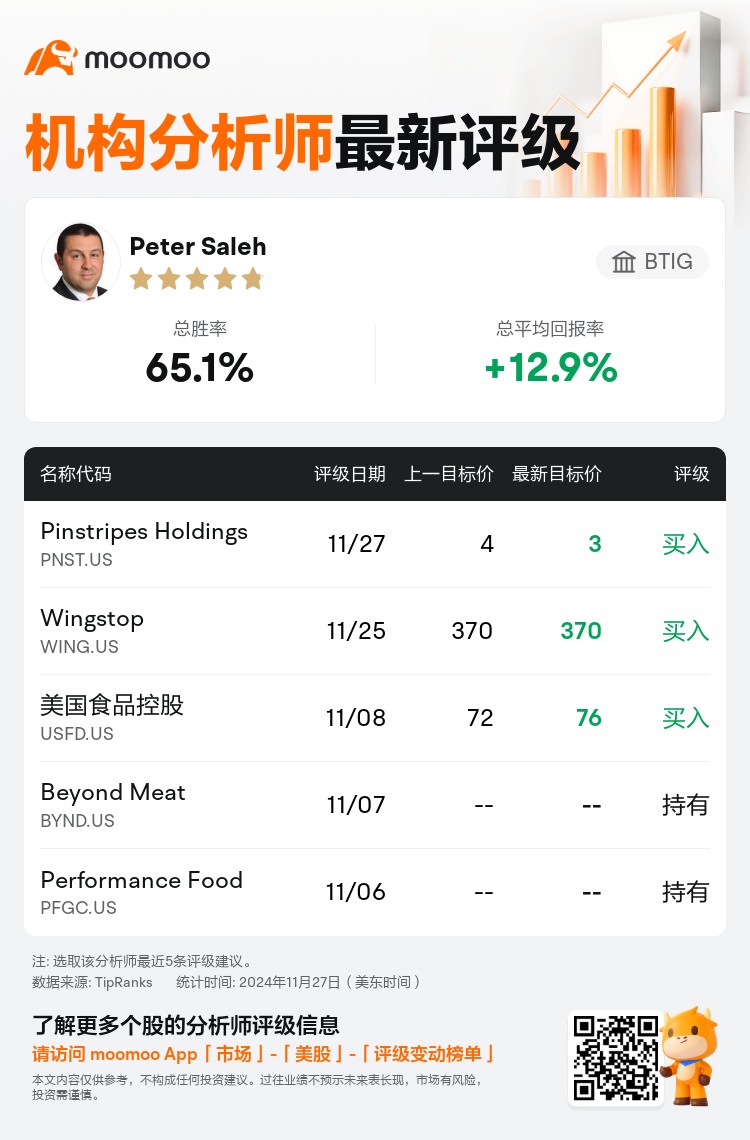

BTIG analyst Peter Saleh maintains $Pinstripes Holdings (PNST.US)$ with a buy rating, and adjusts the target price from $4 to $3.

According to TipRanks data, the analyst has a success rate of 65.1% and a total average return of 12.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Pinstripes Holdings (PNST.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Pinstripes Holdings (PNST.US)$'s main analysts recently are as follows:

Pinstripes reported another weak quarter, concluding a challenging first half of the fiscal year, characterized by a continued decline in sales trends and mid-single digit venue-level margins. The results were similar to the previous quarter in both direction and theme, yet some positive signs have begun to surface recently, suggesting a potentially stronger second half.

Pinstripes has been experiencing heightened business volatility, evident from a 9.4% decline in same-store sales during Q2 2025, with similar trends expected to continue into fiscal Q3 2025. The unpredictability of near-term forecasts prompted the management to withdraw fiscal 2025 full-year financial guidance. Despite these challenges, the company anticipates a solidly positive EBITDA by Q3 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

BTIG分析师Peter Saleh维持$Pinstripes Holdings (PNST.US)$买入评级,并将目标价从4美元下调至3美元。

根据TipRanks数据显示,该分析师近一年总胜率为65.1%,总平均回报率为12.9%。

此外,综合报道,$Pinstripes Holdings (PNST.US)$近期主要分析师观点如下:

此外,综合报道,$Pinstripes Holdings (PNST.US)$近期主要分析师观点如下:

Pinstripes报告了又一个疲软的季度,结束了艰难的上半年,其特征是销售趋势持续下降,场馆利润率处于中等个位数。业绩在方向和主题上都与上一季度相似,但最近一些积极的迹象开始浮出水面,表明下半年可能会走强。

Pinstripes的业务波动加剧,2025年第二季度同店销售额下降了9.4%,预计类似的趋势将持续到2025财年第三季度。短期预测的不可预测性促使管理层撤回了2025财年的全年财务指导。尽管面临这些挑战,但该公司预计,到2025年第三季度,息税折旧摊销前利润将稳步增长。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Pinstripes Holdings (PNST.US)$近期主要分析师观点如下:

此外,综合报道,$Pinstripes Holdings (PNST.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of