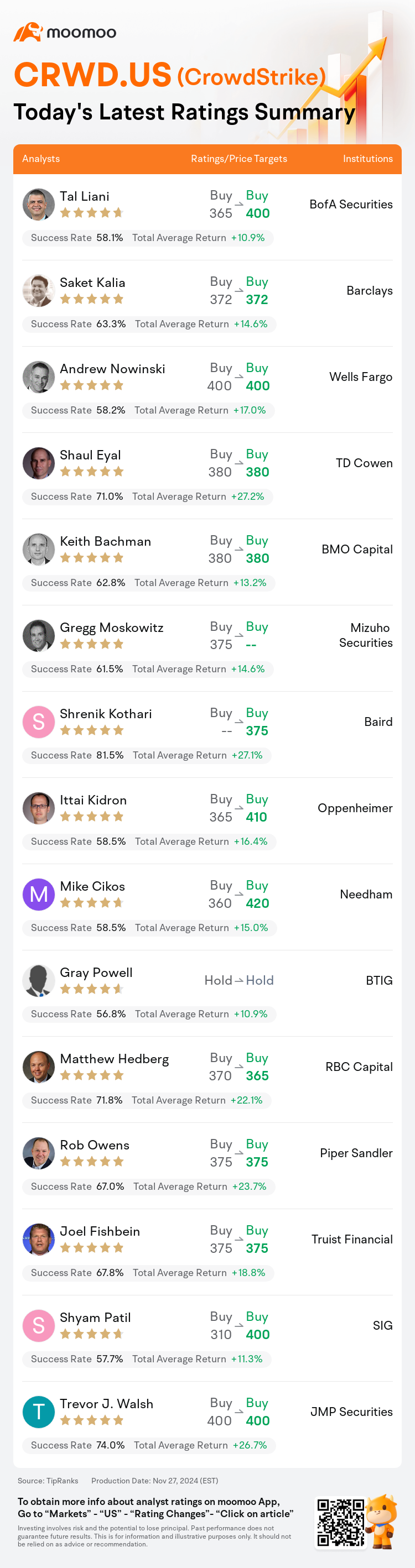

On Nov 27, major Wall Street analysts update their ratings for $CrowdStrike (CRWD.US)$, with price targets ranging from $365 to $420.

BofA Securities analyst Tal Liani maintains with a buy rating, and adjusts the target price from $365 to $400.

Barclays analyst Saket Kalia maintains with a buy rating, and maintains the target price at $372.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $400.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $400.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $380.

BMO Capital analyst Keith Bachman maintains with a buy rating, and maintains the target price at $380.

Furthermore, according to the comprehensive report, the opinions of $CrowdStrike (CRWD.US)$'s main analysts recently are as follows:

Crowdstrike reported a notable $1B milestone revenue quarter paired with significant operating leverage, despite the financial impact of outage costs. Near-term business momentum has been temporarily affected by the July outage, which might cautiously influence Q4 renewals, potentially leading to a consolidation in the share price.

Following recent disturbances, the company has demonstrated robust customer retention capabilities along with sustained momentum for upsell and cross-sell opportunities. Although the current customer retention initiatives are exerting temporary pressures on nnARR and free cash flow, expectations are set for these pressures to subside in the latter half of FY26, leading to an acceleration in growth.

Crowdstrike's results were described as 'reasonable,' though it appears the net new annual recurring revenue and anticipated January quarter ARR didn't entirely meet expectations. According to an analyst, ongoing challenges resulting from an increase in customer commitment packages might lead to adjusted ARR projections in the upcoming quarters. Nonetheless, management's strong execution and the robustness of Crowdstrike's offerings are likely to facilitate sustained consolidation of security expenditures.

CrowdStrike reported a robust third quarter, surpassing expectations on both revenue and earnings while maintaining strong gross retention and module adoption following a key system outage on July 19. Despite expectations that the stock may remain range-bound until there is greater clarity concerning comments on annual recurring revenue (ARR) shifts to net new ARR re-acceleration anticipated in the later half of 2026, the overarching growth prospects for CrowdStrike are still considered intact.

Crowdstrike delivered a solid performance in Q3, driven by Falcon Flex momentum. However, near-term headwinds and visibility challenges, including extended sales cycles, underscore temporary volatility in ARR/FCF momentum.

Here are the latest investment ratings and price targets for $CrowdStrike (CRWD.US)$ from 15 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月27日,多家华尔街大行更新了$CrowdStrike (CRWD.US)$的评级,目标价介于365美元至420美元。

美银证券分析师Tal Liani维持买入评级,并将目标价从365美元上调至400美元。

巴克莱银行分析师Saket Kalia维持买入评级,维持目标价372美元。

富国集团分析师Andrew Nowinski维持买入评级,维持目标价400美元。

富国集团分析师Andrew Nowinski维持买入评级,维持目标价400美元。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价380美元。

BMO资本市场分析师Keith Bachman维持买入评级,维持目标价380美元。

此外,综合报道,$CrowdStrike (CRWD.US)$近期主要分析师观点如下:

Crowdstrike报告了一个显著的1000000000美元的营业收入季度,加上显着的经营杠杆,尽管停机成本产生了财务影响。近期业务势头受7月停机的暂时影响,可能谨慎地影响Q4的续约,可能导致股价的巩固。

在最近的干扰事件后,该公司展示了强大的客户保留能力,并持续为提升销售和跨销售机会而努力。尽管当前的客户保留倡议给净年度重复收入(nnARR)和自由现金流施加了暂时压力,但预计这些压力将在FY26下半年减轻,从而导致增长加速。

Crowdstrike的业绩被描述为"合理",尽管净新增的年度重复收入和预期的1月季度ARR似乎并未完全达到预期。据一位分析师称,由于增加了客户承诺包而产生的持续挑战可能导致在未来季度调整的ARR预测。然而,管理层的强劲执行和Crowdstrike产品的强大性可能有助于安防-半导体支出的持续巩固。

CrowdStrike报告了强劲的第三季度,超过了营业收入和收益的预期,同时保持了强劲的毛客户保留率和模块采用率,这是在7月19日关键系统停机后出现的。尽管预计股票可能保持区间范围,直到对年度重复收入(ARR)的评论有更明确的见解,预计在2026年下半年净新增ARR重新加速之前,CrowdStrike的潜在增长前景仍然被视为完整的。

Crowdstrike在Q3表现出色,受到Falcon Flex势头的推动。然而,短期内的阻力和能见度挑战,包括延长的销售周期,突显了在ARR/FCF势头上的暂时波动。

以下为今日15位分析师对$CrowdStrike (CRWD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Andrew Nowinski维持买入评级,维持目标价400美元。

富国集团分析师Andrew Nowinski维持买入评级,维持目标价400美元。

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $400.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $400.