Market Whales and Their Recent Bets on ADI Options

Market Whales and Their Recent Bets on ADI Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Analog Devices.

有很多资金的鲸鱼对亚德诺采取了明显的看好态度。

Looking at options history for Analog Devices (NASDAQ:ADI) we detected 12 trades.

查看亚德诺(纳斯达克:ADI)的期权历史,我们发现了12笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 33% with bearish.

考虑到每笔交易的具体情况,可以准确地说,50%的投资者以看好的预期开盘交易,33%则是看淡。

From the overall spotted trades, 7 are puts, for a total amount of $275,604 and 5, calls, for a total amount of $196,440.

在所有观察到的交易中,7笔是看跌期权,总金额为275,604美元;5笔是看涨期权,总金额为196,440美元。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $180.0 and $230.0 for Analog Devices, spanning the last three months.

在评估交易量和未平仓合约后,可以明显看出主要的市场推动者集中在亚德诺的价格区间在180.0美元到230.0美元之间,涵盖了过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

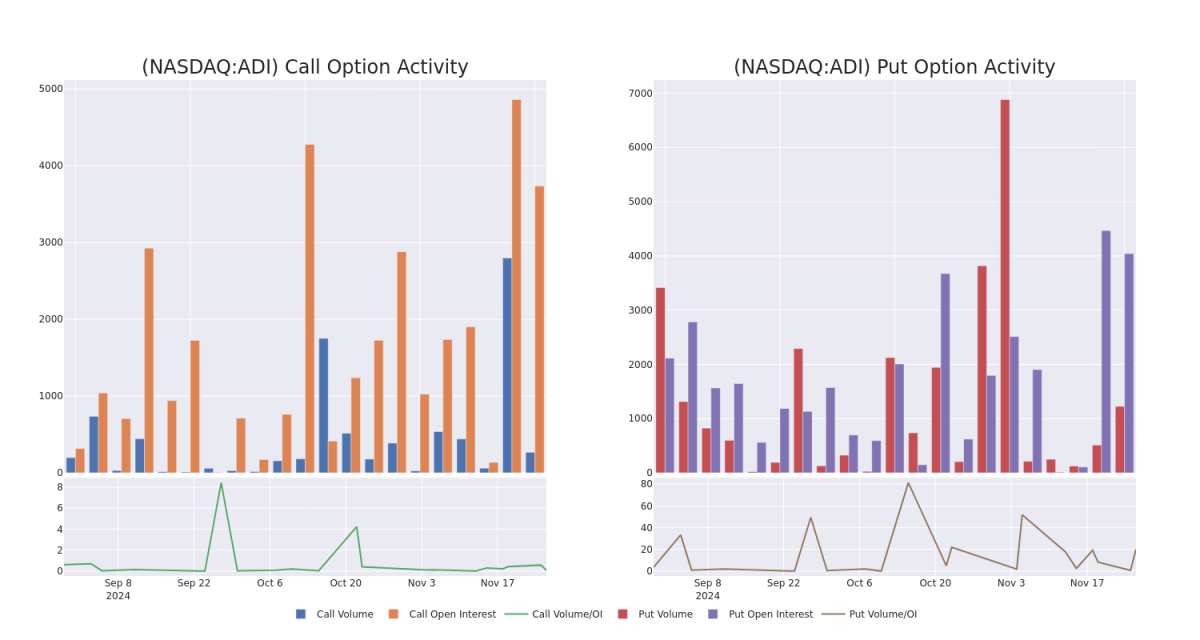

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Analog Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Analog Devices's substantial trades, within a strike price spectrum from $180.0 to $230.0 over the preceding 30 days.

评估成交量和未平仓合约是进行期权交易的一项战略步骤。这些指标揭示了亚德诺在指定行使价期权的流动性和投资者兴趣。接下来的数据将可视化过去30天内与亚德诺的重大交易相关的看涨和看跌的成交量和未平仓合约的波动,涉及行使价范围从180.0美元到230.0美元。

Analog Devices 30-Day Option Volume & Interest Snapshot

亚德诺30天期权成交量与未平仓合约快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | CALL | TRADE | BEARISH | 11/29/24 | $6.9 | $6.5 | $6.5 | $217.50 | $65.0K | 163 | 112 |

| ADI | PUT | TRADE | BULLISH | 06/20/25 | $20.7 | $20.0 | $20.0 | $230.00 | $60.0K | 1.1K | 30 |

| ADI | PUT | SWEEP | BULLISH | 12/20/24 | $2.9 | $2.55 | $2.55 | $210.00 | $47.1K | 1.8K | 501 |

| ADI | PUT | TRADE | BULLISH | 11/29/24 | $4.4 | $4.0 | $4.0 | $222.50 | $40.0K | 166 | 195 |

| ADI | PUT | SWEEP | BULLISH | 02/21/25 | $3.8 | $2.7 | $2.7 | $190.00 | $39.9K | 70 | 200 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | 看涨 | 交易 | 看淡 | 11/29/24 | $6.9 | $6.5 | $6.5 | $217.50 | $65.0K | 163 | 112 |

| ADI | 看跌 | 交易 | BULLISH | 06/20/25 | $20.7美元 | $20.0 | $20.0 | $230.00 | $60.0K | 1.1K | 30 |

| ADI | 看跌 | SWEEP | BULLISH | 12/20/24 | $2.9 | $2.55 | $2.55 | $210.00 | $47.1K | 1.8K | 501 |

| ADI | 看跌 | 交易 | BULLISH | 11/29/24 | $4.4 | $4.0 | $4.0 | $222.50 | $40.0千美元 | 166 | 195 |

| ADI | 看跌 | SWEEP | BULLISH | 02/21/25 | $3.8 | $2.7 | $2.7 | $190.00 | 39.9K美元 | 70 | 200 |

About Analog Devices

关于亚德诺

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

Analog Devices是一家领先的模拟、混合信号和数字信号处理芯片制造商。该公司在转换器芯片中拥有重要的市场份额领先优势,这些芯片用于将模拟信号转换为数字信号,反之亦然。 该公司为数以万计的客户提供服务,其销售的芯片超过一半用于工业和汽车终端市场。Analog Devices的芯片也被纳入无线基础设备中。

After a thorough review of the options trading surrounding Analog Devices, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对亚德诺的期权交易进行全面审查后,我们开始更详细地研究该公司。这包括对其当前市场状况和表现的评估。

Current Position of Analog Devices

亚德诺的当前状态

- Currently trading with a volume of 4,673,920, the ADI's price is down by -3.07%, now at $216.71.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

- 目前成交量为4,673,920,ADI的价格下跌了-3.07%,现为$216.71。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预期收益发布还有0天。

What Analysts Are Saying About Analog Devices

分析师对亚德诺的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $220.0.

在过去的一个月里,1位行业分析师分享了他们对这只股票的见解,提出的平均目标价为220.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Wells Fargo lowers its rating to Equal-Weight with a new price target of $220.

一位拥有20年经验的期权交易员揭示了他的单行图表技巧,显示何时买入和卖出。复制他的交易,每20天平均利润达到27%。点击这里以获取访问权限。* 反映担忧,一位来自富国银行的分析师将其评级下调至中立,新的目标价为220美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 7 are puts, for a total amount of $275,604 and 5, calls, for a total amount of $196,440.

From the overall spotted trades, 7 are puts, for a total amount of $275,604 and 5, calls, for a total amount of $196,440.