Top 3 Consumer Stocks That Are Set To Fly In Q4

Top 3 Consumer Stocks That Are Set To Fly In Q4

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消费不可或缺板块中最被低估的公司股票出现了买入机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Kohls Corp (NYSE:KSS)

科尔士公司 (纽交所: KSS)

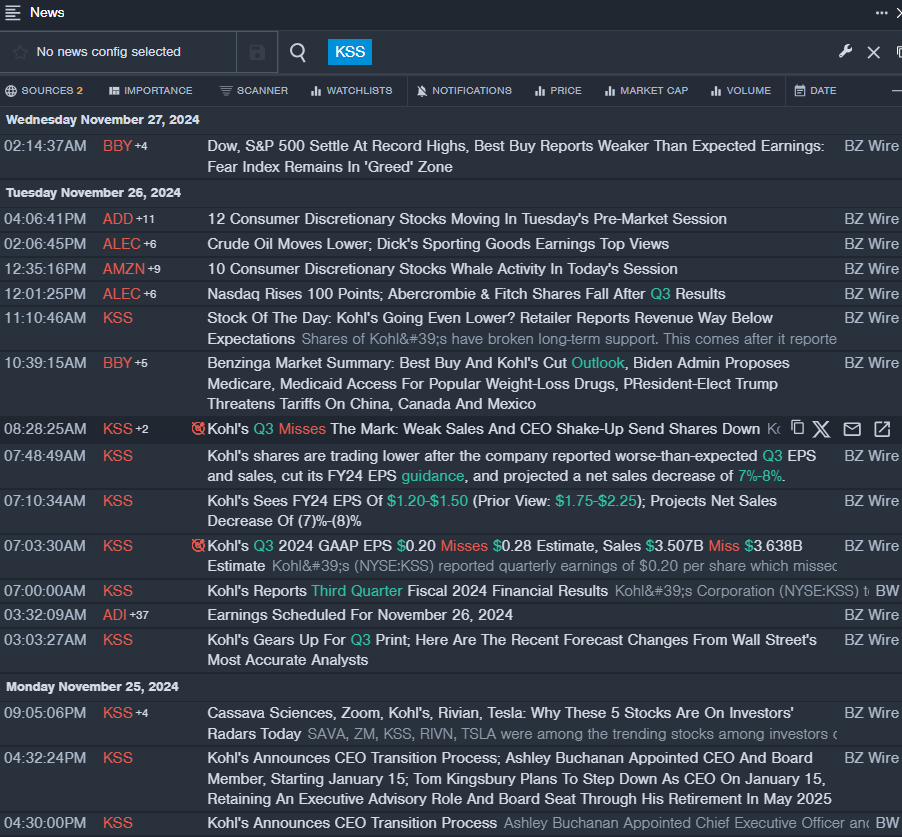

- On Nov. 26, Kohl's shares are trading lower after the company reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Tom Kingsbury, Kohl's chief executive officer, said, "Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies "R" Us shops in 200 of our stores, these were unable to offset the declines in our core business." The company's stock fell around 20% over the past month and has a 52-week low of $14.22.

- RSI Value: 26.35

- KSS Price Action: Shares of Kohls fell 17% to close at $15.22 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest KSS news.

- 11月26日,科尔士的股票在公司公布的第三季度业绩差于预期,降低了2024财年的每股收益指导,并预计净销售额减少7%-8%后,股价下跌。科尔士首席执行官汤姆·金斯伯里表示:“我们的第三季度业绩未达到预期,因为我们的服装和鞋类业务销售疲软。尽管我们在包括Sephora、家居装饰、礼品和冲动消费在内的关键增长领域表现强劲,并且还受益于在我们200家门店开设Babies "R" Us商店,但这些无法抵消我们核心业务的下降。”该公司股票在过去一个月下跌了约20%,52周低点为$14.22。

- 相对强弱指数(RSI)值:26.35

- KSS价格动态:科尔士的股票在周二下跌17%,收盘价为$15.22。

- Benzinga Pro的实时资讯提醒了最新的KSS资讯。

Honda Motor Co Ltd (NYSE:HMC)

本田汽车有限公司 (纽交所:HMC)

- On Nov. 6, Honda Motor reported a decline in the first-half profit and lowered its annual profit forecast. The company reported the first half of FY24 revenue growth of 12.4% year over year 10.798 trillion yen ($69.9 billion), while profits declined 19.7% to 494.6 billion Yen ($3.20 billion). The company's stock fell around 17% over the past month and has a 52-week low of $25.57.

