Decoding Coca-Cola's Options Activity: What's the Big Picture?

Decoding Coca-Cola's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on Coca-Cola (NYSE:KO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in KO often signals that someone has privileged information.

高额投资者已将自己定位为看好可口可乐(纽约证券交易所代码:KO),散户交易者注意这一点很重要。\ 这项活动今天通过Benzinga对公开期权数据的追踪引起了我们的注意。这些投资者的身份尚不确定,但是KO的如此重大的举动通常表明有人拥有特权信息。

Today, Benzinga's options scanner spotted 9 options trades for Coca-Cola. This is not a typical pattern.

今天,Benzinga的期权扫描仪发现了可口可乐的9笔期权交易。这不是典型的模式。

The sentiment among these major traders is split, with 55% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $30,456, and 8 calls, totaling $678,335.

这些主要交易者的情绪分歧,55%看涨,44%看跌。在我们确定的所有期权中,有一个看跌期权,金额为30,456美元,还有8个看涨期权,总额为678,335美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注可口可乐在过去一个季度的价格范围从55.0美元到75.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

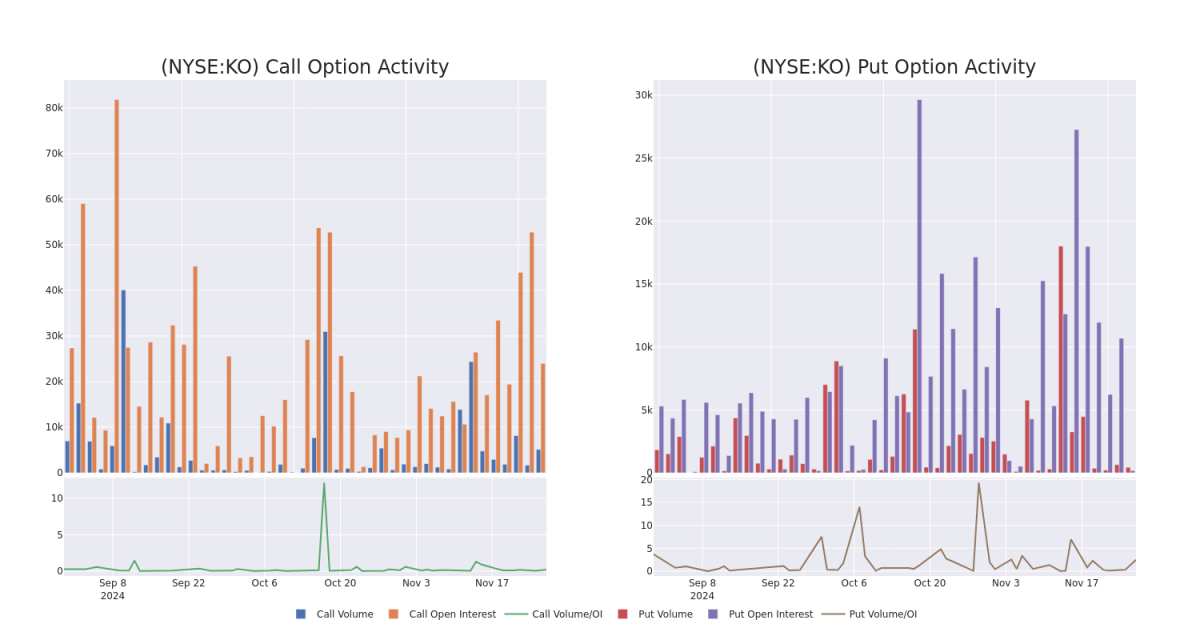

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Coca-Cola's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Coca-Cola's significant trades, within a strike price range of $55.0 to $75.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量可口可乐期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月可口可乐重大交易的看涨期权和未平仓合约的趋势,行使价区间为55.0美元至75.0美元。

Coca-Cola 30-Day Option Volume & Interest Snapshot

可口可乐30天期权交易量和利息快照

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | BULLISH | 09/19/25 | $2.1 | $2.08 | $2.1 | $70.00 | $295.6K | 2.0K | 1.4K |

| KO | CALL | SWEEP | BULLISH | 09/19/25 | $4.3 | $4.25 | $4.28 | $65.00 | $104.8K | 1.2K | 263 |

| KO | CALL | SWEEP | BULLISH | 01/15/27 | $13.25 | $12.9 | $13.25 | $55.00 | $92.7K | 232 | 70 |

| KO | CALL | SWEEP | BEARISH | 02/21/25 | $1.08 | $1.04 | $1.04 | $67.50 | $43.8K | 5.1K | 2.3K |

| KO | CALL | SWEEP | BULLISH | 01/16/26 | $2.14 | $2.0 | $2.14 | $72.50 | $42.8K | 1.5K | 204 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | 打电话 | 扫 | 看涨 | 09/19/25 | 2.1 美元 | 2.08 美元 | 2.1 美元 | 70.00 美元 | 295.6 万美元 | 2.0K | 1.4K |

| KO | 打电话 | 扫 | 看涨 | 09/19/25 | 4.3 美元 | 4.25 美元 | 4.28 美元 | 65.00 美元 | 104.8 万美元 | 1.2K | 263 |

| KO | 打电话 | 扫 | 看涨 | 01/15/27 | 13.25 美元 | 12.9 美元 | 13.25 美元 | 55.00 美元 | 92.7 万美元 | 232 | 70 |

| KO | 打电话 | 扫 | 粗鲁的 | 02/21/25 | 1.08 美元 | 1.04 | 1.04 | 67.50 美元 | 43.8 万美元 | 5.1K | 2.3K |

| KO | 打电话 | 扫 | 看涨 | 01/16/26 | 2.14 美元 | 2.0 美元 | 2.14 美元 | 72.50 美元 | 42.8 万美元 | 1.5K | 204 |

About Coca-Cola

关于可口可乐

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

总部位于亚特兰大的可口可乐成立于1886年,是全球最大的无酒精饮料公司,拥有由200个品牌组成的强大产品组合,涵盖碳酸软饮料、水、运动、能量、果汁和咖啡等关键类别。该公司与装瓶商和分销合作伙伴一起,通过全球200多个国家和地区的零售商和餐饮服务网点销售含有可口可乐和特许品牌的成品饮料产品。可口可乐约有三分之二的总收入来自海外,其中很大一部分来自拉丁美洲和亚太地区的新兴经济体。

After a thorough review of the options trading surrounding Coca-Cola, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕可口可乐的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Where Is Coca-Cola Standing Right Now?

可口可乐现在处于什么位置?

- Currently trading with a volume of 4,581,373, the KO's price is up by 0.57%, now at $64.92.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 76 days.

- KO目前的交易量为4,581,373美元,价格上涨了0.57%,目前为64.92美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计收益将在76天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处访问。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coca-Cola options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的可口可乐期权交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $75.0 for Coca-Cola during the past quarter.