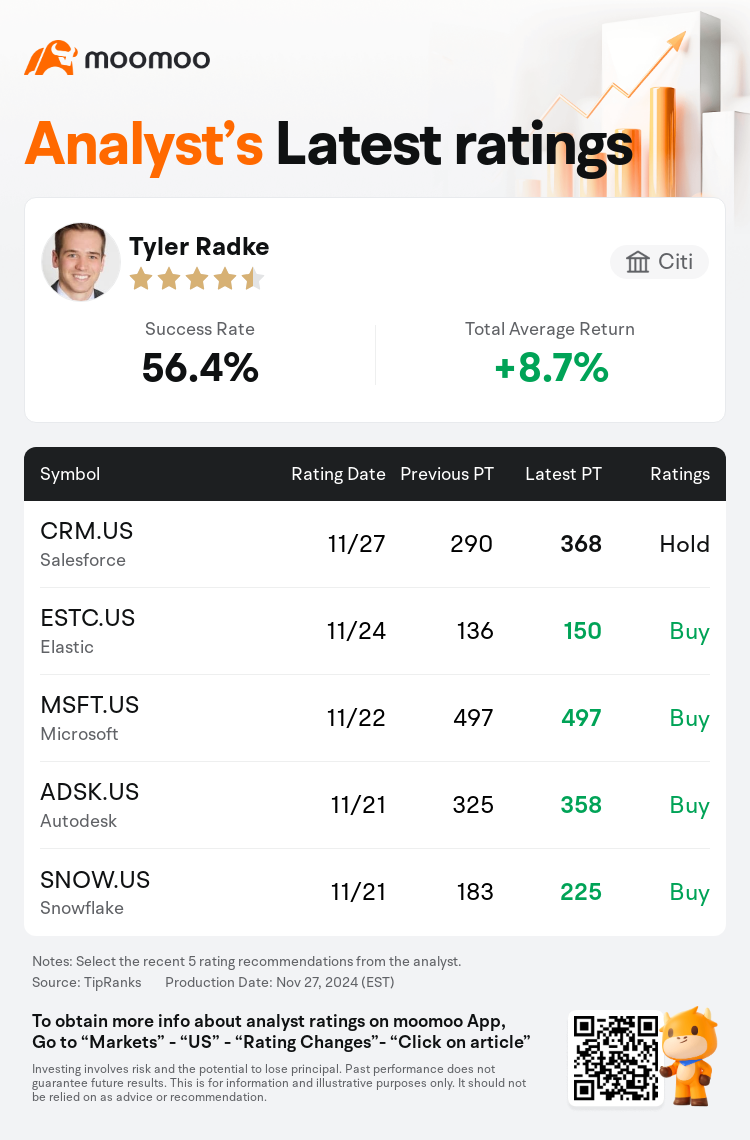

Citi analyst Tyler Radke maintains $Salesforce (CRM.US)$ with a hold rating, and adjusts the target price from $290 to $368.

According to TipRanks data, the analyst has a success rate of 56.4% and a total average return of 8.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Agentforce has begun overshadowing Salesforce's narrative, bolstered by positive feedback from partners which pushed the stock up by 35% since Dreamforce. As Salesforce approaches its Q3 report on December 3, emerging trends suggest a modest improvement in demand. Revenue and bookings growth are anticipated to stay in the high-single-digits, aligning with the general expectations for Q3 and Q4.

For the broader software sector, the advent of Artificial Intelligence (AI) is anticipated to serve as a significant catalyst, particularly as use cases multiply. The entry into the enterprise consumption phase, marked by the wide-scale deployment of large language models by 2025, underscores the sector's transformative trajectory into the next phase of AI's evolution. This growing optimism in the sector's potential is further underpinned by the expected surge in generative AI adoption.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

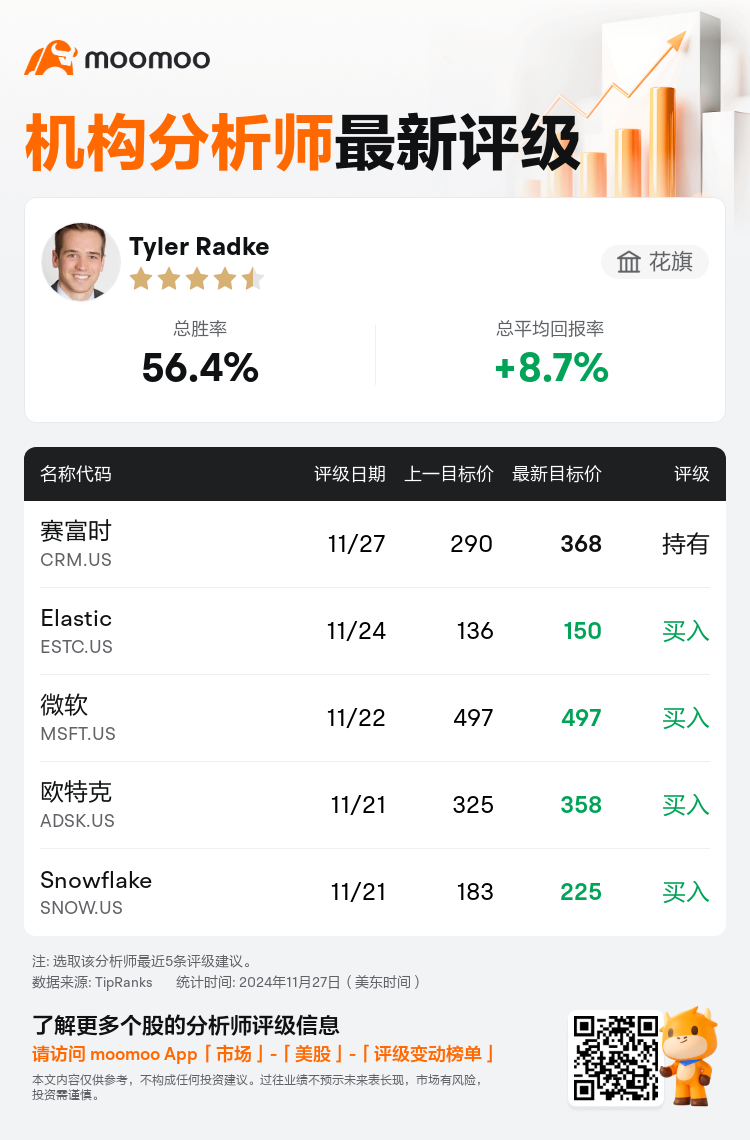

花旗分析师Tyler Radke维持$赛富时 (CRM.US)$持有评级,并将目标价从290美元上调至368美元。

根据TipRanks数据显示,该分析师近一年总胜率为56.4%,总平均回报率为8.7%。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

Agentforce已经开始在叙述上超越赛富时,这得益于合作伙伴的积极反馈,自Dreamforce以来股价上涨了35%。随着赛富时在12月3日接近发布第三季度报告,新兴趋势表明需求有了适度改善。预计营业收入和订单增长将保持在个位数的高位,符合对第三季度和第四季度的普遍预期。

对于更广泛的软件板块而言,人工智能(AI)的到来被预计将成为一个重要的催化剂,尤其是在应用案例不断增加的情况下。到2025年,通过大规模部署大型语言模型进入企业消费阶段,强调了该板块在人工智能演变下一个阶段的变革轨迹。对该板块潜力的乐观情绪进一步得到预期在生成型人工智能采用中的激增的支持。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

此外,综合报道,$赛富时 (CRM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of