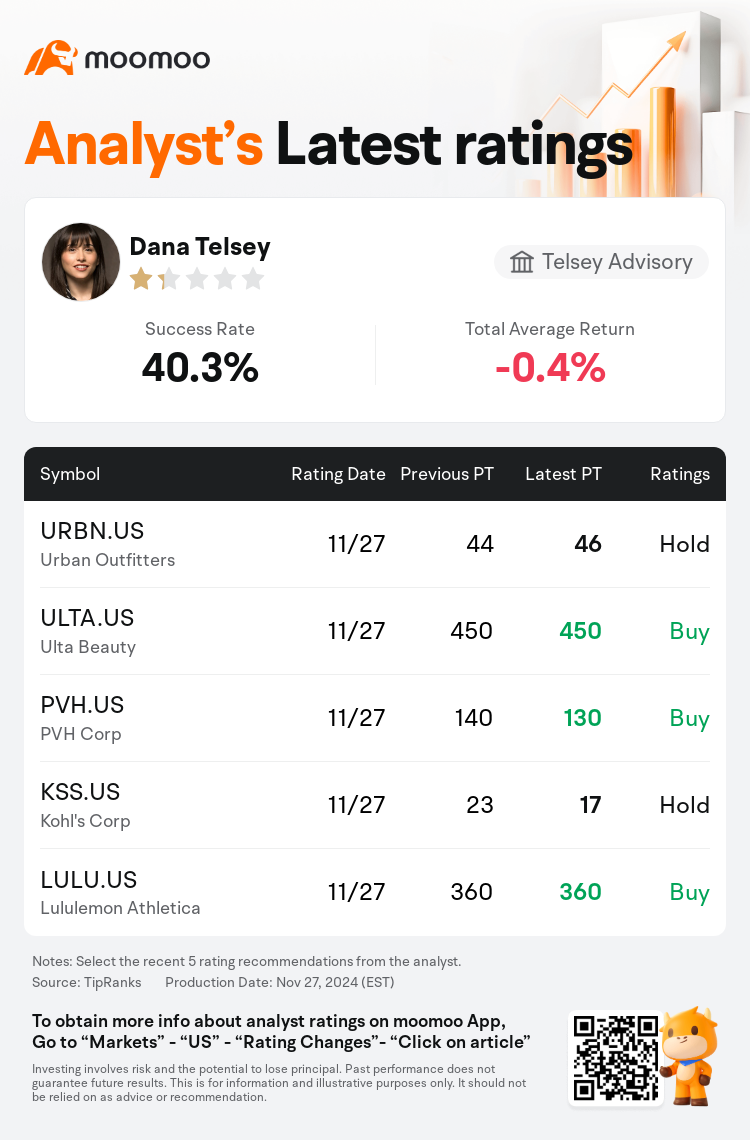

Telsey Advisory analyst Dana Telsey maintains $Urban Outfitters (URBN.US)$ with a hold rating, and adjusts the target price from $44 to $46.

According to TipRanks data, the analyst has a success rate of 40.3% and a total average return of -0.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Urban Outfitters (URBN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Urban Outfitters (URBN.US)$'s main analysts recently are as follows:

The outperformance observed at Anthropologie, Free People, and Nuuly has helped offset challenges at the Urban Outfitters banner. The strong performance of Anthro and FP positions them as leading apparel brands in the market. Additionally, Nuuly is seen as a promising growth opportunity, while there are expectations for the Urban Outfitters flagship to establish a basis for renewed growth.

Urban Outfitters' recent earnings report indicated a stronger than anticipated rise in both top-line figures and margin-driven EPS, surpassing expectations. Despite acknowledging these positive results, the prospect of a re-evaluation of the company's stock multiple is deemed unlikely, even with what is described as an attractive valuation and potential for a positive rate of change.

