Check Out What Whales Are Doing With WDAY

Check Out What Whales Are Doing With WDAY

Deep-pocketed investors have adopted a bullish approach towards Workday (NASDAQ:WDAY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDAY usually suggests something big is about to happen.

财力雄厚的投资者对Workday(纳斯达克股票代码:WDAY)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是WDAY的如此重大变动通常表明重大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Workday. This level of activity is out of the ordinary.

我们从今天的观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Workday的11项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 63% leaning bullish and 27% bearish. Among these notable options, 3 are puts, totaling $139,697, and 8 are calls, amounting to $359,531.

这些重量级投资者的总体情绪存在分歧,63%的人倾向于看涨,27%的人倾向于看跌。在这些值得注意的期权中,有3个是看跌期权,总额为139,697美元,8个是看涨期权,总额为359,531美元。

What's The Price Target?

目标价格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $305.0 for Workday over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将工作日的价格定在260.0美元至305.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

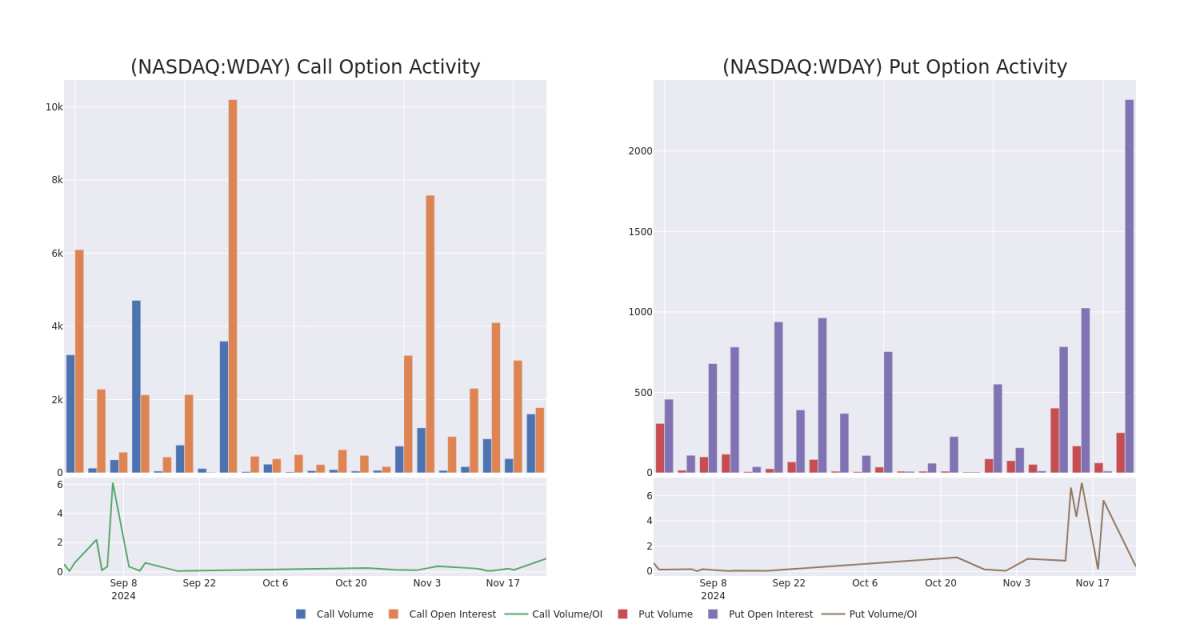

In today's trading context, the average open interest for options of Workday stands at 409.9, with a total volume reaching 1,857.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Workday, situated within the strike price corridor from $260.0 to $305.0, throughout the last 30 days.

在今天的交易背景下,工作日期权的平均未平仓合约为409.9,总交易量达到1,857.00。随附的图表描绘了过去30天内工作日看涨期权和看跌期权交易量以及未平仓合约的变化,行使价走势从260.0美元到305.0美元不等。

Workday Option Activity Analysis: Last 30 Days

工作日期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | TRADE | BULLISH | 11/29/24 | $7.3 | $6.7 | $7.33 | $287.50 | $71.1K | 15 | 210 |

| WDAY | CALL | SWEEP | BEARISH | 12/06/24 | $13.8 | $13.7 | $13.7 | $275.00 | $68.5K | 84 | 65 |

| WDAY | CALL | SWEEP | BULLISH | 11/29/24 | $6.6 | $6.2 | $6.55 | $290.00 | $65.5K | 159 | 1.0K |

| WDAY | PUT | SWEEP | BULLISH | 11/29/24 | $8.5 | $8.3 | $8.4 | $260.00 | $59.6K | 1.9K | 192 |

| WDAY | PUT | TRADE | NEUTRAL | 01/16/26 | $40.8 | $39.6 | $40.15 | $280.00 | $40.1K | 134 | 10 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | 打电话 | 贸易 | 看涨 | 11/29/24 | 7.3 美元 | 6.7 美元 | 7.33 美元 | 287.50 美元 | 71.1 万美元 | 15 | 210 |

| WDAY | 打电话 | 扫 | 粗鲁的 | 12/06/24 | 13.8 美元 | 13.7 美元 | 13.7 美元 | 275.00 美元 | 68.5 万美元 | 84 | 65 |

| WDAY | 打电话 | 扫 | 看涨 | 11/29/24 | 6.6 美元 | 6.2 美元 | 6.55 美元 | 290.00 美元 | 65.5 万美元 | 159 | 1.0K |

| WDAY | 放 | 扫 | 看涨 | 11/29/24 | 8.5 美元 | 8.3 美元 | 8.4 美元 | 260.00 美元 | 59.6 万美元 | 1.9K | 192 |

| WDAY | 放 | 贸易 | 中立 | 01/16/26 | 40.8 美元 | 39.6 美元 | 40.15 美元 | 280.00 美元 | 40.1 万美元 | 134 | 10 |

About Workday

关于 Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Workday是一家软件公司,提供人力资本管理(HCM)、财务管理和业务规划解决方案。Workday以纯云软件提供商而闻名,总部位于加利福尼亚州普莱森顿。Workday 成立于 2005 年,现在拥有超过 18,000 名员工。

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Workday的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Where Is Workday Standing Right Now?

现在 Workday 在哪里?

- Currently trading with a volume of 1,595,656, the WDAY's price is up by 0.26%, now at $268.44.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 1 days.

- WDAY目前的交易量为1,595,656美元,价格上涨了0.26%,目前为268.44美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在 1 天后发布。

Expert Opinions on Workday

关于工作日的专家意见

In the last month, 3 experts released ratings on this stock with an average target price of $303.3333333333333.

上个月,3位专家公布了该股的评级,平均目标价为303.33333333333美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Loop Capital persists with their Hold rating on Workday, maintaining a target price of $270. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $300. * In a cautious move, an analyst from Scotiabank downgraded its rating to Sector Outperform, setting a price target of $340.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处查看。* Loop Capital的一位分析师在工作日维持其持有评级,目标价维持在270美元。*尼德姆的一位分析师谨慎地将评级下调至买入,将目标股价定为300美元。*丰业银行的一位分析师谨慎地将其评级下调至行业跑赢大盘,将目标股价定为340美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $305.0 for Workday over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $305.0 for Workday over the last 3 months.