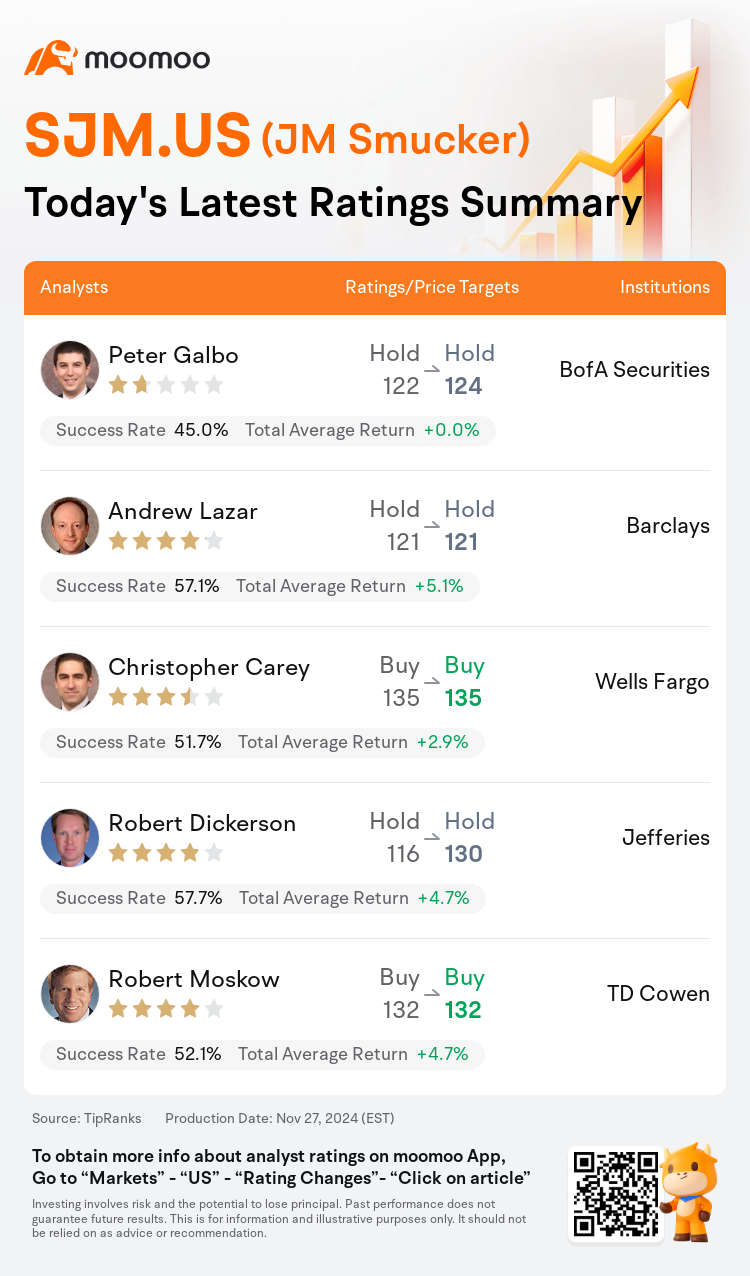

On Nov 27, major Wall Street analysts update their ratings for $JM Smucker (SJM.US)$, with price targets ranging from $121 to $135.

BofA Securities analyst Peter Galbo maintains with a hold rating, and adjusts the target price from $122 to $124.

Barclays analyst Andrew Lazar maintains with a hold rating, and maintains the target price at $121.

Wells Fargo analyst Christopher Carey maintains with a buy rating, and maintains the target price at $135.

Wells Fargo analyst Christopher Carey maintains with a buy rating, and maintains the target price at $135.

Jefferies analyst Robert Dickerson maintains with a hold rating, and adjusts the target price from $116 to $130.

TD Cowen analyst Robert Moskow maintains with a buy rating, and maintains the target price at $132.

Furthermore, according to the comprehensive report, the opinions of $JM Smucker (SJM.US)$'s main analysts recently are as follows:

Amid concerns of potentially needing to adjust the EPS range to reflect weaknesses in Hostess and Coffee inflation, the company's Q2 sales and profit surpassing expectations and the increase in FY EPS proved reassuring. There's recognition that while improvements are required, progress appears to be underway.

The company demonstrated a strong performance in its second quarter, with notably impressive organic volumes amidst the broader food sector environment. Margin enhancements in Coffee were facilitated by pricing strategies, which initially showed minimal elasticity across the portfolio. However, as coffee costs increase, expected elasticity may lead to more constrained margins. Additionally, robust margins in the Pet segment prompt inquiries regarding the extent of stranded overheads.

Here are the latest investment ratings and price targets for $JM Smucker (SJM.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月27日,多家华尔街大行更新了$斯马克 (SJM.US)$的评级,目标价介于121美元至135美元。

美银证券分析师Peter Galbo维持持有评级,并将目标价从122美元上调至124美元。

巴克莱银行分析师Andrew Lazar维持持有评级,维持目标价121美元。

富国集团分析师Christopher Carey维持买入评级,维持目标价135美元。

富国集团分析师Christopher Carey维持买入评级,维持目标价135美元。

富瑞集团分析师Robert Dickerson维持持有评级,并将目标价从116美元上调至130美元。

TD Cowen分析师Robert Moskow维持买入评级,维持目标价132美元。

此外,综合报道,$斯马克 (SJM.US)$近期主要分析师观点如下:

在对可能需要调整每股收益区间以反映Hostess和咖啡通胀的担忧中,公司第二季度的销售和利润超出预期,以及财年的每股收益的增加令人感到安心。人们认识到,虽然需要改进,但进展似乎正在进行中。

该公司在第二季度表现强劲,特别是在更广泛的食品板块环境中,具有显著的有机销售量。咖啡的利润提升得益于定价策略,最初在整个产品组合中显示出很小的弹性。然而,随着咖啡成本的增加,预期的弹性可能导致利润空间更加受限。此外,宠物板块的强劲利润引发了对闲置开支程度的询问。

以下为今日5位分析师对$斯马克 (SJM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Christopher Carey维持买入评级,维持目标价135美元。

富国集团分析师Christopher Carey维持买入评级,维持目标价135美元。

Wells Fargo analyst Christopher Carey maintains with a buy rating, and maintains the target price at $135.

Wells Fargo analyst Christopher Carey maintains with a buy rating, and maintains the target price at $135.