Urban Outfitters reported a Q3 that surpassed expectations in terms of total sales, gross margin, and earnings. The opportunity for investors lies in the brand's turnaround.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

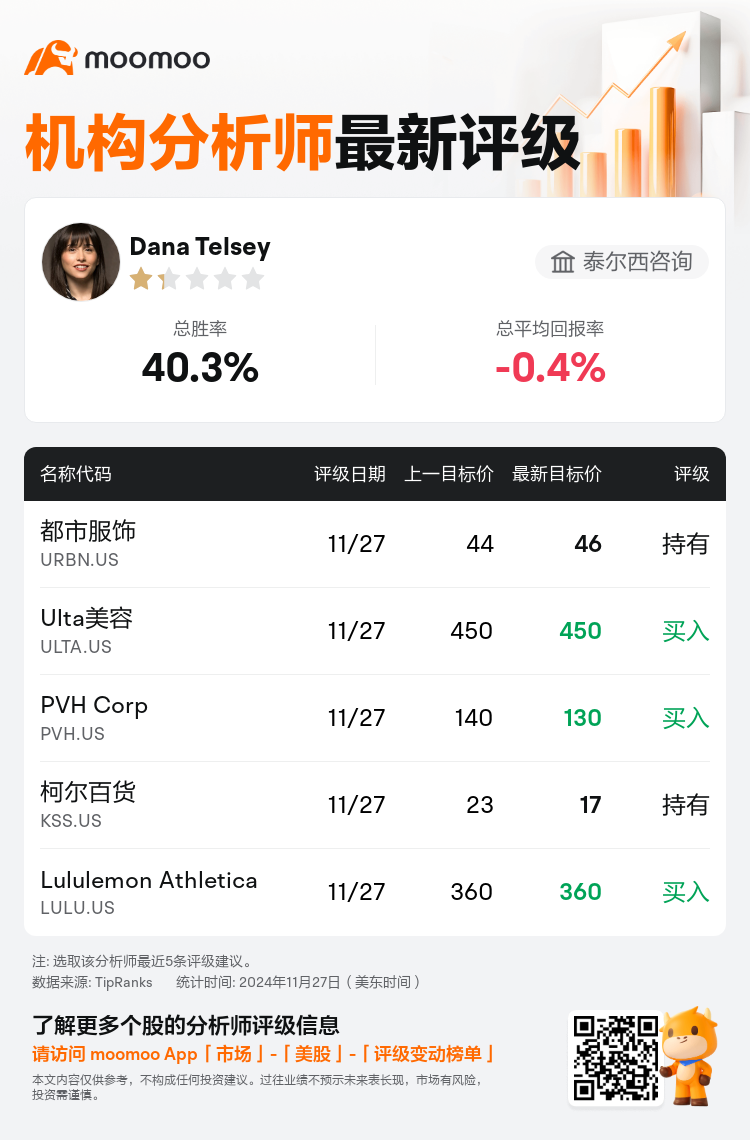

泰尔西咨询分析师Dana Telsey维持$都市服饰 (URBN.US)$持有评级,并将目标价从44美元上调至46美元。

根据TipRanks数据显示,该分析师近一年总胜率为40.3%,总平均回报率为-0.4%。

此外,综合报道,$都市服饰 (URBN.US)$近期主要分析师观点如下:

此外,综合报道,$都市服饰 (URBN.US)$近期主要分析师观点如下:

Anthropologie、Free People和Nuuly的表现强劲,有助于抵消都市服饰横幅所面临的挑战。Anthro和FP的出色表现使它们成为市场领先的服装品牌。此外,Nuuly被视为一个有前景的增长机会,而人们对都市服饰旗舰店建立新的增长基础抱有期望。

都市服饰最近的收益报告显示出超出预期的销售额和以毛利率驱动的每股收益的增长,超过了预期。尽管承认这些积极的结果,但重新评估公司股票估值倍数的前景被认为不太可能,即使公司被描述为具有吸引力的估值和积极变化的潜力。

都市服饰报告的第三季度在销售总额、毛利率和收益方面超出预期。投资者的机会在于该品牌的转型。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$都市服饰 (URBN.US)$近期主要分析师观点如下:

此外,综合报道,$都市服饰 (URBN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of