constitutes 17% of U.S. nonresidential private fixed investments, underscores Palantir's potential dominance as firms increasingly rely on software and AI solutions to enhance margins instead of expanding through fixed assets.

The broader software industry is poised to embrace AI significantly, with expectations that the use cases for AI will proliferate. It is anticipated that enterprise adoption will kick off in earnest by 2025 with the deployment of large language models widely across the industry. Furthermore, the genuine embrace of generative AI is predicted to serve as a key driver for the software sector's growth. This optimism reflects a broader bullish sentiment regarding the upcoming phase of the AI transformation expected to sweep through the software sector by 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

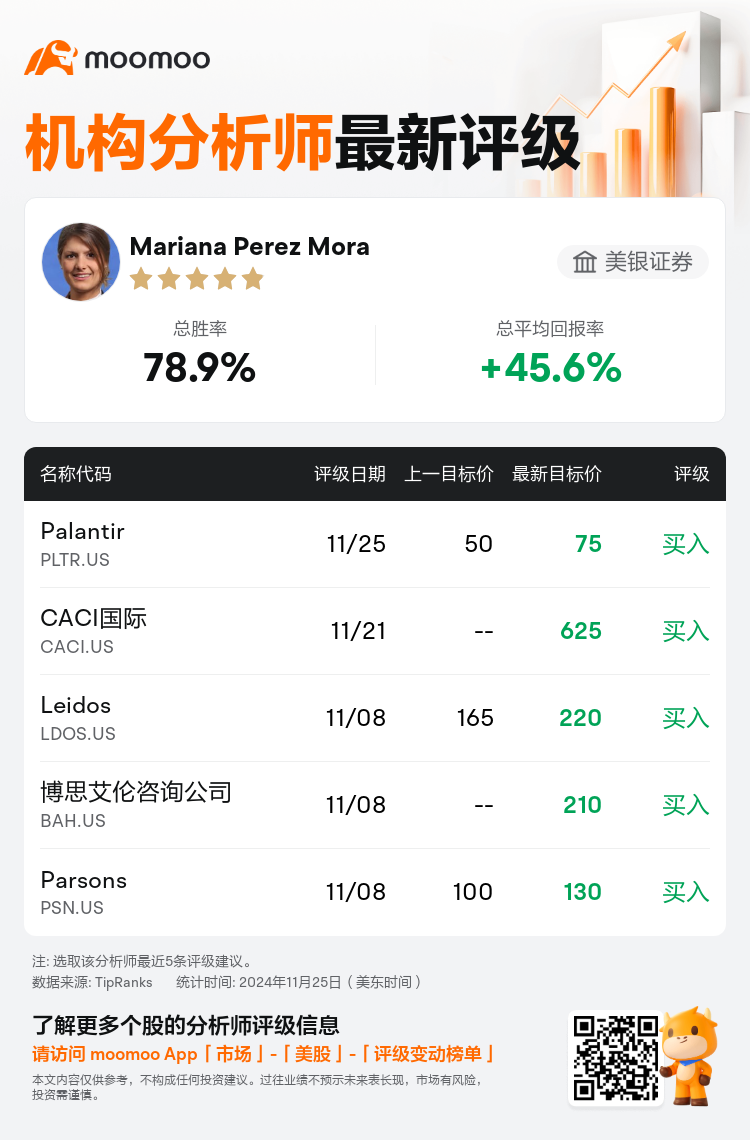

美银证券分析师Mariana Perez Mora维持$Palantir (PLTR.US)$买入评级,并将目标价从50美元上调至75美元。

根据TipRanks数据显示,该分析师近一年总胜率为78.9%,总平均回报率为45.6%。

此外,综合报道,$Palantir (PLTR.US)$近期主要分析师观点如下:

此外,综合报道,$Palantir (PLTR.US)$近期主要分析师观点如下:

Palantir展示了其实现从金融企业到防御系统(包括导弹生产)等各个领域的数字化能力,在效率、创新、安全和速度等属性备受重视的时代,Palantir将自己定位为关键参与者。软件占美国非住宅私人固定投资的17%,其重要性凸显了Palantir的潜在主导地位,因为企业越来越依赖软件和人工智能解决方案来提高利润率,而不是通过固定资产进行扩张。

更广泛的软件行业有望大力采用人工智能,预计人工智能的用例将激增。随着大型语言模型在整个行业的广泛部署,预计到2025年,企业的采用将正式开始。此外,预计真正采用生成式人工智能将成为软件行业增长的关键驱动力。这种乐观情绪反映了对预计到2025年席卷软件行业的人工智能转型的更广泛看涨情绪。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Palantir (PLTR.US)$近期主要分析师观点如下:

此外,综合报道,$Palantir (PLTR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of