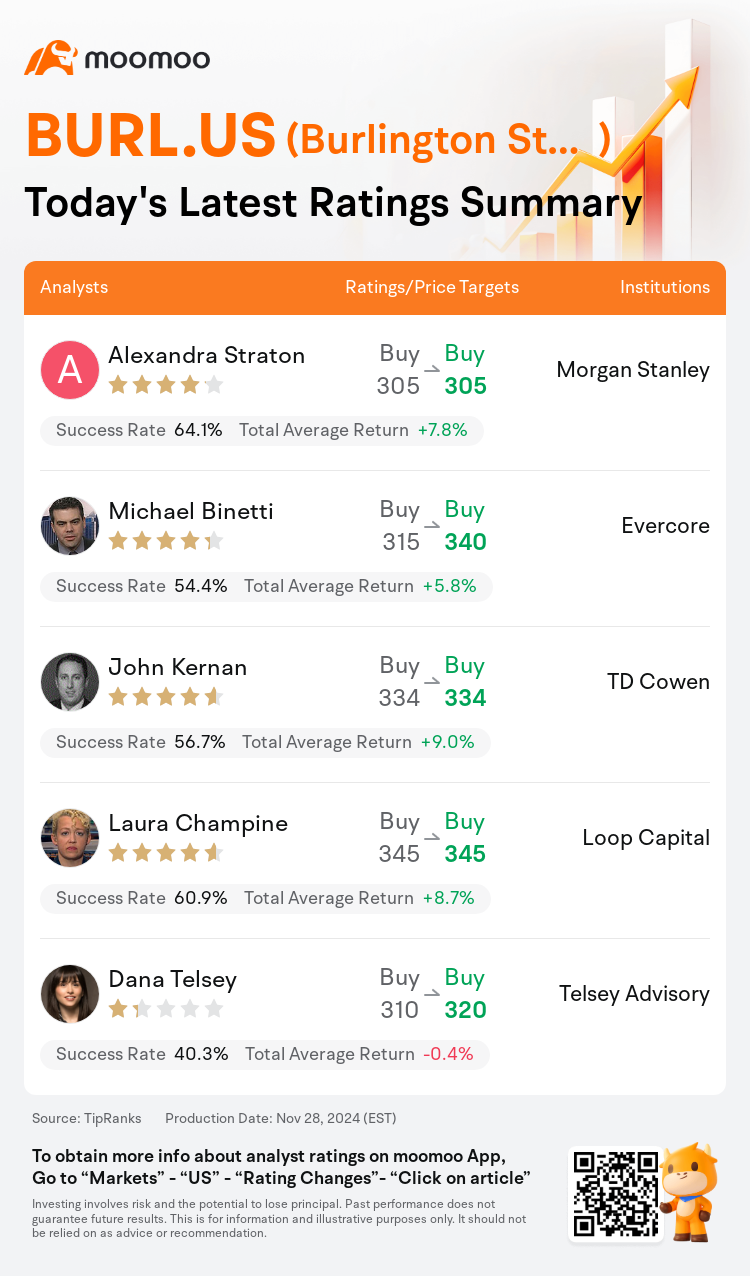

On Nov 28, major Wall Street analysts update their ratings for $Burlington Stores (BURL.US)$, with price targets ranging from $305 to $345.

Morgan Stanley analyst Alexandra Straton maintains with a buy rating, and maintains the target price at $305.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $315 to $340.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

Loop Capital analyst Laura Champine maintains with a buy rating, and maintains the target price at $345.

Telsey Advisory analyst Dana Telsey maintains with a buy rating, and adjusts the target price from $310 to $320.

Furthermore, according to the comprehensive report, the opinions of $Burlington Stores (BURL.US)$'s main analysts recently are as follows:

Warm weather and hurricanes adversely affected Q3 comparatives, yet analysts anticipate an 8% sales growth in FY24, propelled by a 2.5% comparative sales increase and significant gains from productive new stores. It is also noted that there are considerable opportunities for outsized sales and margin recovery at Burlington Stores.

Third quarter top-line and comparable results at Burlington Stores were influenced by temporary weather-related challenges. Despite these obstacles, the company demonstrated margin resilience and expansion, indicating steady progress in its BURL 2.0 strategy. This period is perceived positively upon a thorough analysis. The narrative of a compelling rate of change and the potential for near-term positive earnings revisions underpins Burlington's strong value positioning. This situates the company advantageously as it enters a competitive fourth quarter retail environment.

Burlington Stores' Q3 results were impacted by weather conditions, yet the underlying business strength was maintained. Margins surpassed expectations and are anticipated to remain a source of positive developments. The company is well-prepared for the holiday season and is expected to exceed Q4 guidance.

Burlington Stores' third-quarter earnings aligned with consensus expectations, but the company's comparable store sales increase of 1.0% did not meet expectations. Additionally, while Burlington has raised the lower end of its prior earnings guidance for fiscal 2024, it now anticipates comparable store sales to be at the lower end of prior projections.

Despite significant exposure to weather-related fluctuations, Burlington has adhered to its same-store sales guidance and effectively managed its profit and loss account. This occurred alongside what was considered one of the most significant intra-quarter peak-to-trough same-store sales decelerations that off-price retailers have experienced in recent years. Despite a somewhat harsher weather impact than anticipated in the third quarter, the long-term narrative remains unchanged. The analyst indicates that quarterly comps, adversely affected by severe weather conditions, should not be seen as a definitive gauge of ongoing advancements in maintaining competitive off-price comps alongside strong margin performance.