- RSI Value: 25.03

- HMC Price Action: Shares of Honda fell 3% to close at $25.87 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in HMC stock.

- 11月6日,本田汽车报告了上半年的利润下降,并下调了年度利润预测。该公司报告2024财年上半年营业收入同比增长12.4%,达到10.798万亿日元($699亿),而利润下降19.7%,降至4946亿日元($32亿)。该公司股票在过去一个月中下跌了约17%,并且52周低点为$25.57。

- 相对强弱指标值:25.03

- HMC价格走势:本田股票周二下跌3%,收盘价为$25.87。

- Benzinga Pro的图表工具有助于识别HMC股票的趋势。

PDD Holdings Inc – ADR (NASDAQ:PDD)

PDD Holdings Inc – ADR (纳斯达克:PDD)

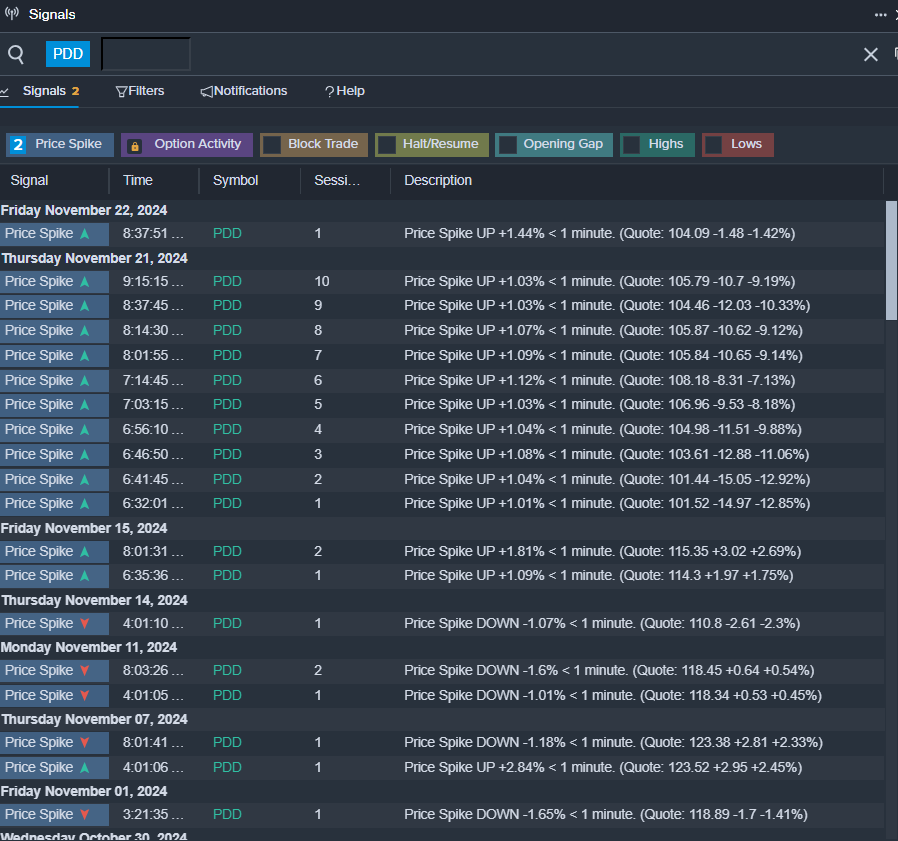

- On Nov. 21, PDD Holdings reported worse-than-expected third-quarter financial results. PDD reported fiscal third-quarter 2024 revenue growth of 44% year-on-year to $14.16 billion (68.84 billion Chinese yuan), missing the analyst consensus estimate of $14.47 billion. The company's stock fell around 21% over the past month and has a 52-week low of $88.01.

- RSI Value: 29.89

- PDD Price Action: Shares of PDD fell 1.4% to close at $99.31 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in PDD shares.

- 在11月21日,pdd holdings报告了第三季度财务业绩不如预期。pdd报告2024财年第三季度营业收入同比增长44%,达到141.6亿(688.4亿人民币),未能达到分析师共识预测的144.7亿。该公司的股票在过去一个月下跌了约21%,并且创下52周低点为88.01美元。

- RSI 值:29.89

- pdd股价动态:pdd的股票在周二下跌1.4%,收于99.31美元。

- Benzinga Pro的信号功能提醒可能在pdd股票中出现突破。

Read More:

阅读更多:

- Jim Cramer: Linde Is A 'Terrific' Company, Sees Another Stock Up 75% As 'Not Done'

- 吉姆·克莱默:linde是一家“优秀”的公司,认为另一只股票上涨75%还“没有结束”