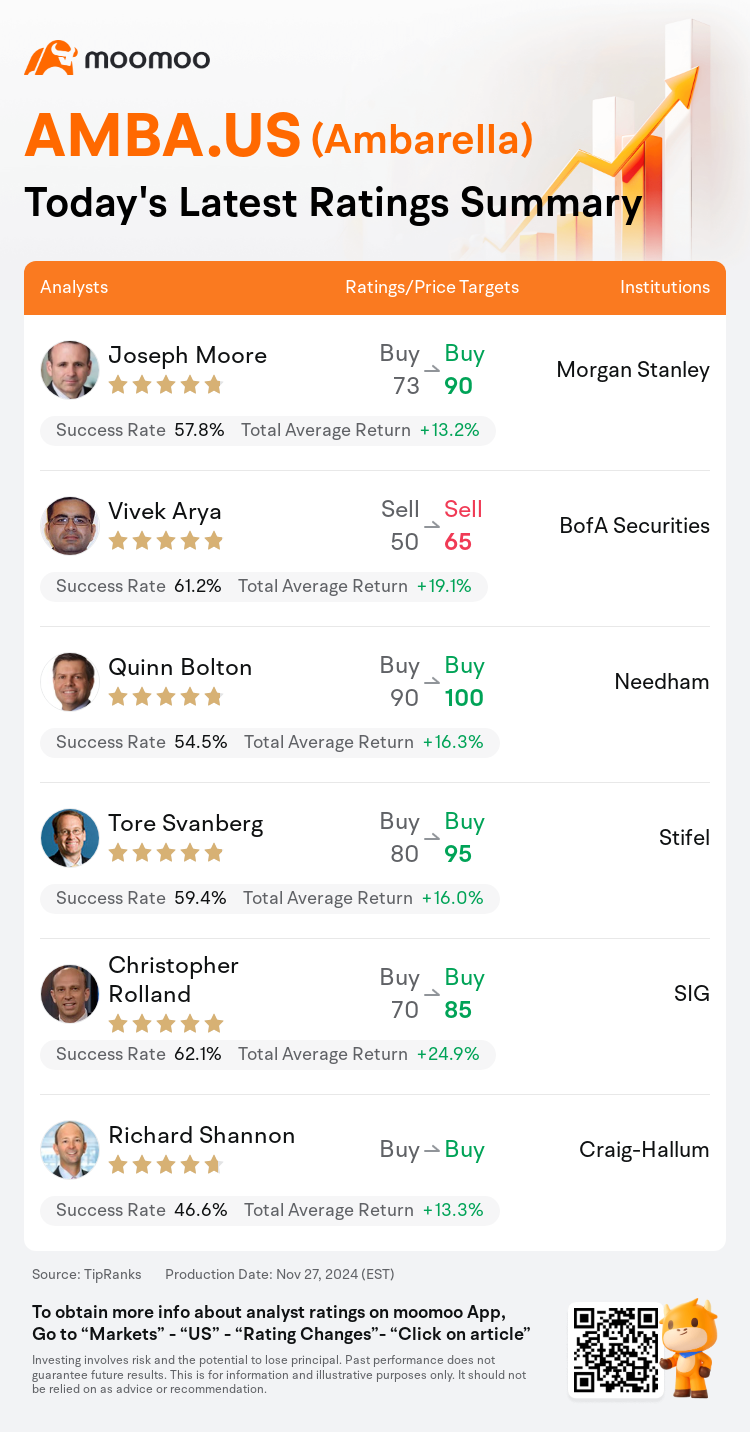

On Nov 27, major Wall Street analysts update their ratings for $Ambarella (AMBA.US)$, with price targets ranging from $65 to $100.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $73 to $90.

BofA Securities analyst Vivek Arya maintains with a sell rating, and adjusts the target price from $50 to $65.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Stifel analyst Tore Svanberg maintains with a buy rating, and adjusts the target price from $80 to $95.

SIG analyst Christopher Rolland maintains with a buy rating, and adjusts the target price from $70 to $85.

Furthermore, according to the comprehensive report, the opinions of $Ambarella (AMBA.US)$'s main analysts recently are as follows:

Ambarella reported solid results for the October-end quarter, which positively influenced the stock's performance. Despite this, questions remain about whether the valuation is justifiable for a business considered to be relatively small scale, especially given that much of the valuation depends on growth projections beyond 2025 that are now perceived as less certain. The firm has slightly raised its sales estimates for calendar years 2025 and 2026, but has concurrently adjusted its pro-forma EPS forecasts downwards for these years.

Ambarella's recent performance was reinforced by 'another strong quarter and outlook,' driven by new product cycles. The analyst observed that their product strength in both IoT and automotive sectors contributed positively. Additionally, the superior capabilities of their technology coupled with the rising demand for Edge AI have effectively countered prevailing market challenges. There's anticipation of a significant automotive inflection by 2026.

Ambarella's recent 'beat-and-raise' performance in Q3 was favorably viewed, particularly noting its third consecutive guidance raise. The company is recognized for its effective execution on its CV product family pipeline, solidifying its status as a key player within the expanding AI at the Edge ecosystem.

Here are the latest investment ratings and price targets for $Ambarella (AMBA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月27日,多家华尔街大行更新了$安霸 (AMBA.US)$的评级,目标价介于65美元至100美元。

摩根士丹利分析师Joseph Moore维持买入评级,并将目标价从73美元上调至90美元。

美银证券分析师Vivek Arya维持卖出评级,并将目标价从50美元上调至65美元。

Needham分析师Quinn Bolton维持买入评级,并将目标价从90美元上调至100美元。

Needham分析师Quinn Bolton维持买入评级,并将目标价从90美元上调至100美元。

斯迪富分析师Tore Svanberg维持买入评级,并将目标价从80美元上调至95美元。

海纳国际分析师Christopher Rolland维持买入评级,并将目标价从70美元上调至85美元。

此外,综合报道,$安霸 (AMBA.US)$近期主要分析师观点如下:

安霸报告了截至十月底季度的扎实业绩,这对股票表现产生了积极影响。尽管如此,仍有疑问,即商业估值是否合理,尤其考虑到业务规模相对较小,特别是大部分估值取决于2025年以后的增长预期,而现在这些预期被认为不太确定。公司略微提高了2025年和2026年的销售预估,但同时调低了这些年份的赠股每股收益预测。

安霸最近的表现得到了'另一个强劲的季度和前景'的支撑,这得益于新产品周期的推动。分析师观察到,物联网和汽车行业产品实力的增强对其有积极影响。此外,其技术的卓越能力结合对边缘人工智能不断增长的需求有效地抵制了当前市场挑战。2026年有着对汽车行业转折的预期。

安霸在第三季度的‘超额击败和提高’表现受到了良好评价,尤其是注意到其连续第三次提高的业绩指引。公司因其在CV产品系列管道上的有效执行而受到认可,巩固了其作为扩展中的边缘人工智能生态系统中的关键参与者的地位。

以下为今日6位分析师对$安霸 (AMBA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师Quinn Bolton维持买入评级,并将目标价从90美元上调至100美元。

Needham分析师Quinn Bolton维持买入评级,并将目标价从90美元上调至100美元。

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $90 to $100.