Here are the latest investment ratings and price targets for $Burlington Stores (BURL.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

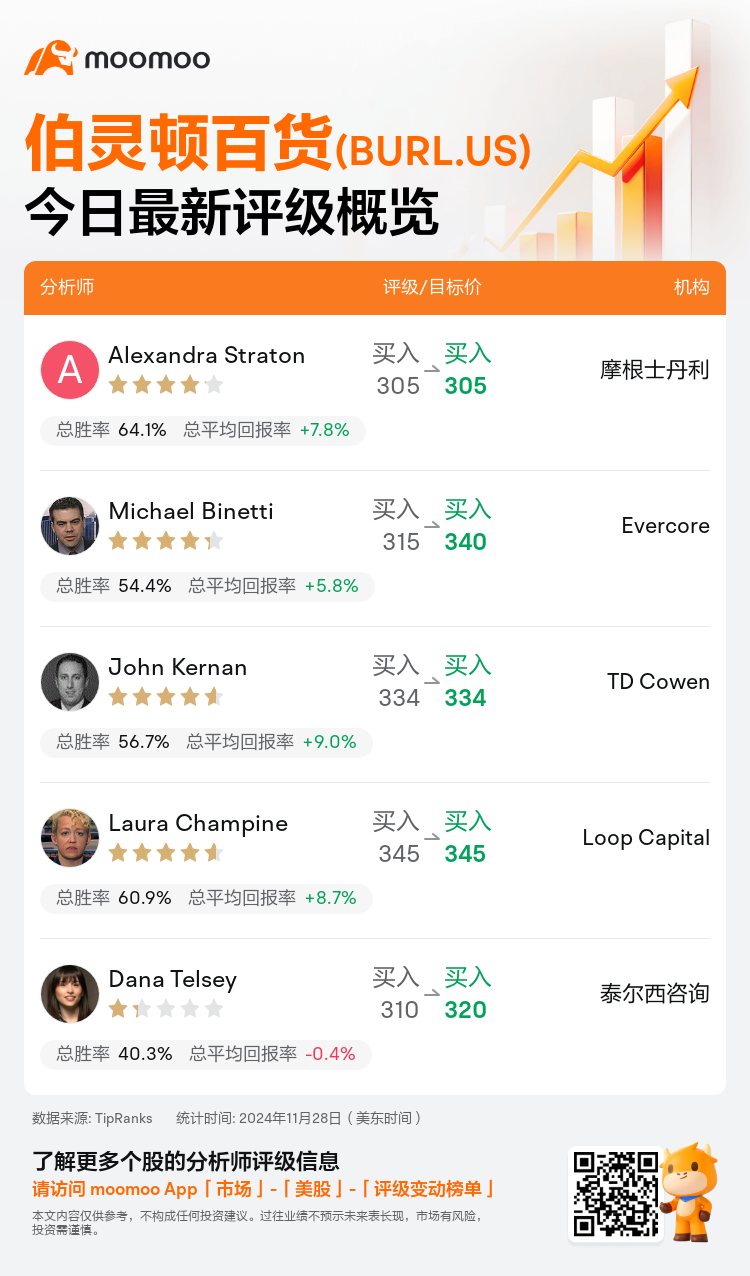

美东时间11月28日,多家华尔街大行更新了$伯灵顿百货 (BURL.US)$的评级,目标价介于305美元至345美元。

摩根士丹利分析师Alexandra Straton维持买入评级,维持目标价305美元。

Evercore分析师Michael Binetti维持买入评级,并将目标价从315美元上调至340美元。

TD Cowen分析师John Kernan维持买入评级,维持目标价334美元。

TD Cowen分析师John Kernan维持买入评级,维持目标价334美元。

Loop Capital分析师Laura Champine维持买入评级,维持目标价345美元。

泰尔西咨询分析师Dana Telsey维持买入评级,并将目标价从310美元上调至320美元。

此外,综合报道,$伯灵顿百货 (BURL.US)$近期主要分析师观点如下:

温暖的天气和飓风对第三季度的比较数据产生了不利影响,但分析师预计 FY24 的销售增长将达到 8%,这得益于 2.5% 的比较销售增长以及新店的显著盈利。 还指出,伯灵顿百货在销售和利润恢复方面有相当大的机会。

伯灵顿百货的第三季度收益和可比结果受到临时天气相关挑战的影响。 尽管面临这些障碍,公司展现了利润的韧性和扩张,显示出在其 BURL 2.0 策略中稳步进展。 经过全面分析,这一时期被视为积极的。 在强劲的改变率和近期盈利修正潜力的叙述,支撑了伯灵顿强大的价值定位。这使得公司在进入竞争激烈的第四季度零售环境时处于有利的位置。

伯灵顿百货的第三季度业绩受到天气条件的影响,但其核心业务实力得以保持。 利润率超出预期,预计仍将是正向发展的来源。 公司为假日季节做好了充分准备,并有望超出第四季度的指导。

伯灵顿百货的第三季度收益符合市场共识预期,但公司可比店销售增长 1.0% 未能达到预期。 此外,尽管伯灵顿已提高其2024财年的低端收益指导,但现在预计可比店销售将位于先前预测的低端。

尽管伯灵顿面临显著的天气波动风险,但仍坚持其同店销售指导,并有效管理其利润和损失账户。 这发生在被认为是近年折扣零售商经历的最显著的季度内部高峰到谷底同店销售放缓的时期。 尽管第三季度的天气影响比预期更为严峻,但长期叙述保持不变。 分析师表示,季度比较因恶劣天气条件而受到不利影响,不应被视为衡量维持竞争性折扣比较和强劲利润表现的持续进展的决定性标准。

以下为今日5位分析师对$伯灵顿百货 (BURL.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师John Kernan维持买入评级,维持目标价334美元。

TD Cowen分析师John Kernan维持买入评级,维持目标价334美元。

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.

TD Cowen analyst John Kernan maintains with a buy rating, and maintains the target price at $334.