We Take A Look At Why Tecnoglass Inc.'s (NYSE:TGLS) CEO Has Earned Their Pay Packet

We Take A Look At Why Tecnoglass Inc.'s (NYSE:TGLS) CEO Has Earned Their Pay Packet

Key Insights

主要见解

- Tecnoglass' Annual General Meeting to take place on 3rd of December

- Salary of US$2.94m is part of CEO José Daes's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, Tecnoglass' EPS grew by 32% and over the past three years, the total shareholder return was 164%

- tecnoglass的年度股东大会将于12月3日举行

- 294万美元的薪水是CEO José Daes总薪酬的一部分

- 总报酬数与行业平均水平相当。

- 在过去三年中,tecnoglass的每股收益增长了32%,在过去三年中,总股东回报率为164%

It would be hard to discount the role that CEO José Daes has played in delivering the impressive results at Tecnoglass Inc. (NYSE:TGLS) recently. Coming up to the next AGM on 3rd of December, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

我们很难忽视首席执行官José Daes在最近为tecnoglass Inc.(纽交所:TGLS)提供出色业绩中所扮演的角色。在即将到来的12月3日股东大会上,股东们会牢记这一点。这也是他们听取董事会审查财务结果、讨论公司未来策略并对任何决议(例如高管薪酬)进行投票的机会。鉴于出色的表现,我们讨论了为什么我们认为首席执行官的薪酬并不过高。

Comparing Tecnoglass Inc.'s CEO Compensation With The Industry

将tecnoglass Inc.的首席执行官薪酬与行业进行比较

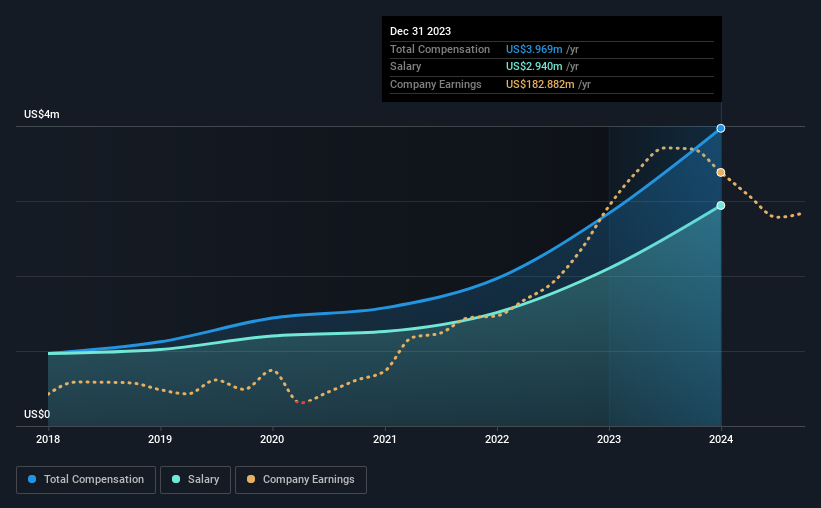

According to our data, Tecnoglass Inc. has a market capitalization of US$3.8b, and paid its CEO total annual compensation worth US$4.0m over the year to December 2023. Notably, that's an increase of 40% over the year before. In particular, the salary of US$2.94m, makes up a huge portion of the total compensation being paid to the CEO.

根据我们的数据,tecnoglass Inc.的市值为38亿美元,并且在截至2023年12月的年度内支付给首席执行官的总年薪酬为400万美元。值得注意的是,与前一年相比,这一数字增长了40%。具体来说,294万美元的薪资占据了支付给首席执行官的总薪酬的很大一部分。

For comparison, other companies in the American Building industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$5.6m. This suggests that Tecnoglass remunerates its CEO largely in line with the industry average.

作为比较,其他美国建筑行业的公司市值在20亿到64亿美元之间,其首席执行官的中位总薪酬为560万美元。这表明tecnoglass的首席执行官薪酬基本符合行业平均水平。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$2.9m | US$2.1m | 74% |

| Other | US$1.0m | US$735k | 26% |

| Total Compensation | US$4.0m | US$2.8m | 100% |

| 组成部分 | 2023 | 2022 | 比例(2023) |

| 薪资 | US$2.9万 | 210万美元 | 74% |

| 其他 | 100万美元 | 735,000美元 | 26% |

| 总补偿 | 美元400万 | 280万美元 | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. It's interesting to note that Tecnoglass pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

在行业板块层面,约15%的总薪酬代表工资,85%为其他报酬。值得注意的是,tecnoglass通过工资支付的报酬比例高于行业平均水平。如果工资是总薪酬的主要组成部分,那么这表明CEO无论业绩如何都能获得更高的固定比例的总薪酬。

A Look at Tecnoglass Inc.'s Growth Numbers

看一下tecnoglass公司的增长数据

Tecnoglass Inc. has seen its earnings per share (EPS) increase by 32% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

tecnoglass公司的每股收益(EPS)在过去三年中每年增长32%。过去十二个月的营业收入与前一时期基本持平。

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

股东们会高兴地知道,公司在过去几年中有所改善。虽然营业收入的增长是不错的,但最终利润更为重要。历史表现有时可以很好地指示未来的发展,但如果您想了解公司的未来,您可能会对这份分析师预测的免费可视化感兴趣。

Has Tecnoglass Inc. Been A Good Investment?

tecnoglass公司是一个好的投资吗?

We think that the total shareholder return of 164%, over three years, would leave most Tecnoglass Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

我们认为,在三年中总股东回报达到164%会让大多数tecnoglass公司的股东感到满意。因此,一些人可能认为CEO的薪酬应该高于规模相似的公司的正常水平。

To Conclude...

总之...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

由于公司业绩相对良好,首席执行官的薪酬政策可能不会成为股东大会的重点。相反,投资者可能更感兴趣的是帮助管理他们长期增长预期的讨论,例如公司的业务策略和未来的增长潜力。

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Tecnoglass that investors should think about before committing capital to this stock.

虽然首席执行官的薪酬是一个需要关注的重要因素,但投资者还应该注意其他领域。这就是为什么我们进行了深入研究,发现了1个提防信号,投资者在向这只股票投资之前应该考虑一下。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以说,业务质量比CEO薪酬水平更为重要。因此,请查看这个免费的有趣公司列表,这些公司具有高的净资产收益率和较低的债务。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. It's interesting to note that Tecnoglass pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. It's interesting to note that Tecnoglass pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.